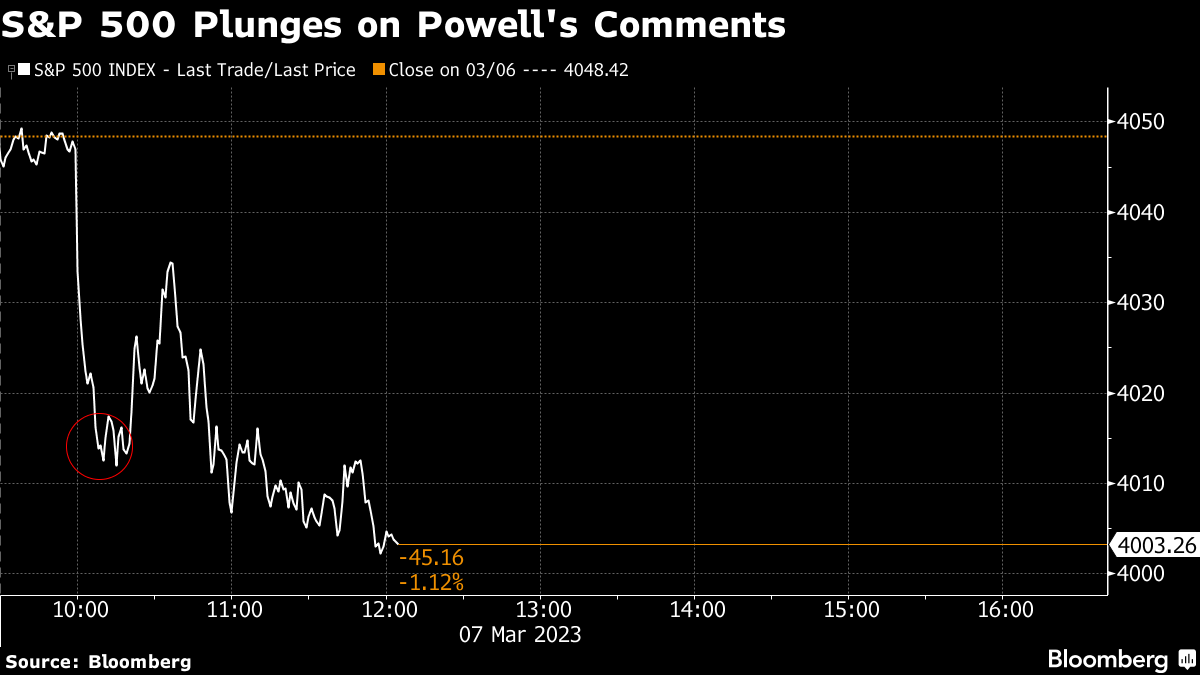

(Bloomberg) -- A hawkish warning from Federal Reserve Chair Jerome Powell that the central bank could speed up interest rate hikes upended Wall Street recent thinking that inflation would be tamed with more modest measures.

Treasuries sank to fresh lows after Powell said in prepared remarks that to battle persistent inflation the Fed was “prepared to increase the pace of rate hikes” and that the terminal rate “is likely to be higher than previously anticipated.” Swaps bets shifted to show traders now expect the Fed will be slightly more likely to announce a half-point hike rather than a quarter point move at their March meeting. The S&P 500 Index fell almost 1% before paring loses.

“They have only gone 25 bps once, if they go back to 50, who says they don't go to 75?” said Lindsay Rosner, multi-sector portfolio manager at PGIM Fixed Income. “The idea that we are in a stair-step function lower — this is definitely throwing water on it.”

Here's what others on Wall Street were saying:

Ian Lyngen of BMO Capital Markets:

“Powell's prepared text was biased hawkishly (more so than we anticipated) with comments that the Fed is ‘prepared to increase the pace of hikes if needed' and the ‘ultimate rate peak is likely higher than expected'. He went on to note decisions will be made ‘meeting by meeting.'”

“The chair also noted that the breadth of revisions to previous quarters suggests inflation is running higher.”

Steve Sosnick, chief strategist at Interactive Brokers:

“Goldilocks came out swinging.”

“These comments are completely in line with a data-dependent Fed. Every major inflation measure in February was both up over January and above expectations. Meanwhile, the other economic reports were generally positive - especially regarding employment. In that light, if he didn't take a hawkish tone about rates, we would have been rightly concerned.”

Michael Antonelli, market strategist at Baird:

“The market hates when interest-rate hikes are bigger than it expects or faster than it expects. Investors are trying to get their arms around where the Fed's terminal rate will be, so that's moving projections up more, which puts a headwind into stocks and makes every rally look more shaky.

Simon Harvey, head of FX analysis at Monex Europe Ltd.:

“Powell has finally yielded control over financial markets after repeated attempts to try and get them to bend to the Fed's message. By keeping the door open to a reacceleration in the Fed's hiking cycle, which we didn't expect because such an action doesn't build confidence over the Fed's control on inflation, Powell is letting financial markets do the dirty work for him.”

Randy Frederick, vice president of trading and derivatives for Charles Schwab Corp.:

“We've seen this story over and over again — even though the Fed has been continuously hawkish, there have been many instances where the market stopped believing the Fed, the Fed comes out hawkish, then the markets go lower again. It's a constant repetition. All of this can change if we get a surprising jobs report this week.”

Max Gokhman, head of MosaiQ Investment Strategy at Franklin Templeton Investment Solutions:

“Even though Powell just underlined what we already highlighted about the surprising resilience seen in the latest data, rates traders were somehow surprised at his candor and started pricing in a 50bp hike for March which then sent the rest of the markets into unease.”

Michael O'Rourke, chief market strategist at Jonestrading:

“Being down 1% is really not a meaningfully move when we rallied 1.6% Friday on no material news. Everything we are witnessing today and the past few days is simply noise. Policy is still too loose and financial conditions are historically ‘average,' not tight.”

Ashish Chugh, a money manager at Loomis Sayles & Co., on emerging markets:

“Higher US rates and stronger dollar have generally not been good for EM but I do think we are in a different regime this time around. In EM, monetary tightening cycle is closer to the end as inflation is easing in EM.”

Timothy Chubb, chief investment officer at Girard, a Univest Wealth Division:

“At the end of the day, we're skeptical of people arguing that inflation hasn't peaked yet. There hasn't been enough data to suggest the Fed would need to go as far as raising interest rates by 50 basis points at its next meeting just because of the recent hot inflation data. We have to see a quarter worth of figures to push the Fed to do that. One month doesn't make a trend.”

--With assistance from , and .

(Adds comments from O'Rourke, Chugh)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.