These days leading banks offer the facility of opening savings accounts instantly via internet on mobile or desktops. The largest lender of the country, State Bank of India, has been offering two such savings accounts, which can be opened via its YONO app and do not require maintenance of any minimum balance as of now. Among private lenders, both Axis Bank and Kotak Mahindra Bank have also introduced similar accounts which do not require maintenance of any minimum balance. However, the interest rates offered on digital savings accounts of Axis Bank and Kotak Mahindra Bank are better than SBI's.

Given below are details and comparisons among digital zero balance savings accounts offered by SBI, Axis Bank and Kotak Mahindra Bank:

State Bank Of India (SBI) Instant Savings Zero Balance Savings Accounts

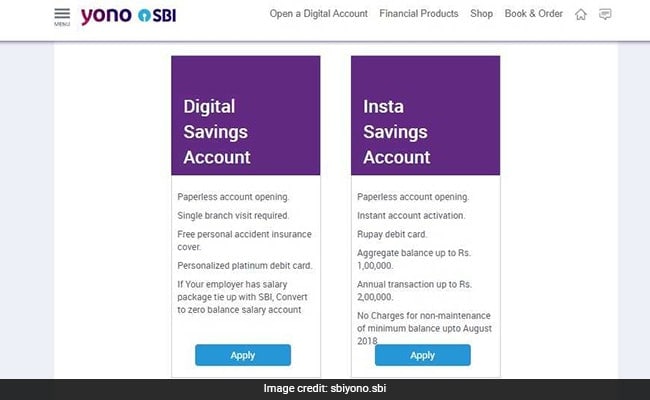

SBI offers two instant savings accounts which can be opened via YONO app. These are the Digital Savings Account and the Insta Savings Account, according to the website of YONO app, sbiyono.sbi.

(Digital Savings Account and Insta Savings Account of State Bank of India (SBI) do not require you to maintain any minimum balance under a special offer.)

Digital Savings Account of SBI does not require any minimum balance till March 31, 2019. Insta Savings Account of SBI does not require any minimum balance till August 2018. But after this date, customers will be required to maintain minimum balance as defined for normal SBI Savings Bank Accounts, according to sbi.co.in. Both accounts can be opened on the basis of paperless opening, which means that a customer does not need to submit physical copies of acceptable documents to SBI at the time of opening of these accounts. All that you need to provide is your Aadhaar card and PAN (permanent account number) details.

SBI Digital Savings Account:

You will be required to make one visit to an SBI branch to open this account. It offers you a personalized Platinum Debit Card.

SBI Insta Savings Account

This account is for new customers having no existing relationship with SBI. It gets started on the basis of OTP or one-time password-based electronic KYC (Know Your Customer), which helps the bank verify the applicant. This account can be opened from home and does not require the applicant to visit a bank branch. Thus, it can be activated instantly. This account offers a free Rupay debit card.

Interest rates on SBI Digital Savings Account, Insta Savings Account

The interest rates on both these accounts are the same as on regular savings accounts of SBI. For a balance up to Rs 1 crore, the interest rate on deposits in both the accounts is 3.5 per cent while for balance above Rs 1 crore, the interest rate is 4 per cent.

Axis Bank's Axis ASAP Zero Balance Savings Account

Axis Bank offers Axis ASAP account, which does not require you to maintain any minimum balance. This instant account can be opened in any Axis Bank branch, according to a mail from Axis Bank. All that you need is your Aadhaar card number and PAN.

Interest rate on Axis Bank's Axis ASAP Zero Balance Savings Account

Axis ASAP Zero Balance Account offers an interest rate up to 7.1 per cent for balances above Rs 1 lakh.

Kotak Mahindra Bank's 811 Digital Zero Balance Savings Account

Kotak Mahindra Bank offers the facility of opening 811 instant account. It offers a virtual debit card. "The essence of 811 is to bring to you all facilities from zero balance banking to seamless shopping, travelling and entertainment experience under one umbrella of Kotak 811," said Kotak Mahindra Bank on its website, m.kotak.com.

(Kotak Mahindra Bank's 811 Digital Account, which offers up to 6% interest rate, does not require any minimum balance.)

Interest rates on Kotak 811 Digital Zero Balance Savings Account

This account offers an interest rate of up to 6 per cent on your deposits. For balance over Rs 1 lakh and up to Rs 1 crore, the interest rate is 6 per cent. For balances above Rs 1 crore, the interest rate is 5.5 per cent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.