Sterlite Technologies Ltd. received shareholders' and creditors' nods for the demerger of its global services business. The approval paves the way for shares of the new business to be listed separately, as per an exchange filing on Friday.

The company expects to get approval from the National Company Law Tribunal for demerger within two to three months. The demerger will allow both STL and the new global services entity to grow independently and unlock value for investors.

It will not alter the economic interests of any shareholder in the demerged company. The proposal garnered unanimous support from both secured and unsecured creditors, as well as overwhelming approval of 99.98% from equity shareholders, during meetings convened on July 10.

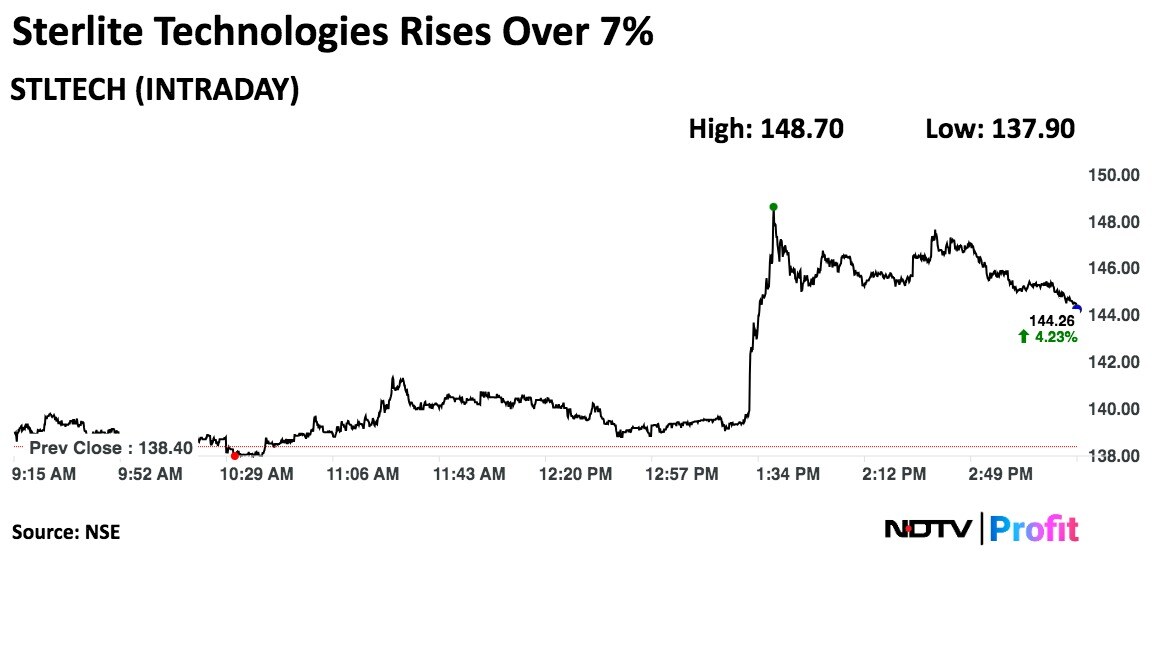

Shares of Sterlite Technologies rose as much as 7.4% intraday. They pared gains to trade 5.7% higher at Rs 498.6 apiece, compared to a 0.99% advance in the benchmark Nifty 50 as of 2:54 p.m.

The stock has fallen 2.5% in the last 12 months and risen 2.1% year-to-date. The relative strength index was at 62.

Of the two analysts tracking the company, one has a 'buy' rating while the other suggests a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 4.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.