Shares of Polycab India Ltd. gained 4% on Tuesday after UBS initiated 'buy' coverage, citing the possibility of a 27% upside to the current stock price. UBS highlighted the company as a prime beneficiary of the burgeoning electrification infrastructure sector.

Polycab, which commands a dominant 40% share of the domestic electrification market, is poised to capitalize on strong, multi-year cyclical tailwinds in the cables and wires segment, driven by substantial domestic low-voltage infrastructure investments, according to the report.

The firm anticipates strong near-term triggers for the company, including better-than-expected domestic volume growth, market share gains, and an accelerated export ramp-up.

Despite holding the second-largest total addressable market in the industry, Polycab's current share in the fast-moving electrical goods segment remains modest at around 2-3%. UBS sees substantial growth potential in this area, estimating FMEG profitability at around 5%.

With projected cash generation exceeding Rs 4,000 crore by fiscal 2027, post-capex, Polycab is well-positioned for inorganic growth opportunities in adjacent FMEG categories, potentially securing a spot among the top players in fans and small appliances.

UBS forecasts a revenue and earnings growth rate of 20% and 23%, respectively, from fiscals 2024 to 2027, driven by cyclical demand, export expansion, and profitable market share gains in the FMEG segment.

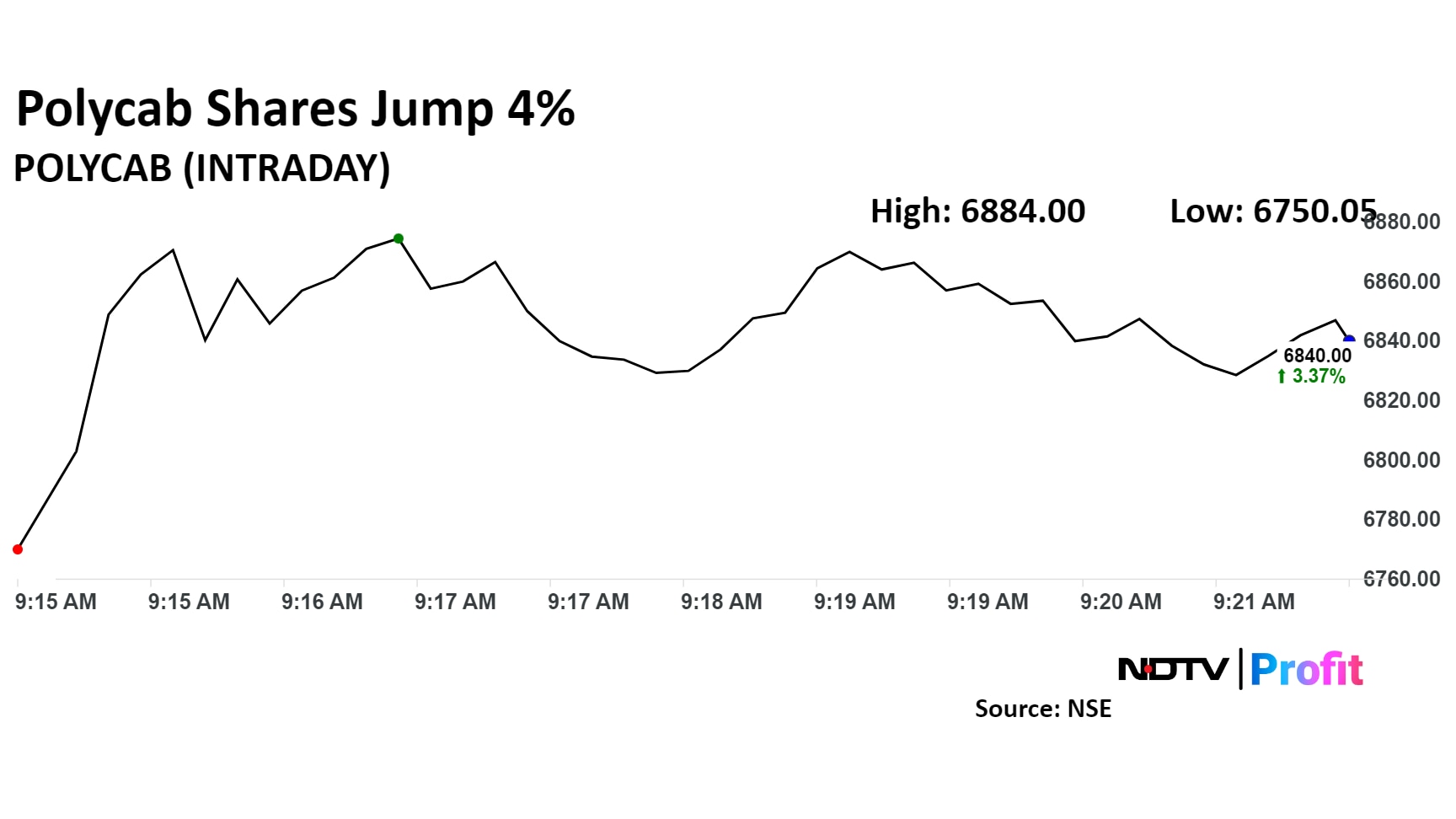

Shares of the company rose as much as 4.04% to Rs 6,884 apiece, the highest level since Aug. 1. It pared gains to trade 3.62% higher at Rs 6,855 apiece, as of 09:20 a.m. This compares to a 0.22 advance in the NSE Nifty 50 Index.

The stock has risen 24.69% on a year-to-date basis. Total traded volume so far in the day stood at 0.39 times its 30-day average. The relative strength index was at 57.69.

Out of 33 analysts tracking the company, 23 maintain a 'buy' rating, six recommend a 'hold,' and four suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.