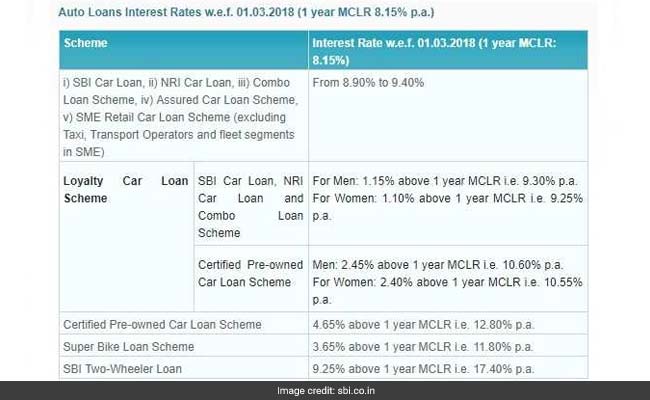

From SBI's housing loan to car loan to education loan, the country's largest bank offers a variety of loans under its personal finance portfolio. SBI or State Bank of India offers loan schemes such as housing loan, education loan and auto loan, among others, based on its MCLR or marginal cost of funds-based interest rate. Its interest rates applicable to different loans vary, depending upon the class of loan and term, among other factors. On its housing loans up to Rs 30 lakh, for example, SBI charges an effective interest rate of 8.35-8.50 per cent, according to its website - sbi.co.in. For car loans, SBI charges a rate of interest ranging of 8.90 per cent to 9.40 per cent, according to the SBI website.

SBI's current rates of interest on loans are based on a one-year marginal cost of funds-based lending rate (MCLR) of 8.15 per cent, according to the bank's website. MCLR or marginal cost of funds-based lending rate is the minimum interest rate below which a bank cannot lend. (Also read: SBI hikes lending rate (MCLR) for first time since April 2016)

Here are different interest rates charged by SBI on its housing loans, auto loans and education loans:

SBI housing loan

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.