(Bloomberg) -- Shares in Asia were primed for a mixed open with the Thursday holiday in the US offering little guidance. The dollar edged lower.

Futures for Japanese shares were steady, but a gain for contracts in the prior session indicates benchmarks will play catch-up after a holiday. Contracts for Australian shares edged higher, while those for Hong Kong shares fell after a Thursday rally.

Cash Treasuries resume trading in Asia after selling on Wednesday nudged yields higher. The Bloomberg dollar index fell Thursday as the greenback gave up gains against most major currencies. Australian and New Zealand yields advanced.

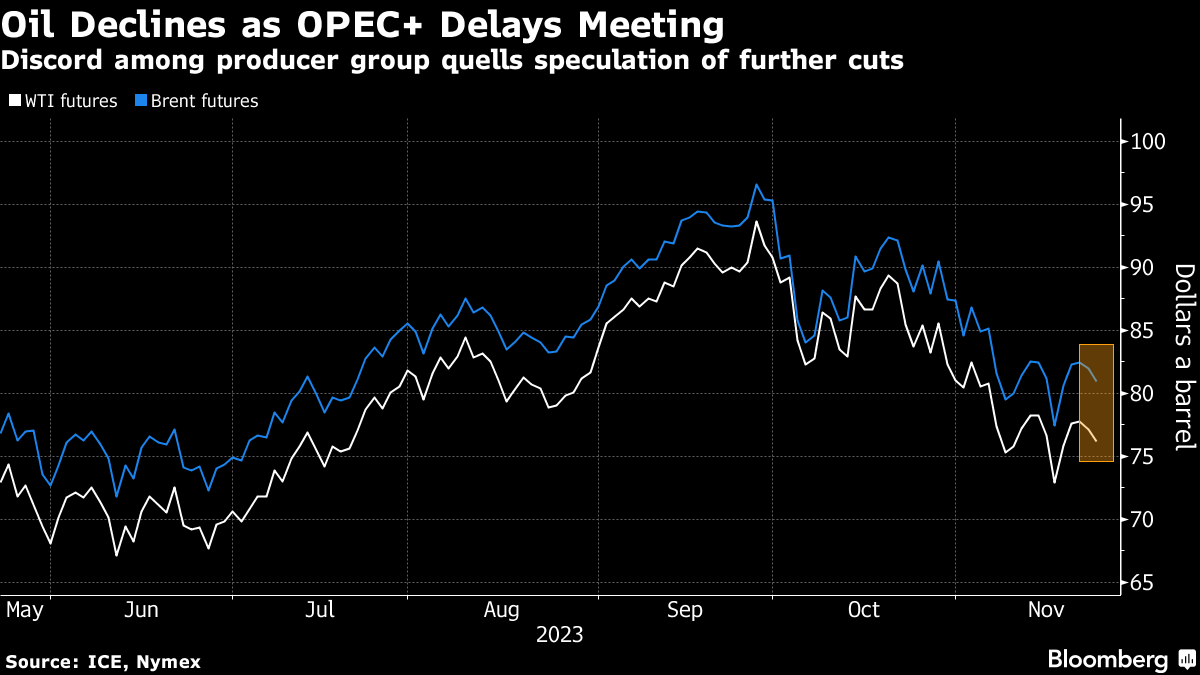

Oil benchmarks slipped further on news that OPEC+ will hold its delayed meeting online rather than in-person. The delay, and discord between members over quotas, has cast doubt on the prospect of further production cuts.

In Asia, economic data set for release includes inflation and PMI reports for Japan, Taiwan money supply and consumer prices for Malaysia. Meanwhile, Sri Lanka's central bank is expected to cut interest rates. In the US, manufacturing PMI data will be released later Friday.

Investors will also be focused on China's property market, after measures aimed at supporting the sector buoyed developer stocks earlier in the week.

China may allow banks to offer unsecured short-term loans to qualified developers for the first time, according to people familiar with the matter, the latest effort to ease the countries property woes. A Bloomberg Intelligence gauge of property developer stocks jumped 8.9% Thursday and is on pace for its best week since December.

Elsewhere, European bonds fell Thursday after a report that Germany will suspend debt limits for a fourth consecutive year, adding to concerns over more borrowing as the euro-area economy slows.

In corporate news, Barclays Plc is working on plans to cut costs by as much as £1 billion ($1.3 billion) over several years, which could involve slashing as many as 2,000 jobs, Reuters reported.

Key events this week:

- Germany IFO business climate, Friday

- US S&P Global Manufacturing PMI, Friday

- Black Friday, traditional kick-off for the US holiday shopping season

- ECB's Christine Lagarde speaks, Friday

Some of the main moves in markets:

Stocks

- Nikkei 225 futures were little changed as of 7:33 a.m. Tokyo time

- Hang Seng futures fell 0.3% as of 7:32 a.m. Tokyo time

- S&P/ASX 200 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro was unchanged at $1.0905

- The Japanese yen was little changed at 149.54 per dollar

- The offshore yuan was little changed at 7.1489 per dollar

- The Australian dollar was little changed at $0.6557

Cryptocurrencies

- Bitcoin was little changed at $37,240.5

- Ether fell 0.1% to $2,066.3

Bonds

- Australia's 10-year yield advanced five basis points to 4.53%

Commodities

- Spot gold rose 0.1% to $1,992.25 an ounce

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.