Zomato Ltd.'s board on Tuesday approved raising up to Rs 8,500 crore by selling shares to institutional investors. The board has constituted a fund raising committee to decide the structure, form of issuance, price, discounts, terms and conditions and all other matters related to the qualified institutions placement, according to an exchange filing.

The decision to pursue QIP comes at a time when institutional investors are increasingly favouring this funding option.

According to Grant Thornton Bharat, QIP activity has reached a decade-high of Rs 90,586 crore in 2024, with the June quarter seeing unprecedented volumes and values. This trend underscores a growing institutional confidence in QIPs as a viable mechanism for raising capital, even amid a recent boom in initial public offerings.

Zomato also reported its second quarter earnings. Net profit fell in the September quarter of fiscal 2025 to miss analysts' estimates, even as the food delivery giant continued to expand its top line.

Net profit was down 30% at Rs 176 crore in the July-September period. This compares to Rs 253 crore in the preceding quarter ended June 30.

The Gurugram-based company, however, marked its sixth consecutive profitable quarter on a consolidated basis. Revenue rose 14% to Rs 4,799 crore versus Rs 4,206 crore in the year ago period. The Bloomberg estimate was Rs 4,682 crore.

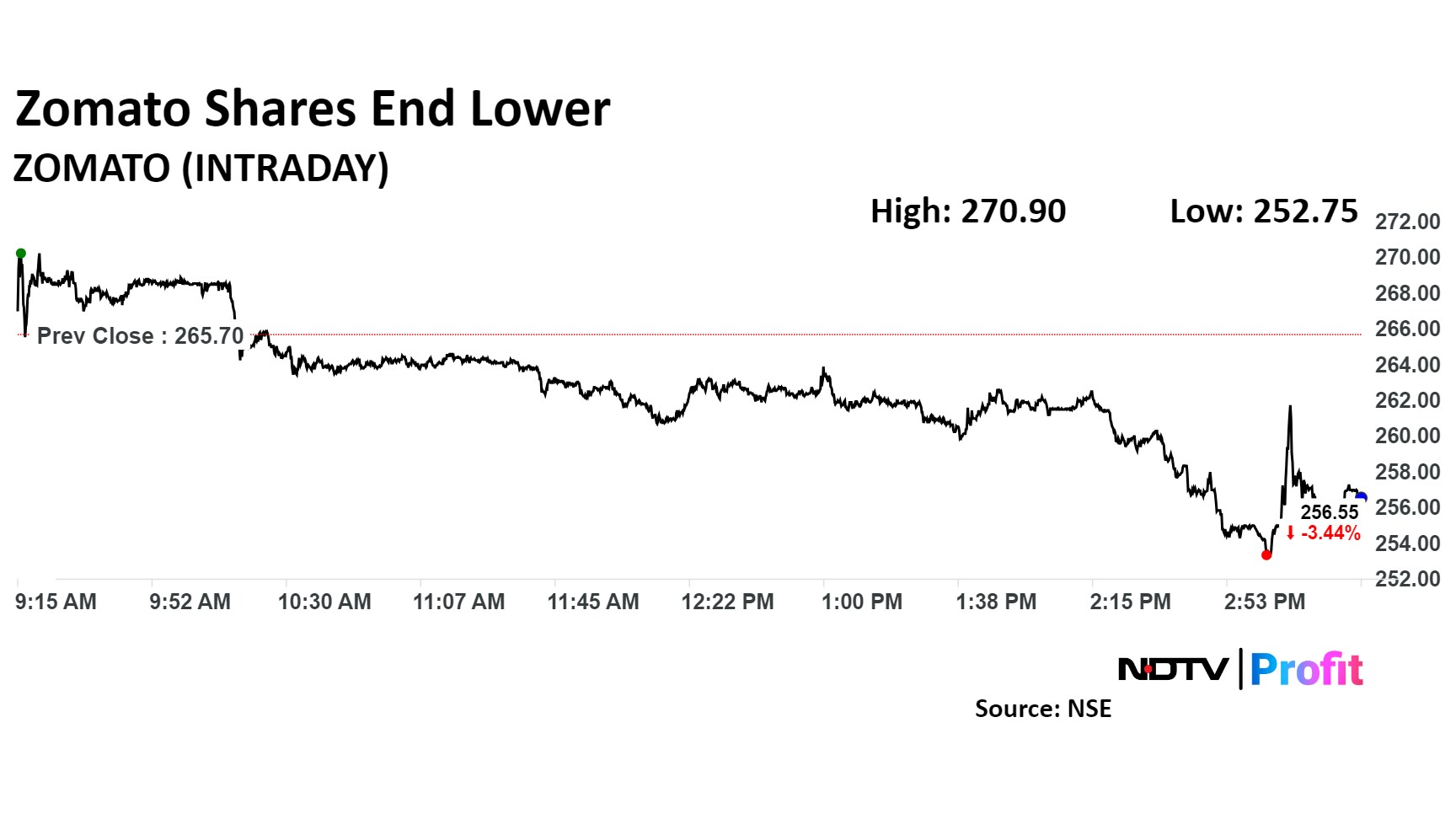

Zomato Share Price Movement

Zomato shares closed much as 3.4% lower to Rs 256.55 apiece, ahead of the announcement.

Zomato shares closed 3.4% lower to Rs 256.55 apiece, ahead of the announcement. This compared to a 1.25% decline in the benchmark Nifty 50.

The stock has risen 126% in the last 12 months.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating and three suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.