Solar Industries India Ltd. announced on Monday that it has secured an export order worth Rs 399.4 crore for supply of defence products. The contracts, awarded by an international client, are set to be fulfilled over a three-year period.

In a regulatory filing, the company provided details in compliance with SEBI guidelines, confirming the nature of the contracts as international in scope. The orders pertain specifically to the supply of defence-related products, a sector that has been gaining momentum as global demand increases.

The announcement did not disclose the identity of the international client, nor did it specify the exact nature of the defence products involved. However, it emphasised that the orders are significant for Solar Industries' export operations.

The company also confirmed that there are no conflicts of interest regarding the awarded contracts, indicating that the promoter group has no stake in the entity granting the orders.

With this development, Solar Industries continues to strengthen its position in the defence market, aligning with the government's push for increased domestic production and export of defence materials. The successful execution of these contracts could enhance the company's growth prospects and contribute to its long-term strategic goals.

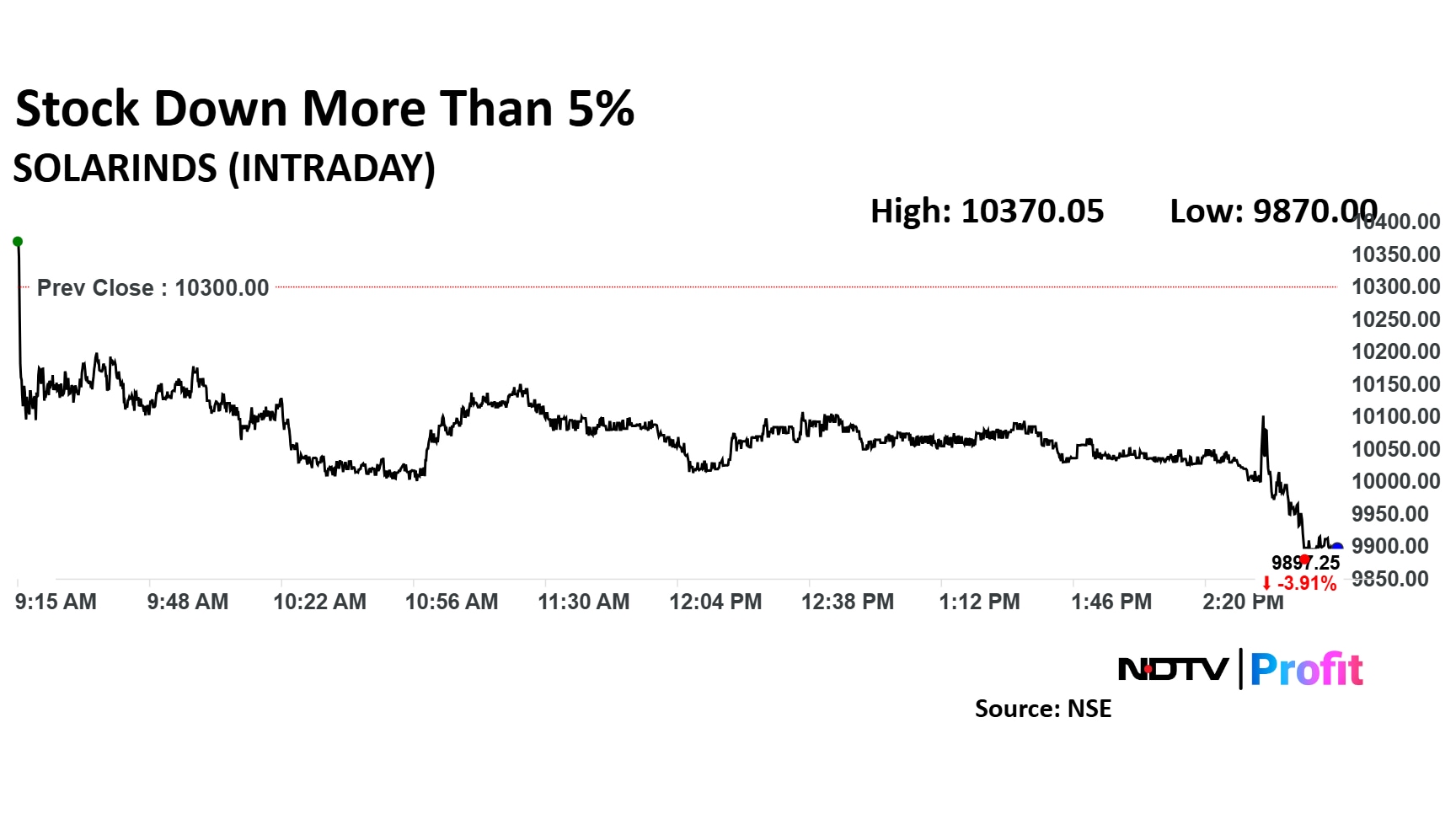

Shares of the company fell as much as 5.08% to Rs 9,870 apiece on the NSE. It pared losses to trade 4.80% lower at Rs 9,899.10 apiece as of 2:55 p.m. This compares to a 1.37% decline in the NSE Nifty 50 Index.

The stock has risen 77.22% in the last 12 months. Total traded volume so far in the day stood at 2.2 times its 30-day average. The relative strength index was at 33.

Out of five analysts tracking the company, three maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 14.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.