Last year in April, shares of Oxygen suppliers were in focus amid increasing demand for oxygen following a surge in Covid-19 cases.

This time around, the Omicron variant has brought oxygen stocks back to the limelight.

In the past few days, shares of oxygen companies are witnessing traction as Indian states prepare for the supply of oxygen.

Amid a surge in Covid cases, states have been asked to immediately strengthen health infrastructure, maintain buffer stocks of essential drugs and ensure that oxygen supply equipment is fully functional.

Amid the continuous surge in Covid cases, the Centre wrote to all states and UTs urging them to direct departments concerned to ensure adequate buffer stock of medical oxygen for at least 48 hours and reinvigorate oxygen control rooms.

Frenzy-driven rally?

India is witnessing a strong wave of cases for the past 2-3 weeks. This in turn has boosted the demand for medical oxygen.

And the companies producing oxygen are just starting to come back in to focus because of this.

The last time there was an oxygen crisis, investors went head over heels over oxygen stocks. Even stocks of companies with the word ‘Oxygen' in their name skyrocketed.

Bombay Oxygen Investments, which is an NBFC firm and has nothing to do with Oxygen, was pumped up unnecessarily just because it had Oxygen in its name.

But this time around, that's not the case. Shares of Bombay Oxygen are trading in a range while other actual oxygen supplier stocks are on a roll.

During the second wave, many hospitals ran out of medical oxygen that was critical for saving lives of Covid-19 patients. This scarcity led to loss of several lives that could have been prevented if early preparations were made.

So how are oxygen companies preparing for the third wave?

Let's take a look at the top oxygen companies in India.

#1 Linde India

Linde India, formerly known as BOC India, is a member of Linde Plc. and one of the leading industrial gases company in India.

The Linde group is the world's leading supplier of industrial, process and specialty gases, with operations across 100 countries.

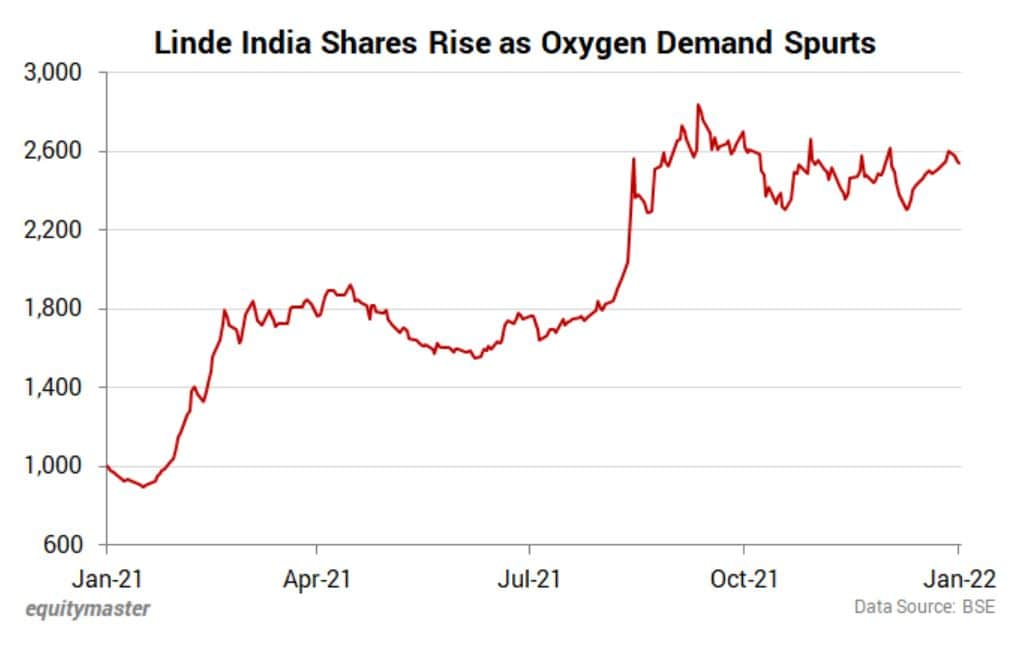

It's among the multibagger stocks of 2021. The stock delivered over 150% gains in the past one year.

The reason behind this? Increased demand for oxygen.

As Covid cases increased, it resulted in scarcity of medical oxygen. This put Linde India in limelight as the company is a supplier of medical oxygen to hospitals and industrial gases to corporations.

According to Haitong, an MNC brokerage, Linde India delivers more than 200 tonnes of medical oxygen every day to hospitals.

However, in a recent interview, the company's head of gases at the company said the oxygen demand has gone away. In fact, in Q4 of the calendar year, there was pick-up in industrial gases.

Also, the usage of foreign vaccines in India would be an added positive for Linde India. The government has already announced it would fast-track approvals of foreign vaccines.

Foreign vaccines need to be transported in cryogenic containers that use liquid nitrogen or dry ice to maintain sub-zero temperature. Linde India is the maker of these two important ingredients for sub-zero temperature.

Interestingly, Linde India is also involved in the all-hyped green hydrogen business.

The Covid-19 pandemic has brought to the fore the urgency to ramp up the hospital infrastructure in the country as well as the supplies of medicines and oxygen, which bodes well for the company.

#2 Refex Industries

Refex Industries is engaged in the business of refilling of eco-friendly refrigerant gases. The company's portfolio consists of trading and re-filling of refrigerant gases.

It's also involved in the sale of electrical energy based on the generation of power and sale of solar accessories and job service related works.

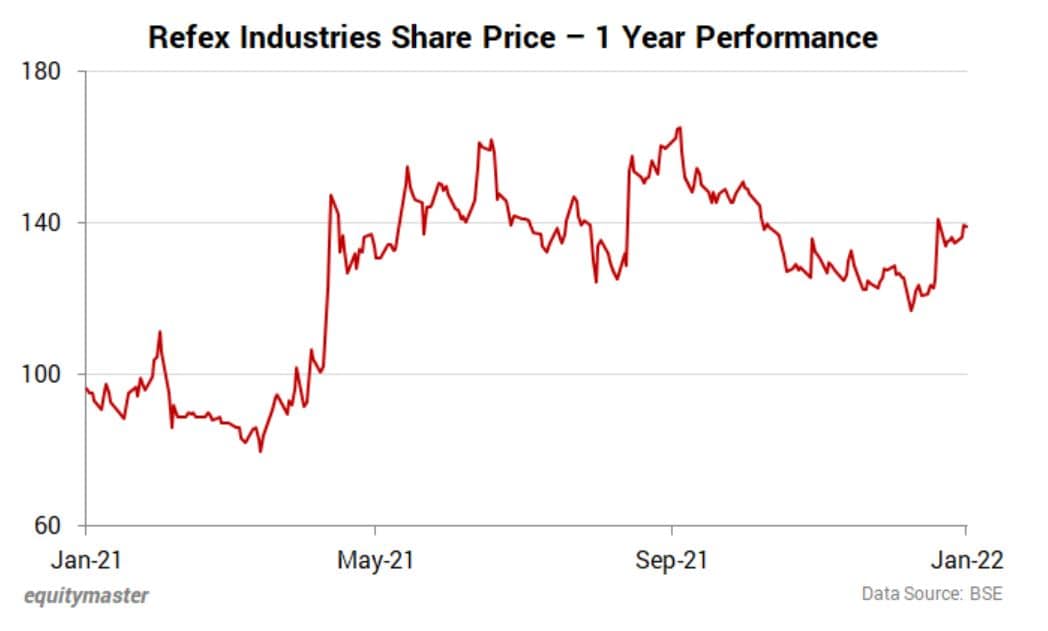

Back in April 2021, when the Delhi government notified the oxygen production promotion policy to make it easier for companies to manufacture medical oxygen, Refex Industries was a major beneficiary.

In just a matter of weeks, the company's stock gained over 50%.

The subsidies announced included giving capital subsidy of Rs 20 lakh per metric ton on cost and machinery, a provision of 100% reimbursement of stamp duty, refund of state Goods and Services Tax (GST), etc.

The company has also recently forayed into the power trading business.

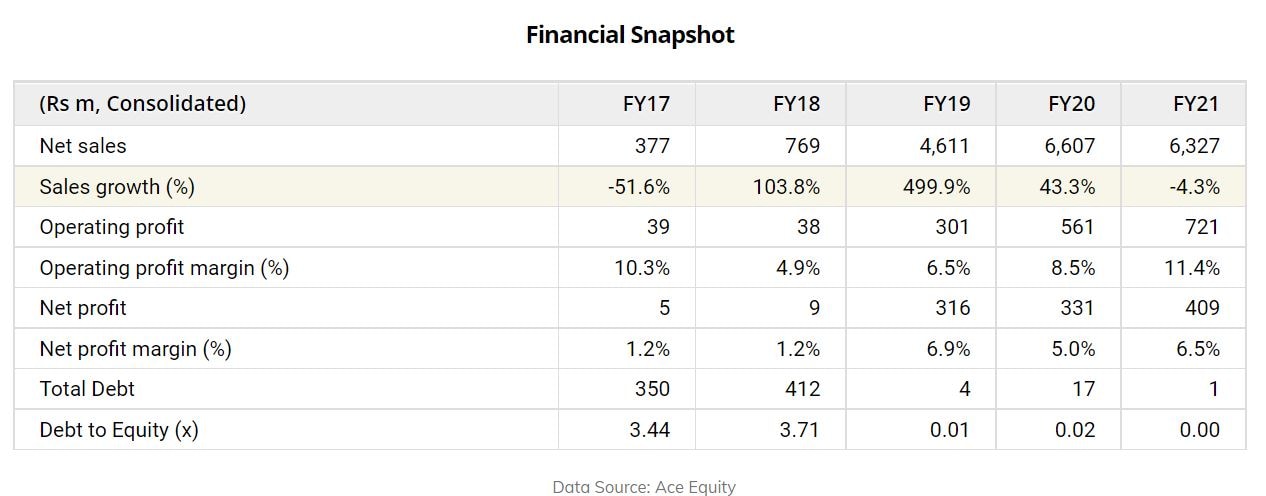

Refex Industries has shown improvement on the profitability front over the years. Apart from this, it has also reduced its debt significantly.

#3 National Oxygen

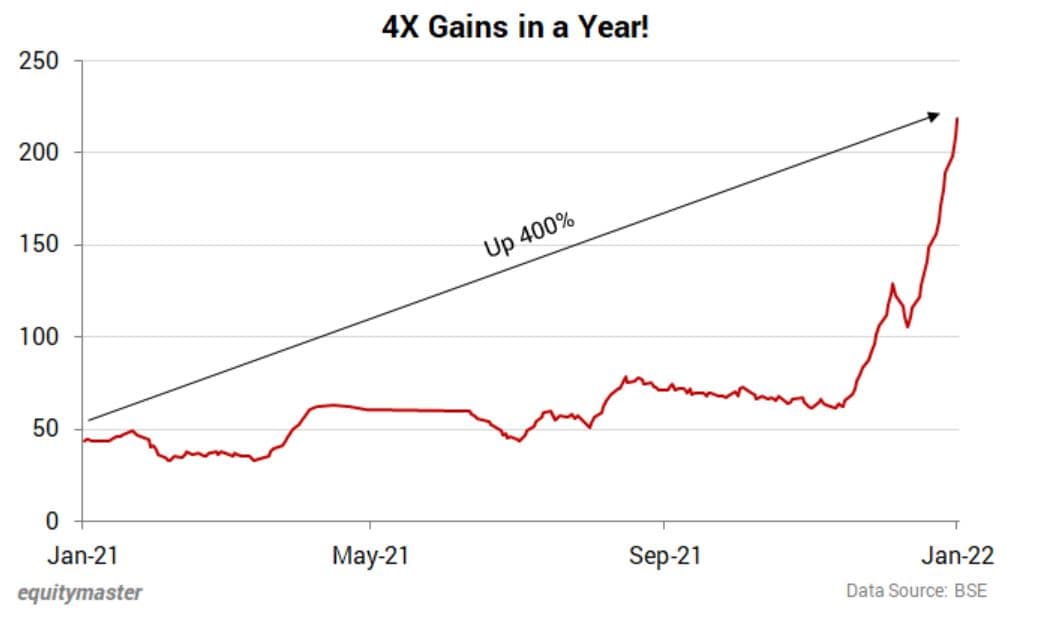

National Oxygen is the top gainer among all the oxygen stocks. Shares of the company have been on a tear for the past twelve months, rising from Rs 32 to Rs 219 today.

That's a massive gain of over 400% in such a short span of time.

The company has a low equity base of only 4.8 m shares, out of which over 69% is owned by promoters. This leaves few shares available for trading. Hence, investors are jumping on board at every chance they get. This has resulted in the stock being locked in upper circuit since 22 December 2021.

National Oxygen is a producer and supplier of industrial gases both in liquid and gaseous form to industries and hospitals.

In 1980, the company installed and commissioned the first oxygen plant of 60 cubic meters per hour capacity at Mathur Village, Pudukottai District, and Tamil Nadu. Currently, it has a capacity of 2,500 meters per hour of oxygen/nitrogen gases and 200,000 meters per annum capacity of dissolved acetylene gas.

After posting losses for several quarters, the company is back in the black, having posted profits for the past four quarters.

#4 Bhagwati Oxygen

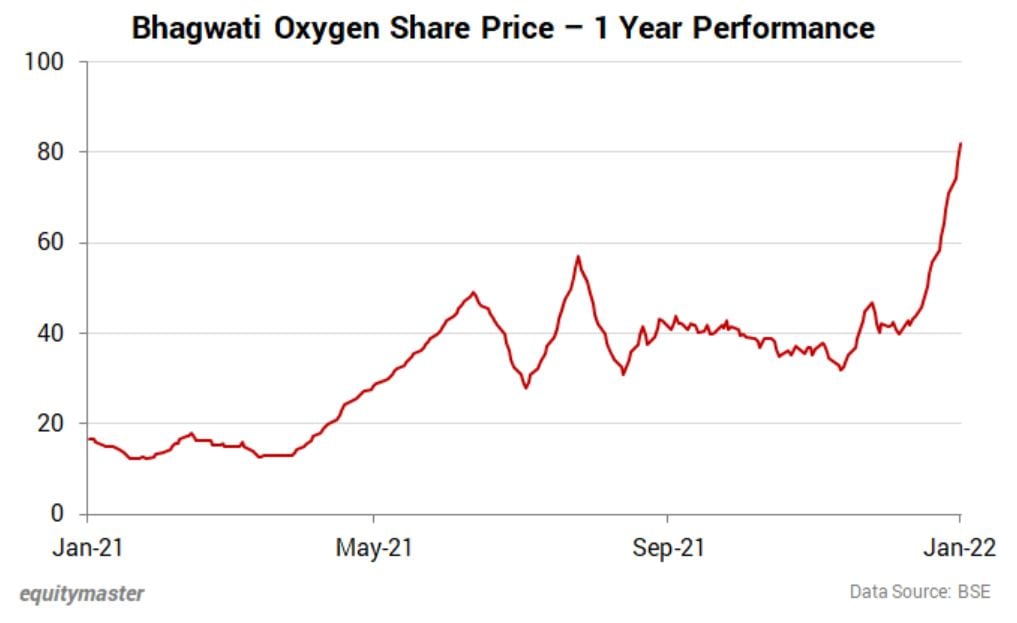

Another stock which has seen a similar rally like National Oxygen is Bhagwati Oxygen.

From trading at a mere Rs 11 a year ago, the stock currently trades at Rs 82. Just like National Oxygen, shares of Bhagwati Oxygen too are locked in 5% upper circuit since 22 December 2021.

Bhagawati Oxygen was incorporated in 1972. The company is engaged in manufacturing and selling of oxygen gas, trading of Sulfur Hexafluoride (SF6) and running a windmill. The company has its manufacturing unit for oxygen gas at Ghatshila in Jharkhand.

Bhagwati Oxygen has a contract with Hindustan Copper for selling of oxygen gas. This has been going on since two decades.

Even though 2021 should have been a good year for oxygen companies, that was not the case for Bhagwati Oxygen. The company's financial performance has deteriorated in the past three years. This is because its oxygen manufacturing plant was closed during most of fiscal 2021.

Bhagwati is dependent on Hindustan Copper and it was a major blow when Hindustan Copper's smelter plant in Ghatsila was non-operational as they it was focusing on the sale of copper concentrates.

Despite all this, shares of the company gained around 400% in the past one year.

Equitymaster's Technical View on Oxygen Stocks ...

We reached out to Brijesh Bhatia, Research Analyst at Equitymaster, and editor of the premium monthly recommendation service Fast Profits Report, for his technical view on oxygen stocks.

Here's what he has to say:

Keeping your ear to the ground in the market is a sound investment – Amah Lambert

When you are investing, understanding the need of the hour business and its future demand plays a key role and such is the scenario for Oxygen stocks.

During the second wave of Covid, most of the hospital faced the shortage of Oxygen and as the cases are increasing in last few weeks, the need of the hour will be Oxygen again.

Technically, most of the Oxygen stocks like Linde India, Bombay Oxygen and Refex Industries are on the verge of consolidation breakout. An increase in volumes indicates the liking for these stocks by traders and investors.

As most of the stocks are from small cap and micro-cap, it is recommended to trade with strict stop loss.

We will keep you updated on the latest developments from this space. Stay tuned.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

(This article is syndicated from Equitymaster.com)

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.