The NSE Nifty 50 closed at 24,857.30 on Tuesday, with analysts noting that the psychological barrier of 25,000 will continue to be a significant resistance level. Immediate support is identified at 24,800, followed by 24,660. Sector-wise performance was mixed, with gains observed in consumer durables, oil & gas, auto, and realty sectors.

"Nifty 50 has made a doji candlestick pattern, which indicates indecisiveness between the bulls and bears," Aditya Gaggar, director of the brokerage Progressive Shares, told NDTV Profit. "A psychological level of 25,000 will continue to act as a strong barrier while immediate support is placed at 24,800 followed by 24,660."

Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd., said the Nifty crossing the 25,000 level would be an "euphoric moment for the equity markets".

Osho Krishan, senior analyst of technical and derivatives at Angel One Ltd., offered a counter view. "On the lower end, 24,600 is likely to be seen as intermediate support, followed by the sacrosanct demand at the 24,500 zone in the comparable period."

The Bank Nifty index rose marginally to settle at 51,499.

"Technically, the index is encountering resistance from a falling trend line, which is placed near 52,300 levels," said Hrishikesh Yedve, AVP Technical and Derivatives Research at Asit C. Mehta Investment Interrmediates Ltd. "Thus, 52,000-52,300 will serve as a resistance zone for Bank Nifty, while on the downside, 51,000 will act as strong support."

F&O Action

Ahead of the Aug. 29 expiry, the value of outstanding positions—also called open interest in the derivatives segment—has increased for FIIs in Nifty Futures.

As for Nifty Futures, foreign investors increased their long positions by 2,206 contracts at the end of the August expiry, while Nifty 50 short positions in futures decreased by 3,874 contracts.

FIIs bought index futures worth Rs 385.5 crore, index options worth Rs 53,913 crore while they sold Rs 2,143 crore in stock futures, Rs 47.49 crore in stock options.

Investor Activity

Overseas investors stayed net sellers of Indian equities on Tuesday for the second straight day.

Foreign portfolio investors offloaded stocks worth Rs 5,598.6 crore, while domestic institutional investors stayed net buyers for the sixth session and bought equities worth Rs 5,565.1 crore, the NSE data showed.

Market Recap

India's benchmark stock indices continued their gains for the third consecutive session to end at fresh record closing highs on Tuesday, led by HDFC Bank Ltd., Tata Motors Ltd. and NTPC Ltd.

Both indices closed at record highs. The NSE Nifty 50 closed 0.09% higher at 24,857.30, and the S&P BSE Sensex ended 0.12% up at 81,455.40.

Broader markets outperformed benchmark indices, with the S&P BSE midcap and smallcap indexes ending with 0.27% and 0.88% gains, respectively.

On the BSE, 16 sectors advanced and four declined. The S&P BSE Utilities rose the most, while the S&P BSE FMCG declined the most.

Major Stocks In News

Vedanta: The company received approval from 75% of its secured creditors for its planned split into six independent listed companies. The company has received a tax demand of Rs 1,289.1 crore from the National Faceless Assessment Centre for the assessment year 2021.

GAIL (India): The company's consolidated net profit rose 77.5% quarter-on-quarter in the first quarter, beating analysts' estimates.

Jindal Stainless: The stainless steel manufacturer reported a 12.4% fall in net profit in the first quarter of financial year 2025, even as it beat analysts' estimates.

Torrent Power: The company beat expectations as it reported a revenue growth of 23% year-on-year to Rs 9,034 crore in the quarter ended June, while net profit rose 87% to Rs 996 crore.

Titagarh Rail Systems: The wagon maker's net profit rose 8.4% year-on-year to Rs 67 crore in the quarter ended June.

Global Cues

Asian markets opened mixed ahead of the Bank of Japan's decision today and the US markets closed lower after poor results from Microsoft Corp. and geopolitical issues arising out of Israel's attack on Beirut.

Ahead of the BOJ's meeting today, most Japan stocks fell with the Nikkei 225 trading at 384.63 points or 0.96% lower at 38149.10. While Japanese stocks fell, South Korean stocks climbed following positive earnings results from Samsung Electronics Co. The S&P ASX 200 was 48.92 points or 0.62% up at 9002.10 as of 06:30 a.m.

The mixed moves in Asian markets came after Microsoft Corp. results disappointed markets and the S&P 500 Index and Nasdaq Composite fell 0.50% and 1.28%, respectively as of Tuesday. The Dow Jones Industrial Average however rose 0.50%.

The Federal Open Meeting Committee will also meet today. US policymakers will be paying close attention to any indications that Chairman Jerome Powell is planning to cut rates in September, a scenario that the market has already priced in.

Brent crude was trading 0.50% higher at $79.02 a barrel. Gold was down 0.10% down at $2,408.32 an ounce.

Key Levels

US Dollar Index at 104.4060.

US 10-year bond yield at 4.15%.

Brent crude up 0.50% at $79.02 per barrel.

Bitcoin was up 0.26% at $66,344.75

Gold spot was down 0.10% at $2,408.32 an ounce.

Money Market Update

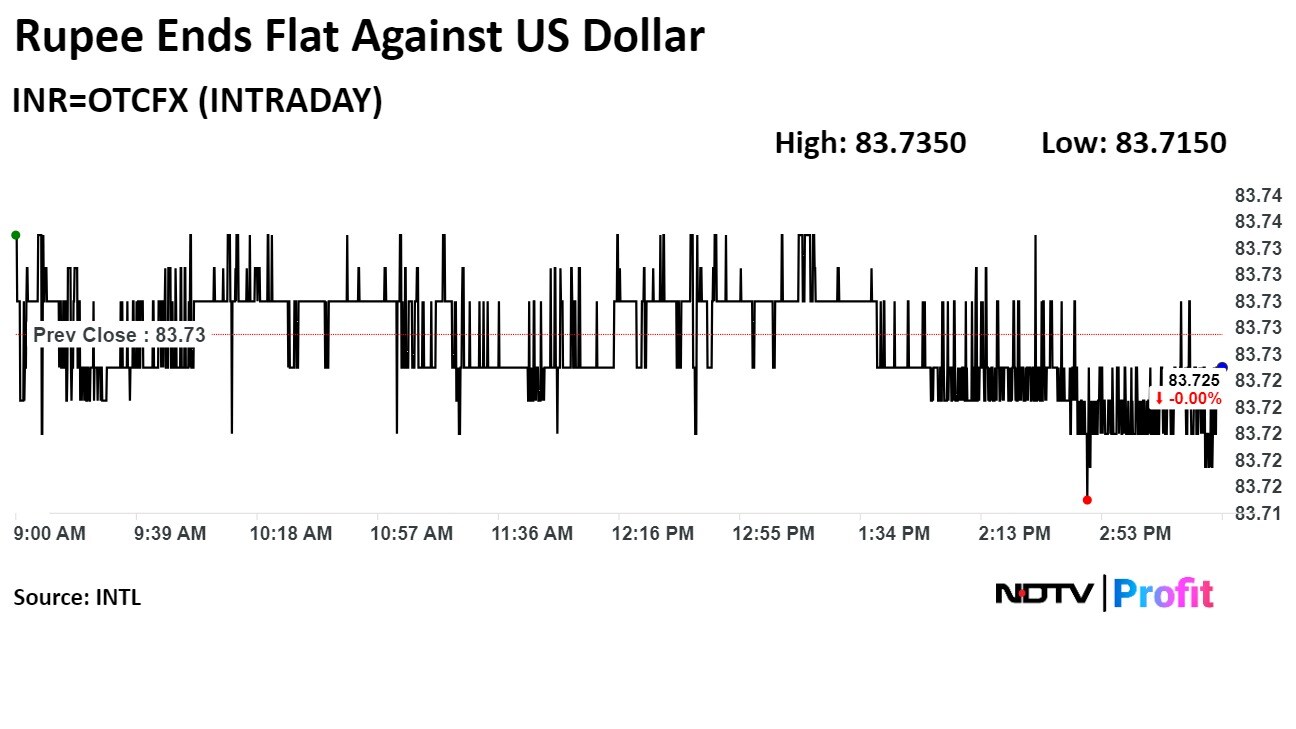

The Indian rupee weakened to a record low against the US dollar on Tuesday, ahead of key policy announcements by US Federal Reserve and Bank of Japan later this week.

The Indian currency closed at Rs 83.72 after dipping to Rs 83.7438 against the greenback in early trade, before paring loss to trade at Rs 83.7363 at 10:04 a.m. The local unit opened at Rs 83.73, unchanged from Monday's closing.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.