The rescue of Yes Bank by a consortium of Indian banks, including State Bank of India, ICICI Bank Ltd., HDFC Bank Ltd., and Life Insurance Corp. of India, marked a turning point for the lender after its financials collapsed due to alleged mismanagement and irregularities by previous promoters. The intervention was made under a reconstruction scheme formulated by the Reserve Bank of India, in collaboration with the government.

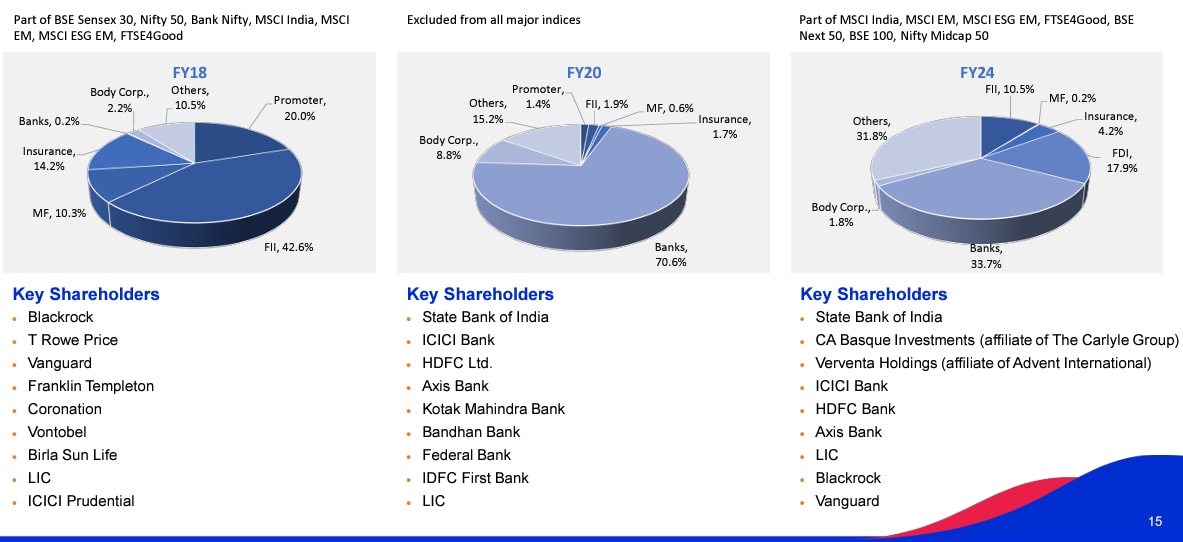

This trend has continued, with a steady reduction in the shareholding of Indian banks, as foreign institutional investors have increased their presence.

Yes Bank's latest investor presentation shows that key shareholders now include global entities like Blackrock and Vanguard, alongside initial rescuers like SBI, ICICI Bank, and HDFC Bank. The evolution of Yes Bank's shareholding structure reflects a transition in ownership, with domestic banks gradually decreasing their exposure in favour of a more diversified, globally-oriented shareholder base.

Back in fiscal 2020, Yes Bank's key shareholders were a group of Indian financial institutions, led by SBI, ICICI Bank, HDFC, Axis Bank Ltd., and others, such as Kotak Mahindra Bank Ltd., Bandhan Bank, Federal Bank, and IDFC First Bank. As the bank moves forward, the reduced shareholding of these institutions signals the winding down of the rescue phase, enabling them to exit as foreign investors step in to take a more significant role in Yes Bank's future.

Yes Bank investor presentation

In September 2022, Yes Bank's shareholding structure was still dominated by domestic banks, such as SBI, Axis Bank, ICICI Bank, and LIC. However, by December 2022, a shift occurred with the entry of foreign investors, notably CA Basque Investments, an affiliate of The Carlyle Group, and Verventa Holdings, an affiliate of Advent International. Both acquired a 6.43% stake each in the lender.

The bank, which was excluded from all the key indices in 2020, is now part of global benchmark indices like the MSCI India, MSCI Emerging Market, MSCI ESG EM, FTSE4Good, BSE Next 50, BSE 100, Nifty Midcap 50. The inclusion in these indices has led to global funds investing in the shares of the company.

Over the past few years, Yes Bank has improved its balance sheet by addressing critical issues like asset quality and growth. As the lender regained stability, the gradual dilution of these Indian banks' stake has become evident, driven by the entry of foreign investors.

Shares of Yes Bank have risen over 31% in the past one year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.