Electric vehicle penetration has gone up three times in the last three years, led by electric two-wheelers. Despite the new EMPS scheme slashing incentives to purchase an electric vehicle, demand has come back after a blip in April. This indicates that growth in electric two wheeler market is here to stay.

This World EV Day, here is a look at India's EV growth journey in the last couple years.

Two-Wheeler Market

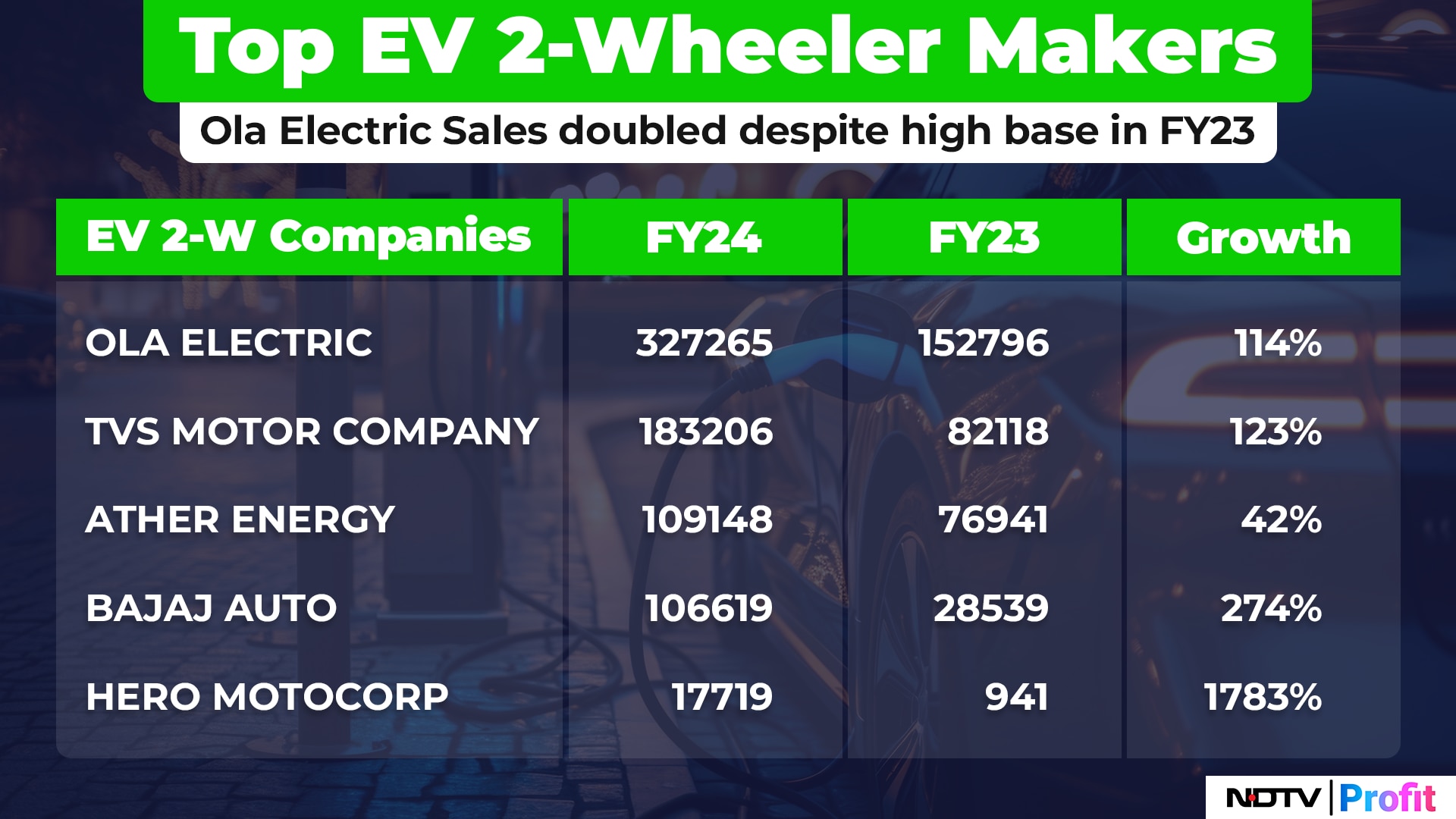

Total electric two-wheeler sales have grown 30% to roughly 9.45 lakh units in fiscal 2024, compared to roughly 7.3 lakh units in the previous fiscal. All companies, except Ather Energy Pvt., have at the least doubled their sales compared to last year.

Ola Electric Mobility Pvt. has doubled its sales despite being on a relatively strong base last year, while TVS Motors Co.—with the I-Qube launch—was able to address a market which needed more reliability and brand trust.

Market Share

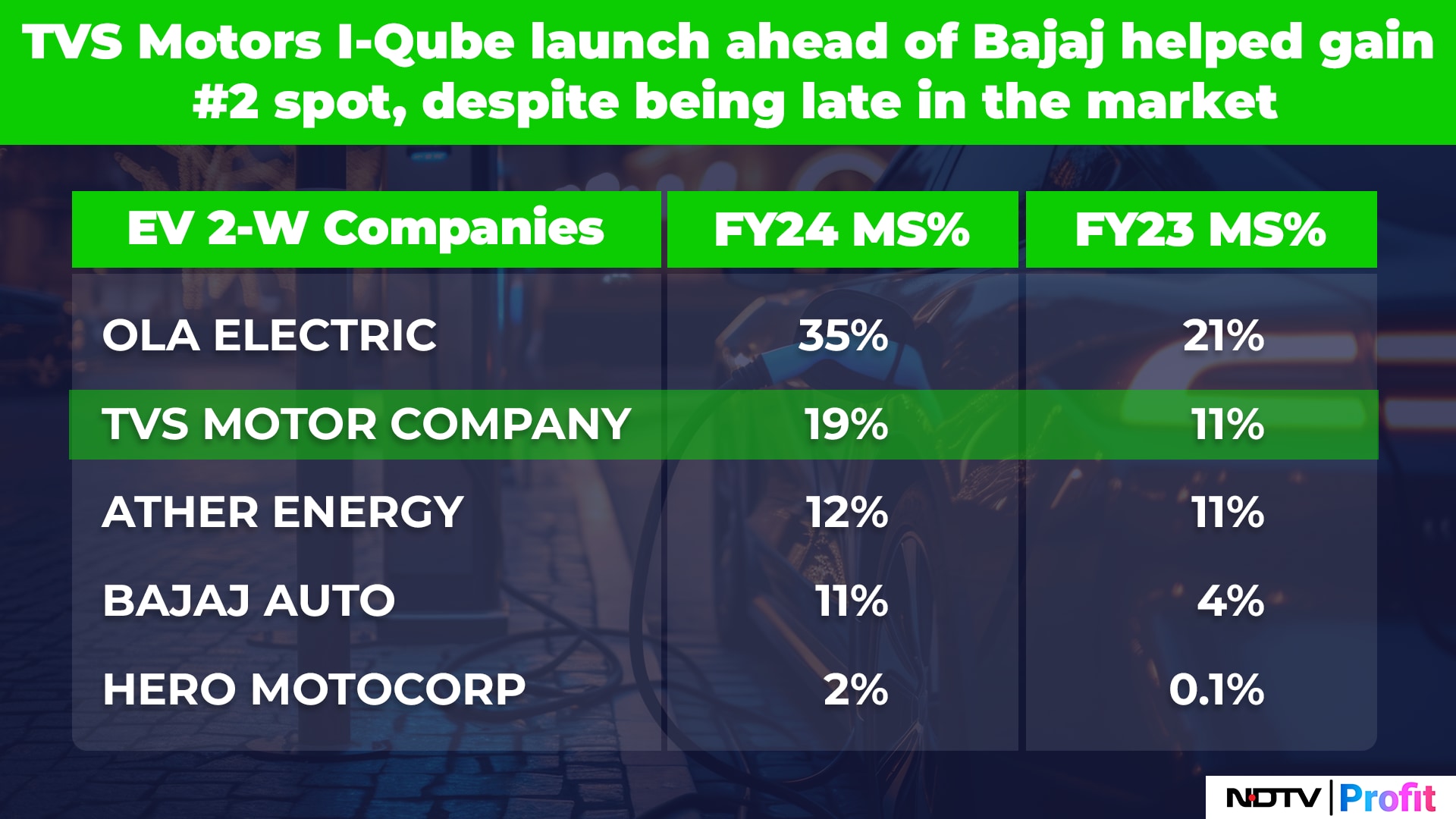

While Ola Electric grew its market share in fiscal 2024, TVS got close to almost capturing a fifth of the market. It was also ahead of its peer Bajaj Auto Ltd., as of fiscal 2024.

Ather Energy, despite having a early headstart compared to legacy players like TVS and Bajaj, hasn't been able to meaningfully capture the market, seeing only a 1% growth from fiscal 2023.

Fiscal 2025 Paints A Different Picture

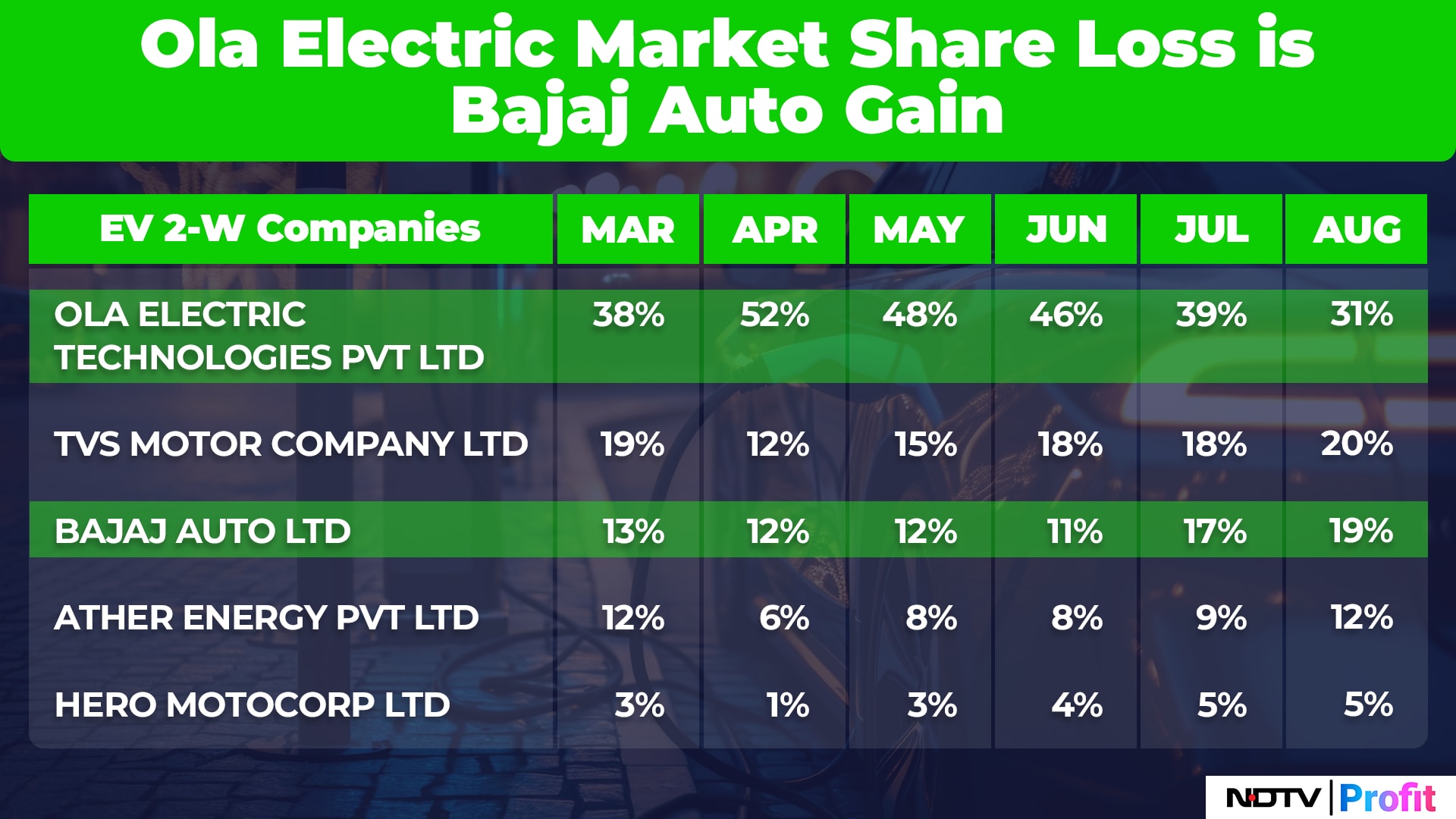

With a fast growing industry like the electric scooters, change is the only constant. The new EMPS scheme, launched after the FAME 2 scheme ended on March 31, 2024, reduced benefits for owning a vehicle by 50%. While the market shrunk in April, sales have grown almost every month after that. Ola Electric did see its market share cross 50%, that was mainly led by sales falling dramatically by other players.

The April to August period of this year has seen almost all players report sales growth. Ola Electric has grown roughly 60% while Hero MotoCorp Ltd. has also grown multifold albeit at a low base.

When it comes to market share, Ola Electric saw its share drop to 31% in August, from 46% by end of June. While, Bajaj Auto's market share rose close to 19%. This has levelled Bajaj with closest rival TVS, which had a 20% market share as of August.

Ather Energy has also seen its market share grow by 50%, commanding a 12% share. The company has launched its ‘family' brand Rizta, which is not positioned as the cheapest scooter but more of a feature rich scooter.

Electric Four-Wheelers

While the electric two-wheeler segment has seen competition become a five horse race, the same cannot be said about the electric car segment. EV four-wheeler sales touched 95,000 in fiscal 2024, led by Tata Motors, which commands 70% market share thanks to its launches of Nexon and Punch EVs.

The other closest peer would be M&M XUV 4OO, but after the initial excitement the product failed to make a meaningful mark. The company is expected to launch a refurbished electric XUV 4OO this fiscal—a strategy seen similar to what the company did with its petrol variant of SUV 3XO replacing its erstwhile predecessor XUV 3OO as well.

Other players like MG Motor, Citroen, Hyundai Motor India Ltd. and Kia India Pvt. have launched premium electric vehicles and most of them are expected to launch mass market electric vehicles in the next 12-18 months.

Maruti Suzuki India Ltd. is also expected to launch its EV by the end of this financial year.

EV Buses

The EV bus segment has been affected due to profitability concerns and the payment mechanism which has led legacy players, like Ashok Leyland Ltd., Tata Motors and VECV, being selective with the contracts they apply for. Certain states have been placing orders for these electric buses, but lack of outright purchase and embargo on operations of said buses have been challenges.

New entrants like Jay Bharat Maruti Ltd. and Olectra Greentech Ltd. are trying to disrupt the market. Their smaller size and singular focus on EV market has seen them accepting these terms by states, which are open to operating these buses as well for 10-12 years.

FAME 3 A Key Monitorable

The announcement of the FAME 3 is going to be a key monitorable. The EMPS scheme that replaced the FAME 2 for a brief period has a smaller outlay of just Rs 778 crore, compared to Rs 10,000 crore of FAME 2.

FAME 3 is expected to be launched in a couple of months, according to HD Kumaraswamy, Minister of Heavy Industries. The scheme's outlay and scope within the segment are another thing to watch out for.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.