Nifty's range of 24,200 and 24,000 will serve as a support for the benchmark index in the short-term, according to analysts.

The benchmark index closed little changed at 24,406 levels on Thursday, even as buying rose nearly 2% in the oil and gas sector as crude oil prices fell to a two-month low. The auto and pharma sectors, too, witnessed positive momentum.

"Monthly expiry and a strong put base at 24,400 aided the recovery. Nifty held onto its 20-DMA barely," Kush Bohra of the investment platform Kushbohra.com, told NDTV Profit. "A close below it would confirm a near-term downtrend, potentially falling to 23,800."

Shrikant Chouhan, head of equity research at Kotak Securities, spoke of similar trends for the Nifty and Sensex.

"Nifty/Sensex could move up to 24,500-24,650/80,500-80,750," he said. "However, below 24,300/79,700 the sentiment could change..., we could see one quick correction up to 24,150-24,100/79,300-79,000."

"Overall, we expect the market to continue its consolidation mode with stock-specific action given the earning season is in full swing," Siddhartha Khemka, head-retail research at Motilal Oswal Financial Services Ltd., said. "All eyes will be on the US Q2 GDP data. Thus, markets would take cues from their peers."

The Bank Nifty index settled on a negative note on Thursday at 50,889, after Axis Bank Ltd. announced poor-than-expected first-quarter earnings.

"As long as the index holds below 51,100, weakness is likely to continue," said Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd. "On the downside, 50,500 and 50,000 will act as support levels."

Bank Nifty's weakness continued, with a failed attempt to hold the 50DMA. "While 50,000 is a key psychological level, significant support is expected in the 49,600-49,800 range," Bohra said. "Traders can maintain their short positions until Bank Nifty crosses 51,500."

GIFT Nifty was trading 80.5 points, or 0.33%, higher at 24,490.5 as of 06:49 a.m.

F&O Action

The Nifty August futures are down 0.13% to 24,461 at a discount of 55.45 points, with open interest up by 55%.

Nifty Bank July futures are up by 0.94% to 50,918 at a premium of 29.25 points, while its open interest is down by 9.22%.

The open interest distribution for the Nifty 50 August 1 expiry series indicated most activity at 25,000 call strikes, with 24,000 put strikes having maximum open interest.

For the Bank Nifty options July 31 expiry, the maximum call open interest was at 53,000 and the maximum put open interest was at 39,500.

FII/DII Activity

Foreign investors have offloaded shares worth Rs 10,711.70 crore since the budget day.

Foreign portfolio investors offloaded stocks worth Rs 2,605.5 crore on Thursday, while domestic institutional investors stayed net buyers for the third session and mopped up equities worth Rs 2,431.7 crore, the NSE data showed.

Market Recap

The benchmark equity indices ended little changed on Thursday as shares of Tata Motors Ltd. and HDFC Bank Ltd. helped erase losses after a lower open.

The NSE Nifty 50 ended 0.03% lower at 24,406.10, and the S&P BSE Sensex closed 0.14% down at 80,039.80.

Intraday, the Nifty declined as much as 0.83% to 24,210.80, and the S&P BSE Sensex fell 0.84% to 79,477.83.

The broader indices ended flat as the BSE MidCap ended 0.1% lower and the SmallCap closed 0.04% down.

Eleven out of the 20 sectoral indices on the BSE ended higher, with oil and gas being the top gainer.

Major Stocks In News

Mankind Pharma: The company will acquire biopharma firm Bharat Serums and Vaccines for Rs 13,630 crore, as it aims to strengthen its position in the women's health and fertility market segment.

Texmaco Rail and Engineering: The board approved the acquisition of Jindal Rail Infrastructure from JITF Urban Infrastructure Service for an aggregate consideration amount of Rs 465 crore.

SJVN: The company has received a huge order worth 13,497 crore from the government of Mizoram for completion of a pumped storage project.

Gandhar Oil Refinery: The board approved the incorporation of new subsidiary Gandhar Lifesciences. The new unit will carry out pharmaceuticals and cosmetics business.

Cupid: The company has expanded its E-commerce presence through Indian platforms like Amazon, Flipkart and 1mg.

Global Cues

Stocks in the Asia-Pacific region recovered from a two-day rout on positive sentiments from strong US economic data signalling rate cuts and a soft landing for the economy.

Equities in Australia and South Korea rose in earlier trade while those in Japan were marginally higher. The Nikkei 225 was 45 points or 0.14% higher at 37,934, while the S&P ASX 200 was 53 points or 0.67% up at 7,914 as of 06:34 a.m.

The CPI print is Japan is due on Friday, while the Monetary Authority of Singapore is scheduled to release its policy decision during the day.

The US economy grew by more than forecast in the second quarter. The economy grew by 2.8% in the June quarter against the Bloomberg's expectation of 2%. The economy's personal spending rose 2.3% for the quarter, beating estimates.

Meanwhile, the continued decline in the mega-tech companies on the Wall Street overshadowed the resilient economic data to end most equity indices lower. The S&P 500 Index and Nasdaq Composite declined 0.51% and 0.93%, respectively as of Thursday. The Dow Jones Industrial Average rose 0.20%.

Brent crude was trading 0.01% higher at $82.38 a barrel. Gold was 0.32% down at $2,357.06 an ounce.

Key Levels

US Dollar Index at 104.32

US 10-year bond yield at 4.25%

Brent crude up 0.01% at $82.38 per barrel

Bitcoin was up 1.37% at $66,168.81

Gold spot was down 0.32% at $2,357.06

Money Market Update

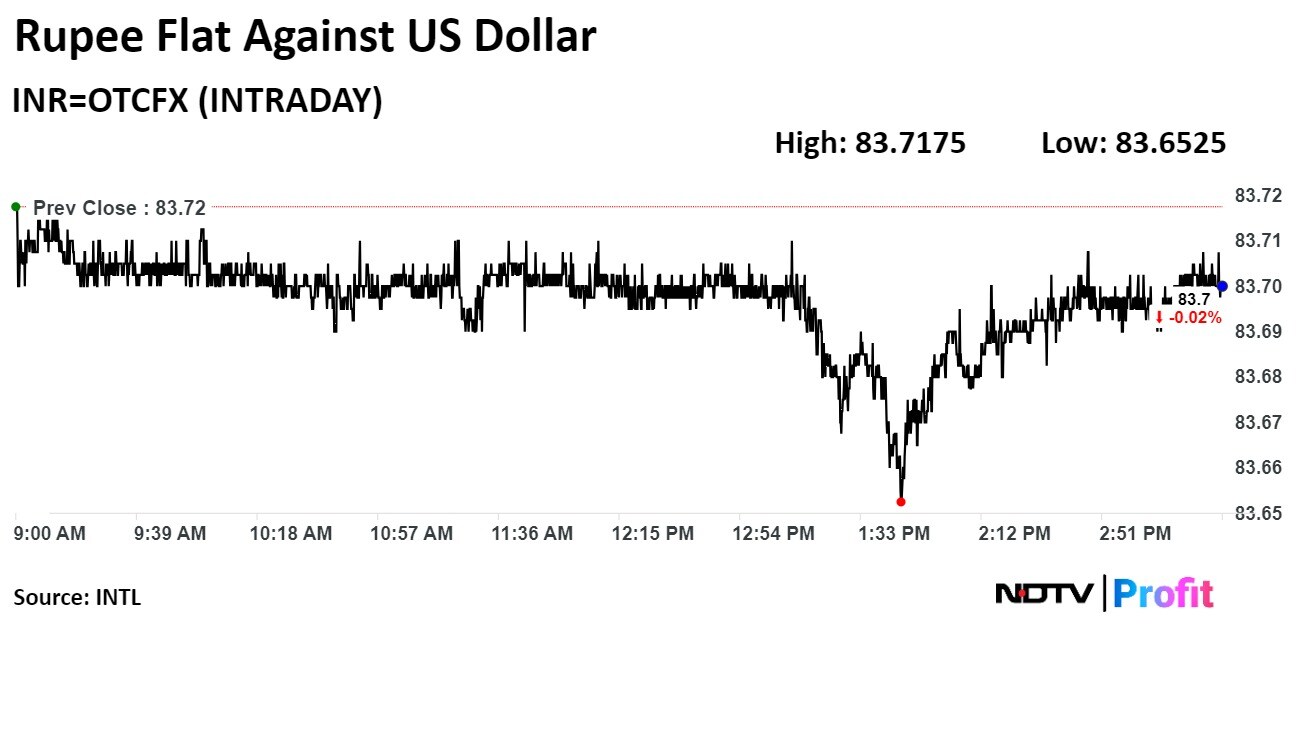

The Indian rupee closed flat against the US dollar on Thursday amid a fall in the prices of Brent crude and ahead of the Federal Reserve meeting.

The local currency closed flat at Rs 83.70; it had opened at Rs 83.71 against the greenback. It had closed at a record closing low for the second consecutive session at Rs 83.71 on Wednesday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.