JPMorgan sees a limited downside for Reliance Industries Ltd. as its consumer business will drive profitability, even as the company's earnings estimates for FY24 have been cut by 5%.

The earnings downgrades were due to a correction in refining margins, weaker petrochemical business, and the deferral of the anticipated telecom tariff increases, according to the brokerage.

Going ahead, petrochemical margins are close to lows and should have limited downside; refining cracks are higher than pre-pandemic levels but are supported by supply dislocations and tightening utilisations, it said.

JPMorgan has maintained its 'overweight' rating on the stock with a price target of Rs 2,810 per share.

Retail And Telecom To Drive EPS

Retail and telecom businesses are expected to drive EPS forward, as they constitute 50% of Ebitda, and can grow bottom lines at double-digit rates, said JPMorgan.

Growth in retail will be driven by store rollout, inflation and rising incomes, while in telecom, it will be led by subscriber addition, the option of higher tariffs and faster home broadband, it said.

The exploration and production business is expected to see one-time growth as new gas fields ramp up, the brokerage said. "However, O2C (oil-to-chemicals) overall might be challenged by current weakness in petchem, but refining and ethylene utilisation should improve over the next two years."

Reliance is expected to generate positive free cash flow in the next three years as capex peaks and Ebitda grows, the brokerage said.

Stock Performance

Despite growth in operating profit, shares of the telecom-to-oil conglomerate have underperformed the Nifty year-to-date, rising 3.72% compared to the index's 10.70% gain, the brokerage said.

Simple free cash flow generation is not enough to drive stock. But Reliance's fair relative valuations are an attraction in a market where most stocks are trading well above historical valuations, JPMorgan said.

Downside risks include a collapse in gross refining margins, no telecom tariff hikes, a delay in commissioning or achieving efficiencies at new energy complexes, and a poor earnings environment translating into elevated levels of debt, the brokerage said.

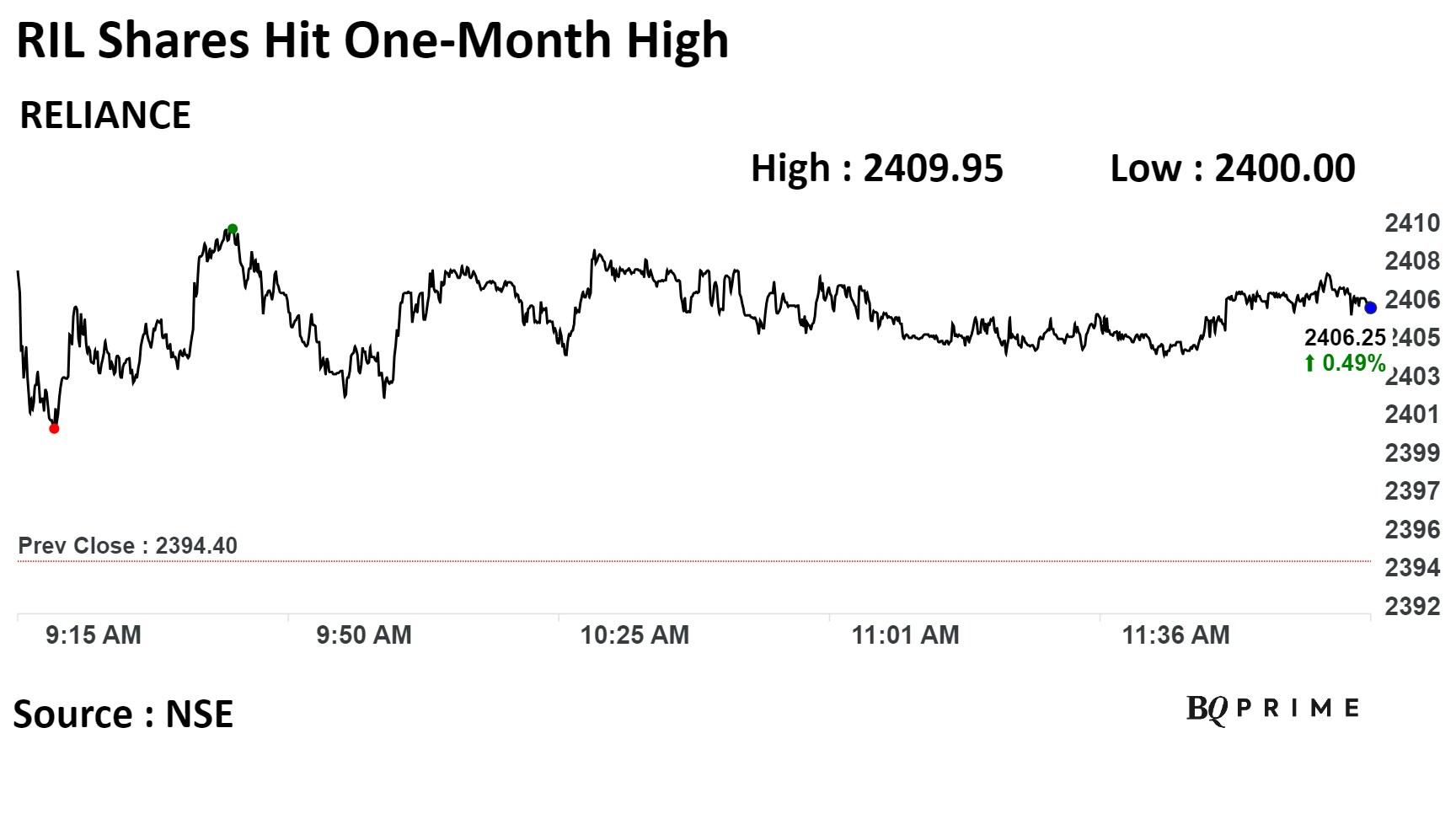

Shares of Reliance Industries rose 0.7% before paring gains to trade 0.5% higher at 12:14 p.m. This compares to a 0.7% advance in the NSE Nifty 50. The relative strength index was at 64.78.

Of the 36 analysts tracking the company, 32 maintain a 'buy' rating, two recommend a 'hold,' and two suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 15.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.