Zee Entertainment Enterprises Ltd. said on Tuesday that it entered into a settlement agreement to settle all merger-related disputes with Japan's Sony Group Corp.

The company said all claims, including the $90 million termination fee, damages, litigation and other costs incurred have been settled with Culver Max Entertainment Pvt. and Bangla Entertainment Pvt., according to its statement to the exchanges.

Zee said it has, along with Culver Max and Bangla Entertainment, agreed to relinquish all their rights to bring any claims in relation to the transaction documents and implementation of the merger before Singapore International Arbitration Centre, the National Company Law Tribunal or any other forum

Additionally, both the parties will inform the relevant regulatory authorities about their decision. It has been further mentioned that finally, none of the companies will have any remaining obligations or liabilities towards each other.

The decision has been taken as per a mutual understanding between Zee and Sony, keeping in mind their future growth.

In January, Sony ended the $10 billion merger with Zee, because Zee failed to meet certain conditions, including alleged financial mismanagement and recovering dues from related parties. Consequently, Sony initiated arbitration proceedings against Zee under the SIAC rules.

Zee had earlier withdrawn all its litigation against Sony that had been filed post the termination of the merger before the NLCT.

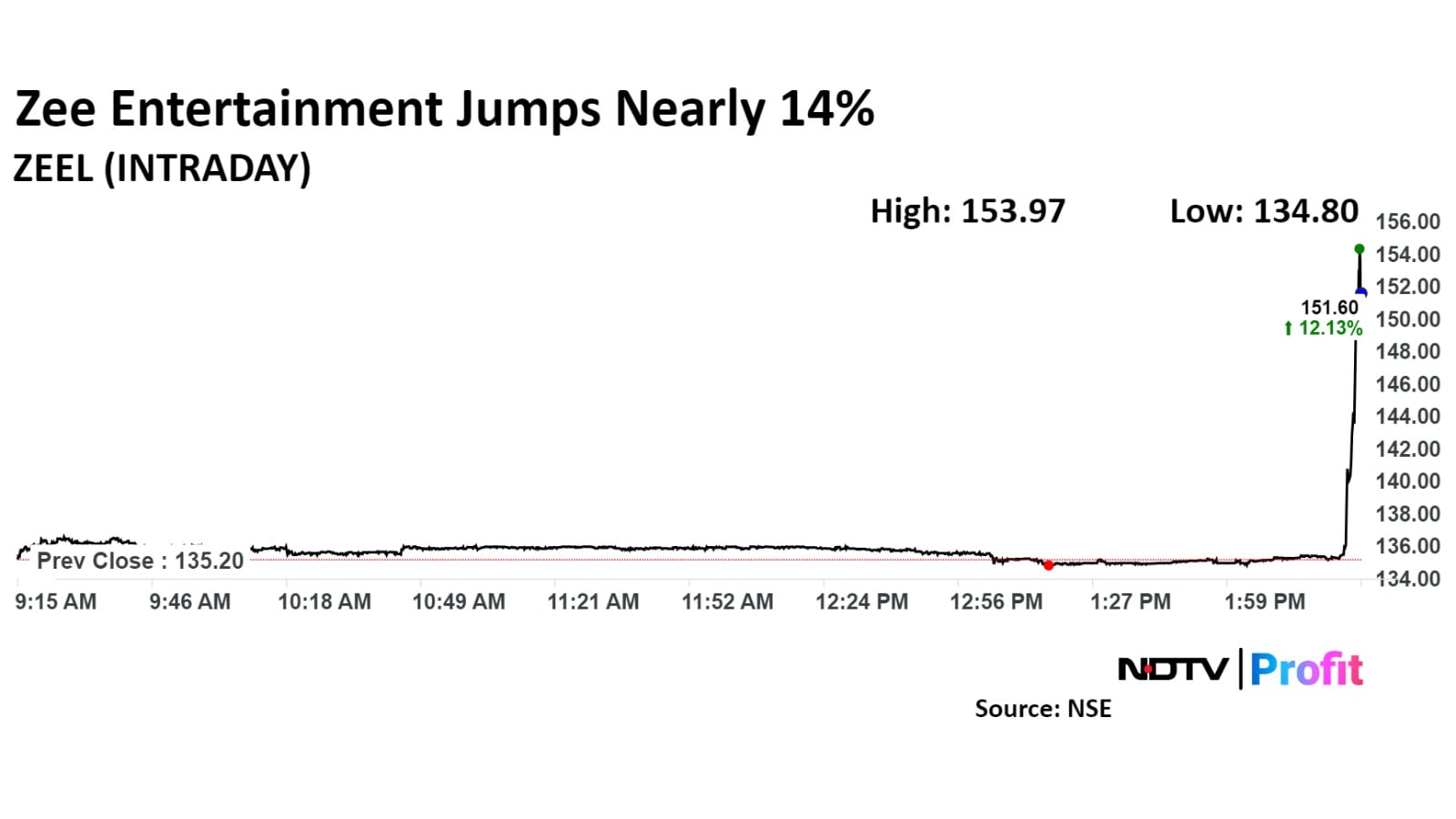

On the NSE, Zee's stock rose as much as 14.5% after the announcement to Rs 154.9 apiece, the highest since July 17. It was trading 12.28% higher at Rs 151.8 per share, compared to a 0.15% advance in the benchmark Nifty as of 2:32 p.m.

The share price has declined 65% during the last 12 months and 46% on a year-to-date basis. The relative strength index was at 59.

Seven out of the 20 analysts tracking the company have a 'buy' rating on the stock, six suggest 'hold' and seven recommend 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 20%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.