(Bloomberg) -- If 10-year US Treasury yields hit 5% or higher, that's a good entry point for investors, according to Morgan Stanley Investment Management.

“Those will be great levels to get longer in your portfolio from a duration perspective” under current conditions, said Vishal Khanduja, money manager and co-head of the broad markets fixed-income team in Boston. “We'll be superbly in that overshoot category” from the firm's fair value levels for Treasuries should yields breach 5%.

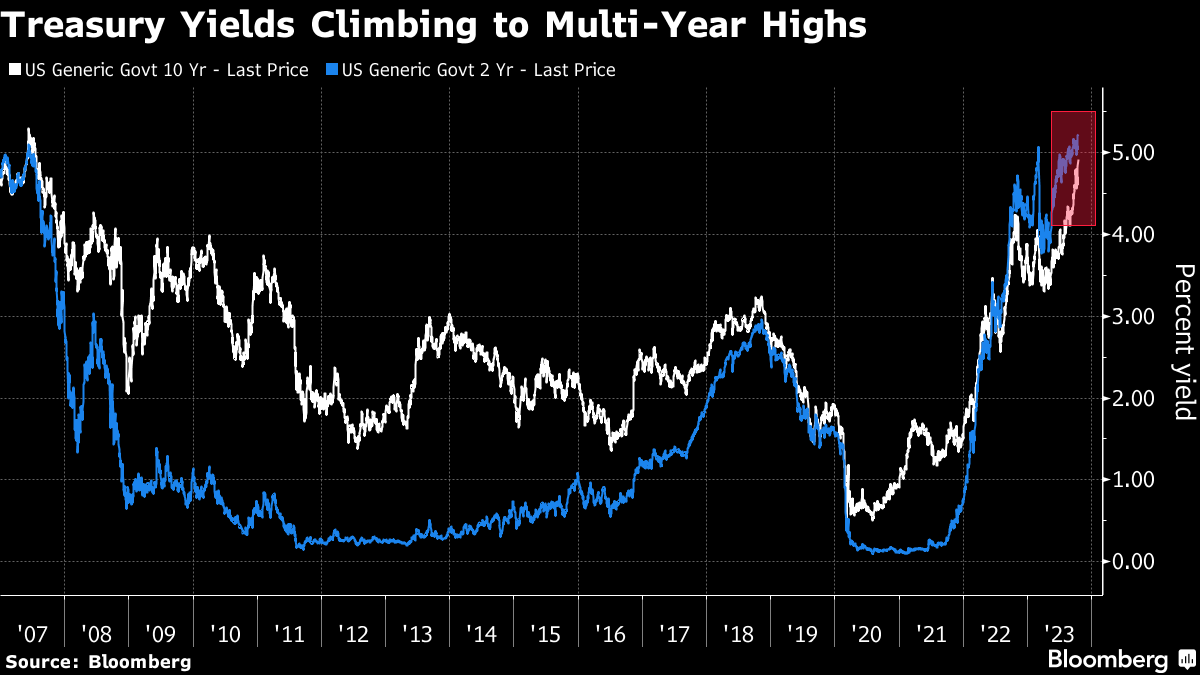

Benchmark US yields are fast closing in on the 5% mark, fueling debate about how much further they can rise as Federal Reserve officials pledge to keep interest rates higher for longer. Traders trying to time an entry into the market have to weigh opposing factors, as the conflict in the Middle East fuels haven bids while a swelling US deficit boosts the supply of securities.

US 10-year yields have soared over 30 basis points this week and reached 4.98% on Thursday, the highest since July 2007. Traders are looking to Fed Chair Jerome Powell's upcoming remarks at the Economic Club of New York to shed more light on the policy outlook.

While Khanduja is eyeing 5% as a decent entry point, he also has a steepener trade among his favored bets. Morgan Stanley Investment is positioned for the yield curve between the two and 10-year bonds to steepen.

That trade has paid off as the 10-year bond yield surged, narrowing the negative spread with the two-year note from more than 100 basis points when Khanduja put that strategy in place to minus 28 basis points.

“We definitely think it'll flip,” back to a positive spread, Khanduja said. “But I think the timeline for that is going to be a little longer.” The firm now thinks the Fed may only cut rates at the end of 2024 or the start of 2025, he said.

Beware the New Treasury Buyers Sparking Fear 5% Is Just a Start

Still, the Fed's most aggressive rate-hike cycle since the 1980s is likely over, as a steeper curve and term premium have “done the job for them” in tightening policy, he said.

Khanduja helps oversee a number of strategies at Morgan Stanley Investment, including the Calvert Bond Fund that's gained 1.1% in the past year to beat 85% of its peers.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.