(Bloomberg) -- As the world assesses the fallout from Silicon Valley Bank's implosion, investors are casting a wary eye at SoftBank Group Corp. — by many measures, the startup arena's biggest backer and advocate.

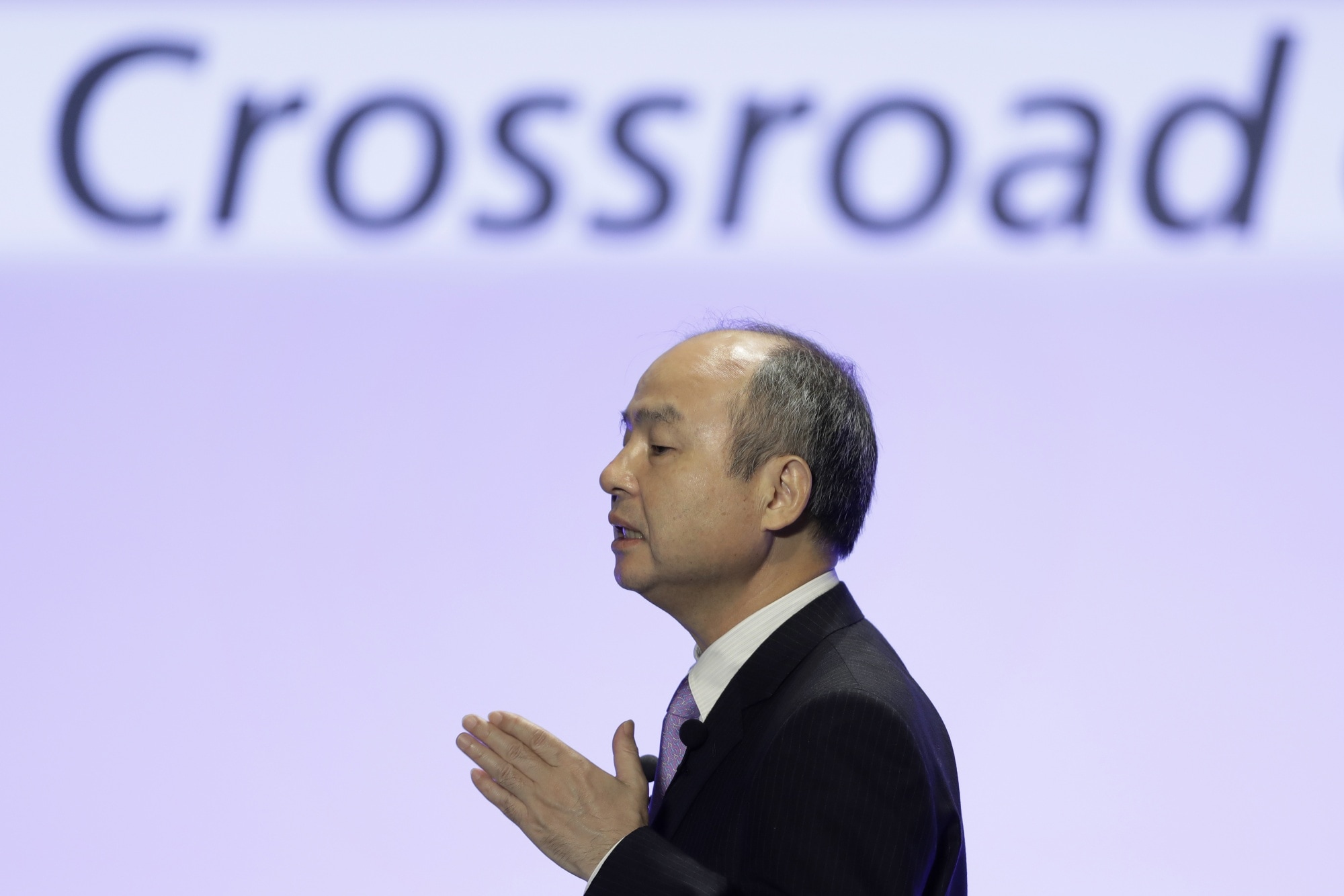

Before the meltdown, Masayoshi Son's investment powerhouse — which has poured more than $140 billion into names from WeWork to ByteDance Ltd. and DoorDash Inc. — had already been reeling from the post-pandemic economic downturn. Now investors are cautiously pulling back despite the overnight pledge from US authorities to rescue the US lender that sits at the heart of Silicon Valley's venture capital ecosystem.

SoftBank, similarly central to the global VC arena, has lost around 7% or $5 billion of its value since news of SVB's difficulties emerged. Its credit default swaps are surging for the second straight day, and speculation is growing on what asset sales might be ahead should SoftBank need to help out portfolio companies.

Jitters about SVB's fallout continued Monday, despite the US pledging to fully protect all depositors' money.

“The potential negative impact on the overall funding environment for startups given the change in sentiment would have been huge,” said Chibo Tang, managing partner of Hong Kong-based Gobi Partners. “Thankfully, the bailout now further reinforces the importance and level of priority that governments around the world attribute to their innovation and technology ecosystems.”

SoftBank sees little impact from SVB's failure on its portfolio companies, a SoftBank spokesperson said, adding that the company expects no impact on its own finances. Most Vision Fund portfolio companies are cash-rich, the company said during its earnings call last month.

But SVB's demise has revealed the extent of the damage rising interest rates might cause on companies and banks that had grown accustomed to years of cheap money. Startups are especially vulnerable to any systemic drop in confidence, given their reliance on investors' faith in their long-term potential when profitability might be years away.

It's still unclear how the crisis might affect fundraising and valuations worldwide. Some observers point to the risks that other lenders might get pulled into a downward spiral. New York regulators swept Signature Bank into receivership on the heels of SVB, which itself followed the demise of crypto-friendly bank Silvergate Capital Corp. WeWork Inc., the long-struggling workspace rental company, is in talks to raise hundreds of millions in capital to support the business, a person familiar with the negotiations said just last week.

“It is quite likely that this brings forward the ‘day-of-reckoning' for the private equity/venture capital-funded universe, and may force PE funds including SoftBank to mark down private books sooner than they'd like to,” Jefferies analyst Atul Goyal said in a note to investors.

VC firms have been advising their startups to withdraw any funds they hold with SVB. The effects of the problem are going to be unevenly felt, according to Shenzhen-based investor Warren Zhou. One of his portfolio companies in the US has several hundred thousand dollars deposited in SVB and its ability to pay salaries has already been challenged. Others, especially the hard-tech startups that have raised funds in Chinese yuan, may feel less of an impact, he said.

SoftBank might also come under pressure to backstop some of its startups from any spillover effects. That could prompt it to raise cash by selling some of its stake in Alibaba Group Holding Ltd., said Bloomberg Intelligence analysts Marvin Lo and Chris Muckensturm.

SVB billed itself as a one-stop shop for tech entrepreneurs, providing loans, currency management services and personal mortgages. It serviced more than 40% of venture-backed technology and health-care companies that went public last year, promising big growth ahead. But that practice of bundling layers of service made it a focal point of risk with reverberations throughout the financial system backing some of the world's biggest ideas.

--With assistance from and .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.