Rail Vikas Nigam Ltd., the construction arm of the Ministry of Railways, has emerged as the lowest bidder for a Rs 180-crore work order from the East Central Railway, an exchange filing said on Monday.

The order involves "design, supply, erection, testing and commissioning of 2x25KV feeder line along the track", and "modification works to meet 3,000 MT loading target" for up and down line of Garwa Road -Mahadiya section of Dhanbad division, the filing stated.

The project is to be executed within 18 months from the date of the contract being awarded, RVNL noted.

RVNL, whose orderbook stood at Rs 85,000 crore at the end of fiscal 2024, has bagged a spree of orders in this financial year so far as well. The company, on Aug. 30, won a Rs 202.8-crore order from South Eastern Railways. This was preceded by the rail PSU being declared as the lowest bidder for a Rs 111-crore project by the Southern Railways on Aug. 27.

Despite the strong orderbook, RVNL's consolidated net profit narrowed 34.7% year-on-year to Rs 223.9 crore in the quarter ended June 2024. The revenue from operations declined 26.9% YoY to Rs 4,073.8 crore.

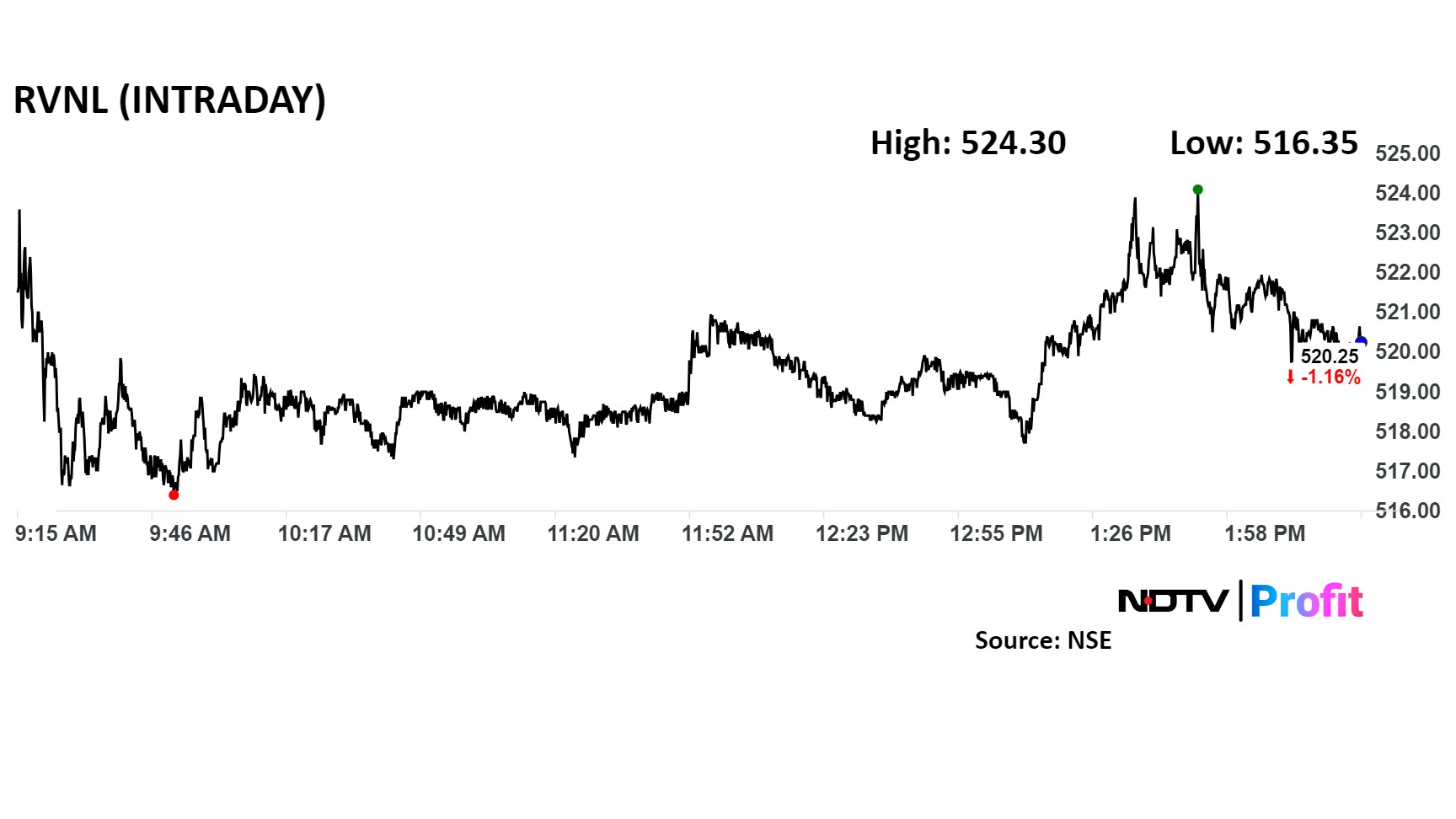

Shares of RVNL edged lower on Monday, in line with the decline in the benchmark indices. At 2:24 pm, the stock was trading 1.12% lower at Rs 520.45 apiece on the NSE, compared to a 1.41% decline in the benchmark Nifty 50.

The stock has emerged as a multibagger in 2024 so far, with an year-to-date climb of 186.2%. The surge has been sharper at 201.7% over the past 12 months. The total traded volume so far in the day stood at 0.19 times its 30-day average. The relative strength index was at 39.6.

Among the three analysts tracking the company, one each has a "buy", "sell" and "hold" rating. The average of 12-month analyst price targets implies a potential downside of 4.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.