(Bloomberg) -- India's upcoming general election will bring volatility to its stock market at a time when the economic growth outlook is moderating, Societe Generale SA strategists wrote, downgrading the nation's equities to neutral from overweight.

The South Asian market will see a “pause in outperformance” until the polls are over, strategists including Frank Benzimra and Rajat Agarwal wrote in a Nov. 29 note.

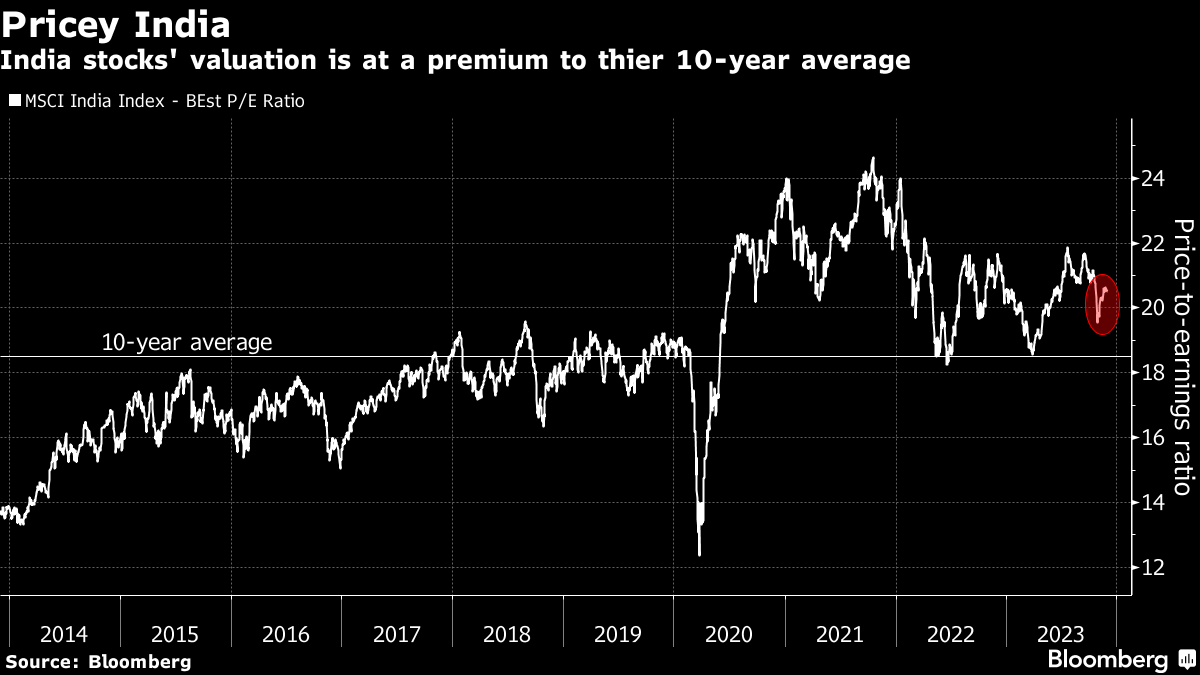

SocGen's downgrade is a rare move that runs counter to Wall Street's optimism. Goldman Sachs Group Inc. strategists upgraded India to overweight earlier this month, saying the nation has the best structural growth prospect in the region. The market has been a top pick for many asset managers this year, attracting foreign inflows.

The S&P BSE Sensex benchmark has risen 15% since Benzimra's team upgraded India stocks in September 2022, compared to an advance of 8.8% in the MSCI Emerging Markets Index.

SocGen strategists also downgraded Indonesia to underweight on weak earnings outlook and political uncertainty. Its allocation changes point to the risks that many markets face as they head into 2024's packed election calendar, starting with Taiwan in January and running through the US presidential election in November. Combined with an uncertain outlook for the Federal Reserve's rate decisions, the polls risk adding volatility to global financial markets.

Indonesians will head to the polls in February, while India's general election is expected sometime in April and May.

READ: Stocks Set to be Rocked by Looming 2024 Election Calendar

While the current situation in India looks almost as optimistic as it did preceding the 2019 election, a loss by Prime Minister Narendra Modi's party could result in a 2004 scenario, when the market quickly corrected itself by more than 15% before recovering, according to SocGen.

For Taiwanese equities the strategists upgraded their view to overweight from neutral, citing “accelerated demand for high performance AI chips and signs of a technology demand revival in China” in the second half.

(Updates with more details on India stock market recommendations)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.