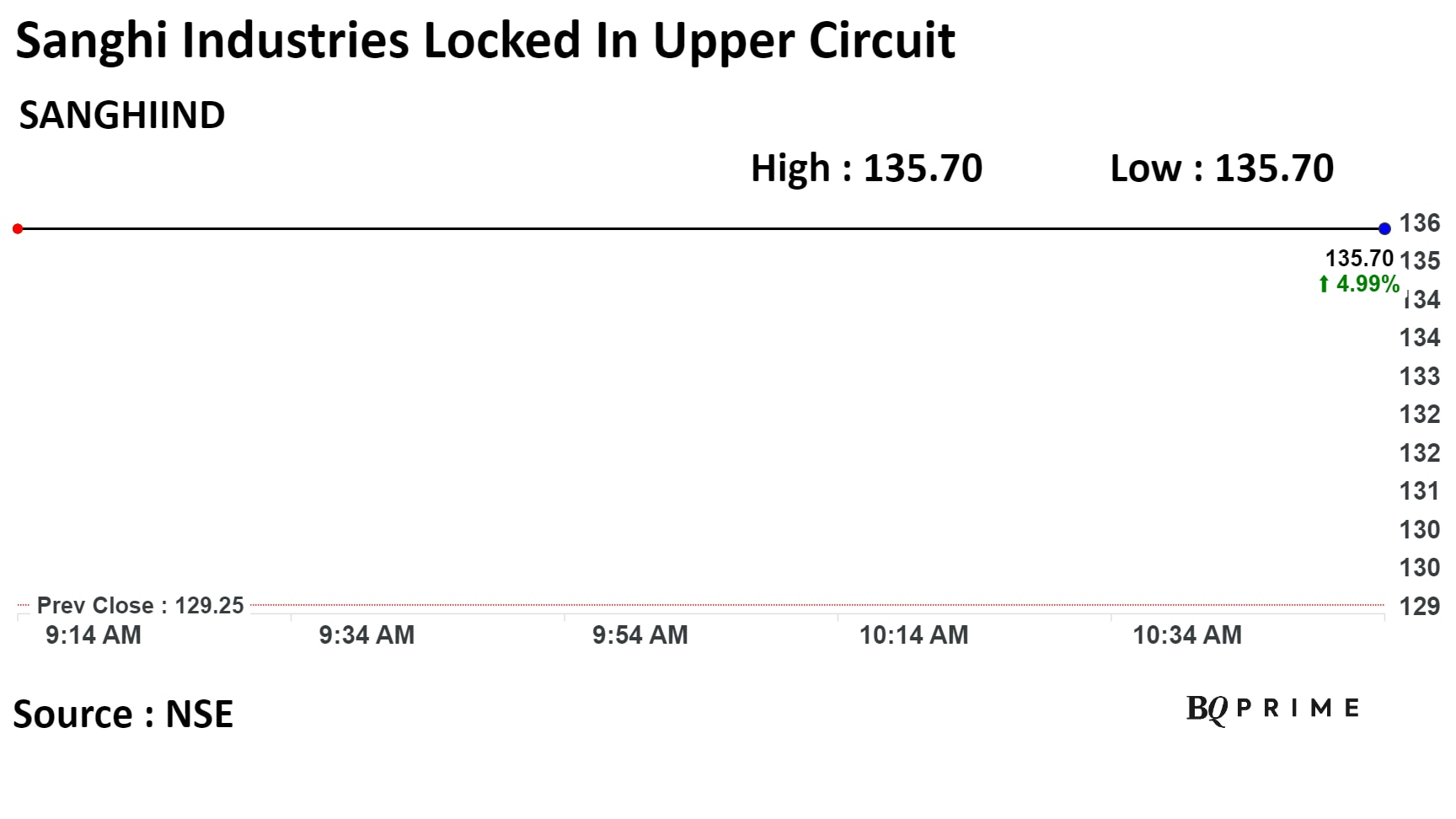

Shares of Sanghi Industries Ltd. soared to all-time high and were locked in upper circuit of 4.99% on Wednesday, as investors cheered Ambuja Cement Ltd.'s acquisition of additional stake in the company.

Ambuja Cements Ltd. acquired an additional of 2.23% stake in Sanghi Industries on Dec. 5. It previously held 54.51% stake in Sanghi Industries. Post the additional stake acquisition, Ambuja holds 56.74% of the voting share capital in Sanghi Industries.

Sanghi Industries and Incor Realty have agreed to revise the sale consideration of Rs 125 crore for non-core surplus land, on account of certain improvements in the land condition and certain other factors, according to an exchange filing.

Shares of Sanghi Industries were locked in upper circuit of 4.99% at Rs 135.70 apiece, as of 10:49 a.m. This compares to a 0.33% advance in the NSE Nifty 50.

The stock has risen 93.58% on a year-to-date basis. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 74.47, indicating that the stock may be overbought.

The two analysts tracking the company maintain a 'buy' rating. The average 12-month consensus price target implies an upside of 40%.

Disclaimer: AMG Media Networks Ltd. (AMNL) currently owns 49% stake in Quintillion Business Media Ltd. (QBML), the owner of BQ Prime Brand. AMNL has entered into an MOU to acquire the balance 51% stake in QBML. Post acquisition, QBML will become a wholly owned subsidiary of AMNL.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.