The board of Wonderla Holidays Ltd., an amusement park company, has approved raising up to Rs 800 crore in one or more tranches through the issue of equity shares with a face value of Rs 10 each via private placement, qualified institutional placement, preferential issue, or a combination of these methods.

The board has also approved an increase in the company's authorised share capital from Rs 60 crore divided into 6 crore equity shares of Rs 10 each to Rs 80 crore divided into 8 crore equity shares of Rs 10 each, according to an exchange filing on Friday.

The fundraising and capital clauses of the Memorandum of Association are subject to approval by the company's shareholders, as well as any regulatory or statutory approvals that may be required.

Furthermore, the company's shareholders must approve the adoption of a new set of Articles of Association as per the Companies Act of 2013.

Wonderla Holidays operates amusement parks in Kochi, Bengaluru, Hyderabad, and Bhubaneswar, as well as the Wonderla resort in Bengaluru under the brand name Wonderla.

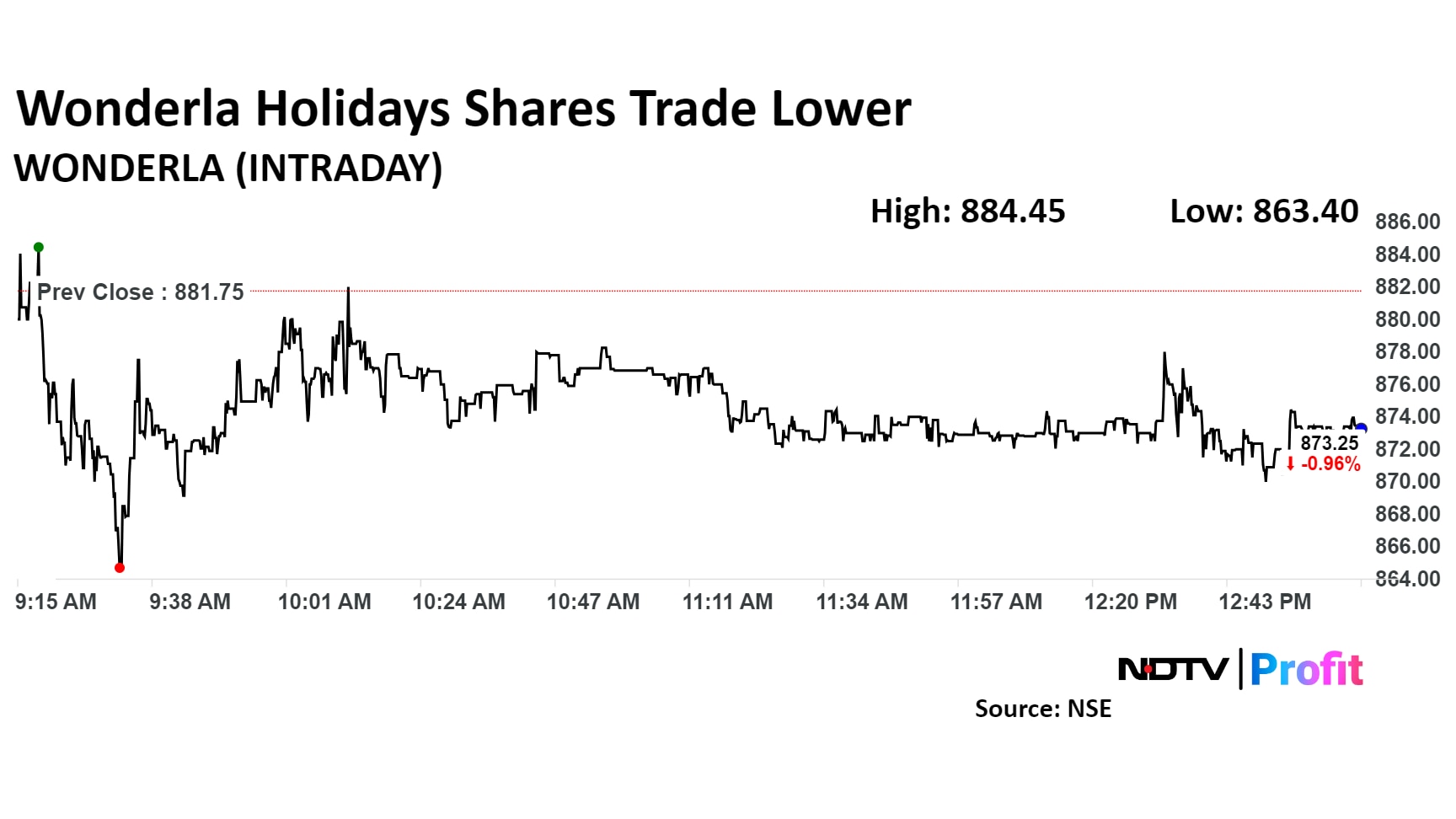

Wonderla Holidays share price was trading 0.96% lower at Rs 872 apiece, compared to a 0.62% decline in the benchmark NSE Nifty 50 as of 1:07 p.m.

The stock has risen 19.70% in the last 12 months and 3.51% on a year-to-date basis. The total traded volume so far in the day stood at 0.05 times its 30-day average. The relative strength index was at 62.34.

All the three analysts tracking Wonderla Holidays have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 29.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.