Most brokerages have raised Voltas Ltd.'s target price, citing continued growth over the next two years following solid earnings in the first quarter of fiscal 2025, marked by notable growth in its unitary cooling products segment and a turnaround in the electro-mechanical projects division.

Brokerages have offered varied perspectives on the company's future prospects, with Jefferies and Nomura maintaining a 'buy' rating while Kotak Institutional Equities has a 'sell' call on the stock.

Jefferies commended Voltas for its impressive first quarter results, particularly highlighting the 67% volume growth year-on-year in the unitary cooling products, or UCP, segment, which comprises the bulk of the company's sales. The brokerage also notes the recovery of the electro-mechanical projects, or EMP, segment, which achieved a positive EBIT margin after several challenging quarters.

Jefferies increased Voltas' earnings per share estimates for fiscals 2025 and 2026 by 10-12% and introduced forecasts for fiscal 2027. The brokerage raised its target price to Rs 1,770 apiece, implying an upside of 15.29% from the previous close, supported by the company's robust growth trajectory.

Similarly, Nomura has set a target price of Rs 1,857 apiece, implying an upside of nearly 21% from the previous close. The brokerage highlighted Voltas' revenue and Ebitda surpassing expectations, driven by strong performance in both UCP and EMP segments. It also noted an improved Ebit margin and a significant increase in market share, particularly in the air conditioning sector.

Nomura has revised the target price in anticipation of continued growth, with catalysts such as price hikes, moderating commodity prices, logistics savings, and PLI incentives assisting margin recovery over the next two years.

In contrast, Kotak Institutional Equities, while acknowledging Voltas' revenue growth, has expressed concerns over the UCP segment's EBIT margin, which fell short of the brokerage's expectations.

Kotak points out that, despite the strong summer performance, the margin of 8.6% was below their estimate of 10%. It maintains a 'sell' rating, reflecting concerns about the market's competitive intensity and limited margin expansion despite robust volume growth.

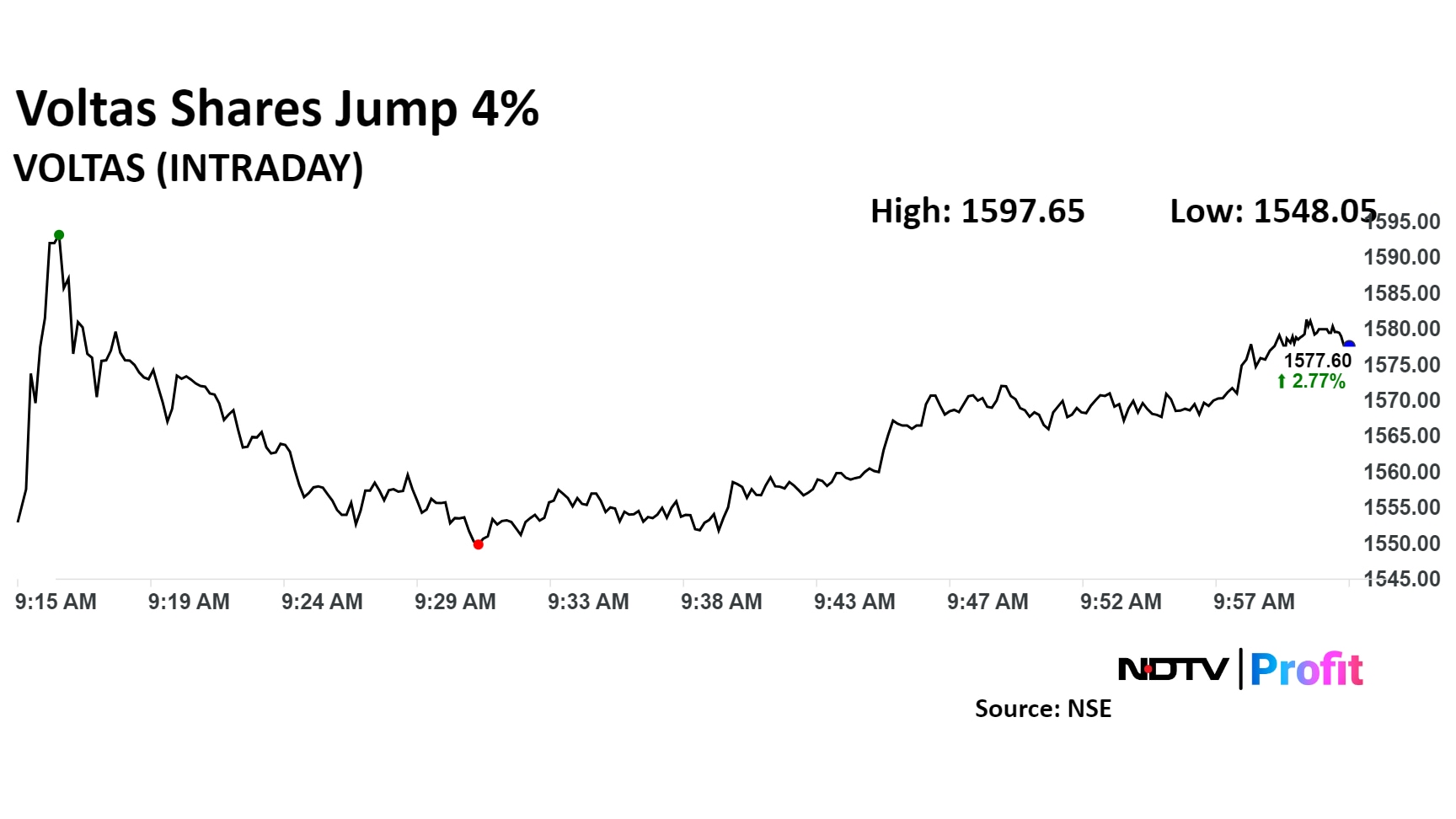

Shares of the company rose as much as 4.07% to Rs 1,597.65 apiece. It pared gains to trade 2.57% higher at Rs 1,573.7 apiece as of 10:00 a.m. This compares to a 0.15% advance in the NSE Nifty 50 Index.

The stock has risen 60.99% on a year-to-date basis. Total traded volume so far in the day stood at 0.49 times its 30-day average. The relative strength index was at 59.87.

Out of 40 analysts tracking the company, 19 maintain a 'buy' rating, 12 recommend a 'hold,' and nine suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 1.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.