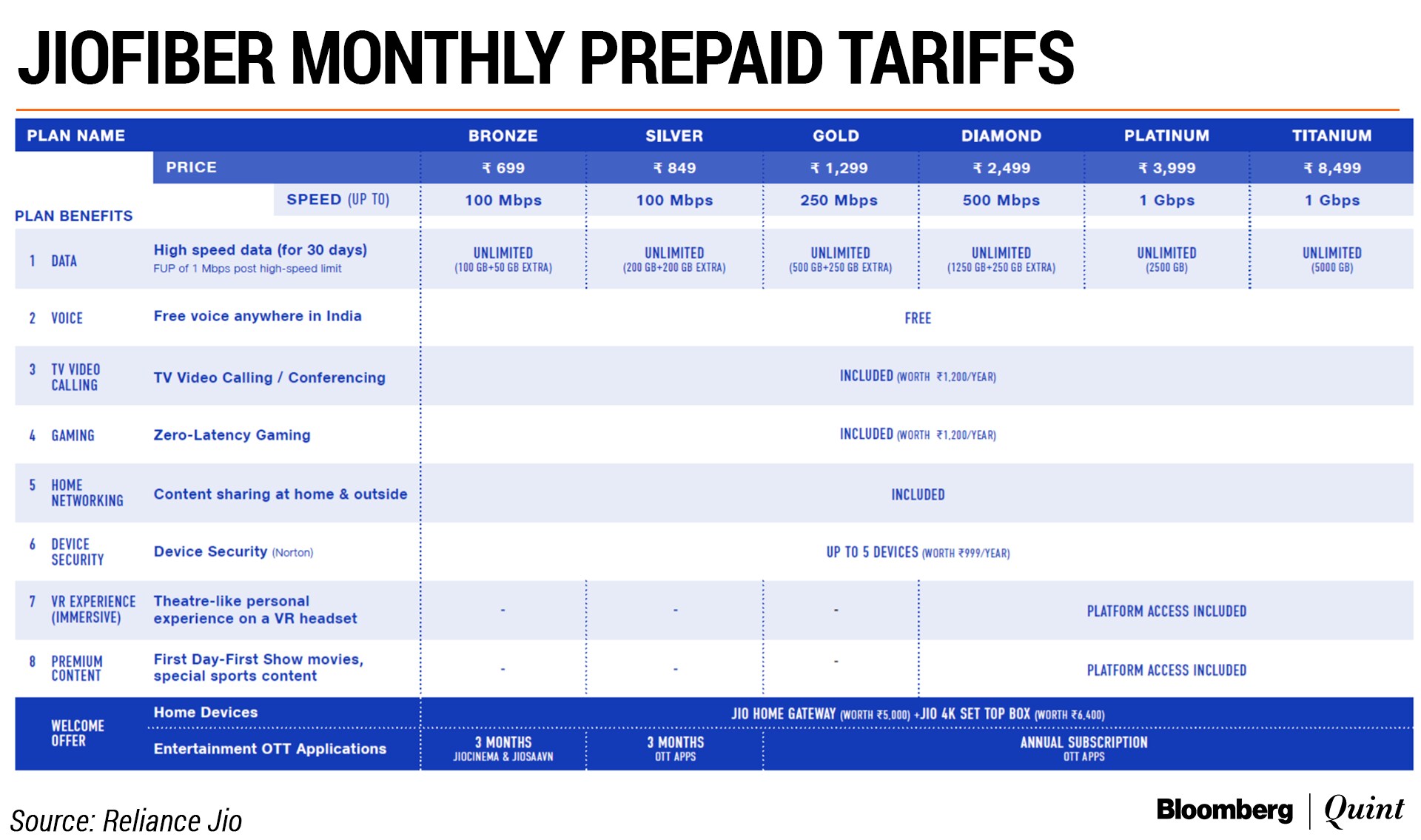

Mukesh Ambani's Reliance Jio Infocomm Ltd. announced tariff plans for its JioFiber broadband service starting at Rs 699 a month, three years after Asia's richest man disrupted the nation's telecom sector with free calls and data.

For the basic Rs 699 ‘Bronze' pack, users will get internet speeds of up to 100 Mbps, 100 + 50 extra gigabytes of data per month along with free voice calls, two Jio streaming applications (JioCinema and JioSaavn) for three months, limited gaming, home networking and device security, according to its media statement.

The ‘Titanium' pack, priced at Rs 8,499 a month, will give users 1 Gbps speed, with 5,000 GB of monthly data. This also includes annual subscriptions of OTT apps and platform access for Jio's immersive VR (virtual reality) experience and premium content that includes ‘first day, first show' movies. To be clear, the company says “platform access” suggesting that the consumption of the content itself may cost extra.

Consumers should consider some of the fineprint in the tariff plans:

- One-time payment of security deposit + non-refundable installation charge: Rs 2,500

- In the lower priced plans the extra data is available only as an introductory offer for six months.

- These tariffs do not include taxes such as GST.

Jio has launched its fiber-to-home service across 1,600 cities in India, it said in the statement.

Jio will also provide longer-term plans of 3, 6 and 12 months and has tied up with banks to provide financing schemes to pay the annual fee in monthly installments.

The JioForever annual subscription plan is also giving a bunch of freebies to users. These include:

- Jio Home Gateway worth Rs 5,000

- Jio 4K set-top box worth Rs 6,400

- A television set (available with plans starting at Rs 1,299 per month and above) )

- Subscription to OTT applications

- Unlimited voice and data

Comparison With Other Services

In contrast, Bharti Airtel Ltd.'s broadband plans start from a monthly rate of Rs 799 for 100 GB at 40 Mbps speed and go up to Rs 1,999 for unlimited data at 100 Mbps. However, Airtel provides subscription to streaming apps including Amazon Prime Video, Netflix and Zee5 Premium in its mid-priced and highest priced plan.

Bharatiya Sanchar Nigam Ltd., the country's largest broadband service provider, offers much lower speeds at similar prices without any benefits.

Atria Convergence Technologies Ltd., which has a significant presence in South India, has speeds similar to Jio but lacks other added benefits.

“Jio's pricing is at a discount to Airtel; however, the speeds offered by both the operators are more or less the same except for Bharti's entry-level plan where it offers 40 Mbps,” according to Rajiv Sharma, co-head of institutional equity research at SBICAP Securities. “One also has to keep in mind the fact that where Airtel is available, JioFiber may not be available right away. As such the churn in subscribers might not happen if there is no difference in OTT subscriptions. More clarity around Jio's OTT offerings is awaited as so far it has not promoted Amazon and Netflix on its platform.”

Customers will look to choose an operator based on an arbitrage between speed and OTT subscription that the operator provides.Rajiv Sharma, Co-Head Institutional Equity Research, SBICAP Securities

Next Phase Of Disruption

The JioFiber service can unleash the next phase of disruption after Reliance Jio triggered a tariff war driving consolidation in the world's second-largest telecom market. An average Indian telecom user now consumes about 2 GB of data every month compared to 0.23 GB before Reliance Jio's launch, according to the telecom regulator's data. A fiber network, delivering everything from television content to movies to users at home, will only boost that.

JioFiber was announced at Reliance Industries Ltd.'s annual general meeting last year. Since then it has been running as a pilot in select locations. In his AGM speech this year, Ambani disclosed the launch date of the broadband offering, along with some other details.

The fiber-TV combination comes after Reliance Jio became India's largest telecom operator by subscribers. Bharti Airtel Ltd. and Vodafone-Idea Ltd. are also trying to lure users by offering access to TV and movie content.

Ahead of JioFiber's full launch, Airtel, too, unveiled a newer version of its set-top box and a USB stream stick called Airtel Xstream. That allows normal television sets to access the likes of Netflix, Amazon Prime Video, YouTube and Airtel's other content.

While aggressive pricing will be key to Reliance Jio cracking the broadband space, research firm Jefferies cautioned there are factors that could work against the hydrocarbons-to-telecom giant.

Subscriber base in the fixed broadband space has remained largely stagnant. That, according to Jefferies, is due to expensive pricing and lack of focus and execution among incumbents. The market is dominated by two state-run firms and has five major service providers.

Reliance Industries' stock closed 0.27 percent lower ahead of the announcement compared with a 0.22 percent drop in the benchmark BSE Sensex.

Watch video here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.