The outperformance of India's midcap stocks over their larger peers since the coronavirus pandemic engulfed global markets may take a breather, according to some investors. Fund managers at Star Health & Allied Insurance and Smartsun Capital said they are currently avoiding midcaps based on global economic cues and valuations. Both said there is more safety in buying large stocks now that India has become the epicenter of virus resurgence in Asia, while inflation is set to rise in the U.S. and China as the world's two biggest economies are rebounding.

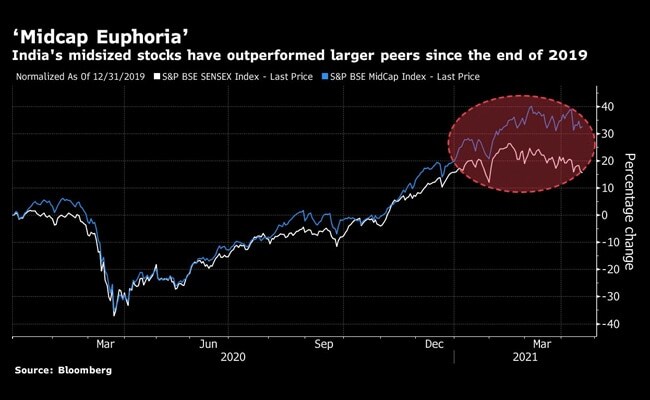

The S&P BSE Midcap Index has outperformed the benchmark S&P BSE Sensex Index in all but five months since the end of 2019, according to data compiled by Bloomberg. The smaller stock measure has gained nearly 33 per cent in that span, more than double the rise in the broader benchmark, with the outperformance becoming particularly pronounced amid the recent market chill.

While the Sensex is now flirting with a technical correction after climbing to a record high in February, expensive smaller stocks may have more to lose, the fund managers said.

"Midcap euphoria has picked up and people are now operating in a casino," said Aneesh Srivastava, chief investment officer at Star Health, which oversees about $694 million in India assets. His firm has started nibbling at shares of some large companies and plans "meaningful buying" on corrections, especially in bank stocks.

The easy monetary policies of global central banks have lifted midcaps more than large stocks as they were relatively very cheap, but that's not the situation anymore, Mr Srivastava said. He also sees larger companies as better equipped to navigate crises and opportunities, and therefore to win market share from smaller rivals, once vaccinations curtail the spread of infections.

The midcap gauge is trading at 21.3 times 12-month forward earnings estimates, while the Sensex is at about 20 times, according to data compiled by Bloomberg.

Sumeet Rohra, a fund manager at Smartsun Capital, said "there is more margin of safety in larger names now on valuation, while a continuation of the selloff can evaporate liquidity from smaller names at a very fast pace."

Large stocks in pharmaceuticals and technology are "a great place to hide now, not midcaps," he said.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.