(Bloomberg) -- The Biden administration wants to tighten the screws on Iran's oil sales to neutralize its support for militants in the Middle East. But squeezing too hard risks inflicting higher prices on both a sluggish global economy and President Joe Biden's looming election rematch with Donald Trump.

The White House aims to strengthen enforcement of existing sanctions as the regional crisis worsens, according to people familiar with the situation, although it's aware missteps risk disrupting global oil markets.

Solving this dilemma has become a priority given Iran's support in Gaza for Hamas — which started a war with Israel — and in Yemen for the Houthis — who are disrupting global trade — as well as other groups harassing US forces in the region. The situation escalated late last month with the killing of three US soldiers in an Iran-linked attack, leading Biden to strike related targets in Iraq and Syria and vow further actions.

“The administration has a desire to tighten sanctions enforcement on Iran,” said Ali Vaez, project director for Iran at the International Crisis Group. “But it doesn't necessarily have the means because of political and geopolitical limitations.”

Those challenges include persuading other major producers, particularly Saudi Arabia, to prevent oil prices from moving higher. The kingdom rebuffed a plea from Biden for more oil in 2022 and more recently led OPEC output cuts. China, the leading buyer of Iranian oil, also has little incentive to help Washington given it's the world's biggest oil importer and a top strategic competitor.

A bipartisan group of lawmakers in the US has urged Biden to crack down by using existing sanctions on ships, ports and refineries that handle Iranian oil. Such tough action risks pushing up prices and hurting consumers, a political problem for Biden ahead of the November election.

So far this year, oil prices have fluctuated in a narrow $10 band, with traders seeing the market in balance even amid risks in the Middle East, a deep freeze that knocked out chunks of US production and a relatively sanguine outlook for global economic growth this year, despite a lackluster performance by China.

Options the White House is considering include targeting vessels that carry Iranian crude or even punishing some of the countries that buy it or facilitate shipments, said one of the people, who asked not to be identified describing internal deliberations.

“The United States continues to hold Iran accountable for their escalatory actions by enforcing our sanctions and conducting maritime interdictions,” Adrienne Watson, a spokesperson for the White House National Security Council, said in a statement. “We will continue to take action to disrupt Iran's ability to fund terrorist elements in the region.” The Treasury Department declined to comment.

The State Department said the sanctions regime has forced nearly all of Iran's oil sales onto the black market, increasing the operational costs and reducing the profits available to Tehran.

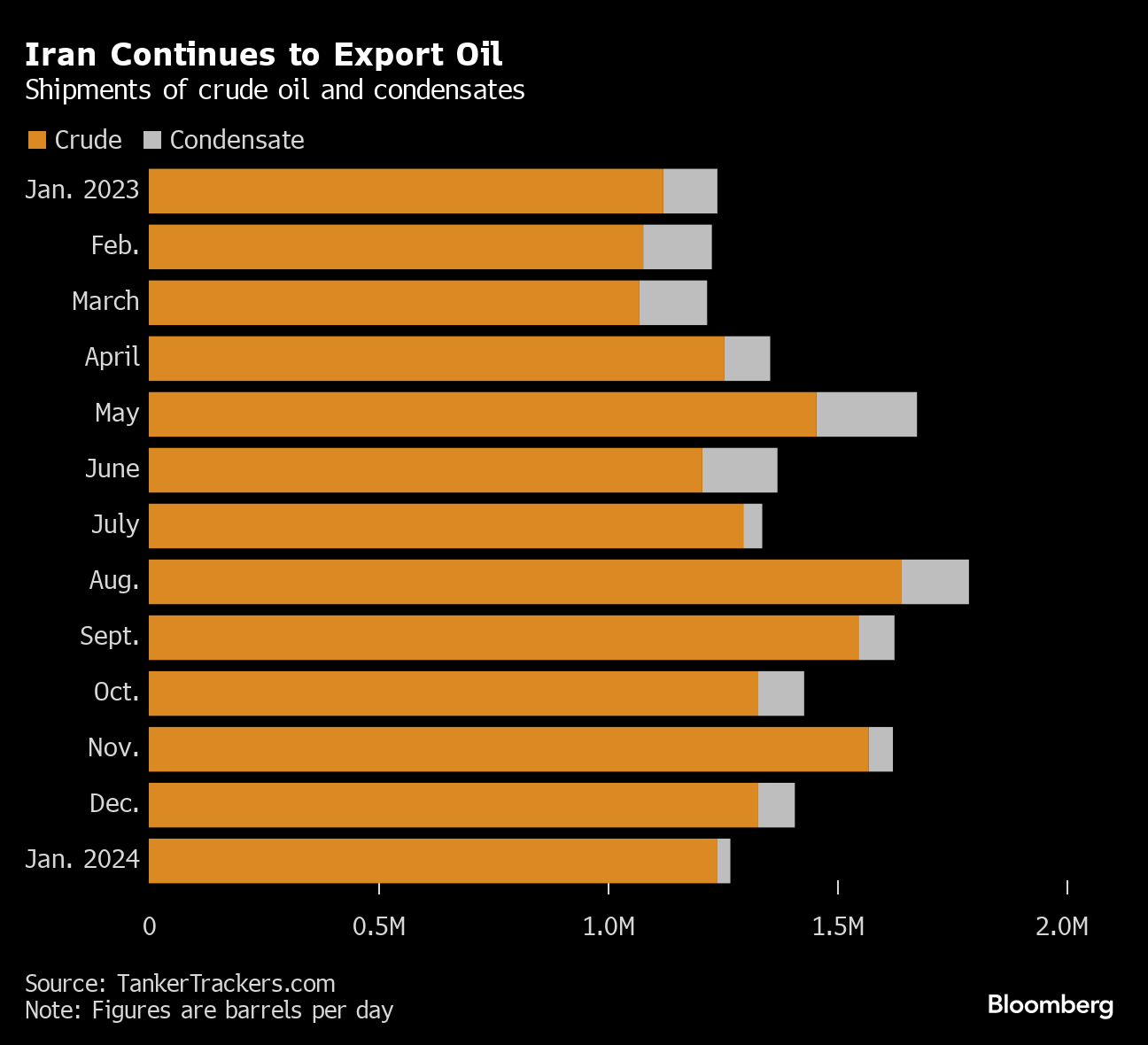

Iranian exports have steadily climbed as Washington's focus shifted to throttling Russia's energy revenue, an effort along with Group of Seven allies to dislodge President Vladimir Putin's troops from Ukraine. Their main tool has been a price “cap” on sales of Russian oil, a novel, if imperfect, approach aimed at cutting oil proceeds to Moscow while still keeping global markets supplied.

Iran's exports of crude and condensates, a light form of oil produced along with natural gas, averaged about 1.4 million barrels per day last year, according to data from TankerTrackers.com Inc.

A senior administration official said that exports would be more than 2.5 million barrels per day without current US sanctions enforcement, and that the US can tighten and ease sanctions as needed.

Many traders and analysts saw signs of such easing over the past year, as Iran's exports rose amid secret diplomacy between Washington and Tehran over prisoner swaps and frozen assets. Sales to China, which has rejected the US sanctions and is estimated to buy the majority of Iran's exports, rose to the highest in a decade last August.

Read more: For Global Oil Markets, a US-Iran Deal Is Already Happening

Everything changed Oct. 7, when Iran-backed Hamas attacked Israel, setting off a war in Gaza that's rallied other groups across the region that are part of the so-called Axis of Resistance backed by Tehran.

Since then, US officials including Treasury Secretary Janet Yellen and Secretary of State Antony Blinken have said the US has the ability to punish Iran.

Observers are skeptical, saying past rhetoric from the White House about stepped-up enforcement hasn't been followed by meaningful action.

“There are no indications that the Biden administration is about to change what has been a very consistent policy of prioritizing Iranian oil flows over tightening Iranian oil sanctions,” said Scott Modell, chief executive officer of Rapidan Energy Group.

And even if Washington did try to tighten sanctions, it would struggle to disrupt an expanded network of payments, middlemen and shippers that has emerged in recent years. Similar issues, including a “shadow” fleet of old oil tankers, have helped Russia dent the impact of the US-led price cap efforts.

Read More: Why the US Can't Stop Iran's Lucrative Oil Trade With China

One way to slow exports is to start targeting individual ships that carry the oil, said Claire Jungman, chief of staff at United Against Nuclear Iran.

“There are 360-plus vessels currently traveling the waters right now transporting Iranian oil and 90% of those are not sanctioned,” said Jungman. “Starting with sanctioning the vessels would have a huge impact.”

At this point, the best the US can hope to achieve is a reduction of 300,000 to 400,000 barrels per day, via a crackdown on way stations for Iranian oil, said Vaez of the International Crisis Group.

Beyond the oil markets, officials could use secondary sanctions on banks in the United Arab Emirates and Turkey that help Iran fund militias, said Kim Donovan, a former Treasury official and the director of the economic statecraft initiative at the Atlantic Council.

“We have a range of tools that we just really have not been enforcing very much over the past couple of years,” Donovan said in an interview. “Now that things are starting to escalate in the region again, I think we need to turn more attention back to Iran.”

--With assistance from Alaric Nightingale, Daniel Flatley, Paul Burkhardt, Alex Longley, Serene Cheong and Sarah Chen.

(Updates with State Department comment in 10th paragraph.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.