Shares of Allcargo Logistics Ltd. jumped 13% to their highest in over a month on Tuesday as its management expects the Ebitda margin to expand in the next financial year due to improved volume.

The logistics firm's consolidated net profit plunged 88% to Rs 17 crore in the quarter ended in December, and its revenue declined 22% to Rs 3,212 crore.

Allcargo expects the gross profit to go up on account of volume increases and improved utilisation, subsequently resulting in an expansion of the profit margin as well, Chief Strategy Officer Ravi Jakhar said in a post earnings conference call.

Allcargo does not expect operating expenses to go up as it is implementing cost-reduction initiatives, Jakhar said.

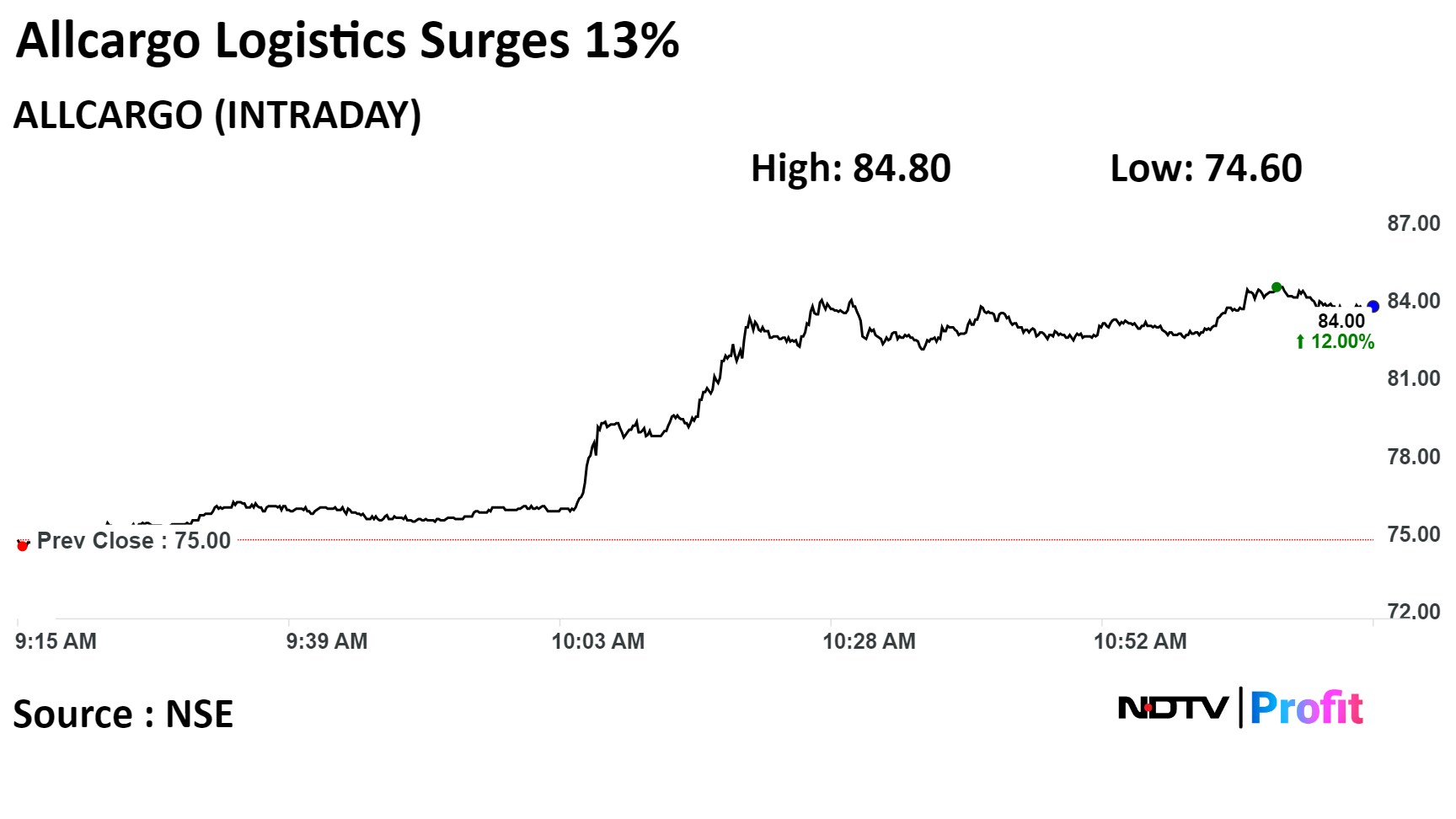

On the NSE, Allcargo's stock rose as much as 13.06% during the day to Rs 84.80 apiece, the highest since Jan. 9. It was trading 11.87% higher at Rs 83.90 per share, compared to a 0.03% decline in the benchmark Nifty 50 at 11:44 a.m.

The share price has risen 51.91% in the past 12 months. The total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 61.84.

Three out of five analysts tracking the company have a 'buy' rating on the stock, one recommends 'hold' and another suggests 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 4.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.