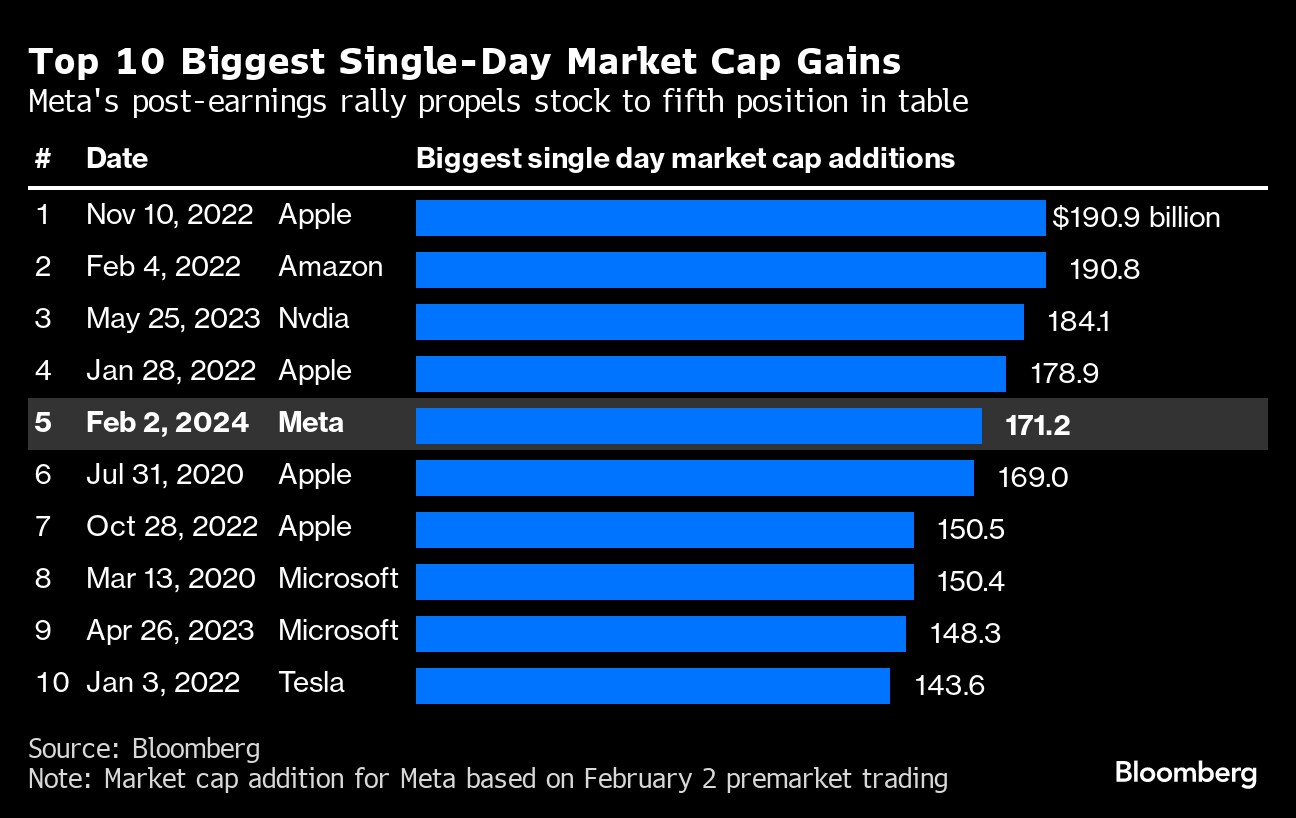

(Bloomberg) -- Cutbacks at Meta Platforms Inc. and Amazon.com Inc. paid off in a big way, with both companies reporting better-than-expected earnings that sent stock prices soaring by a combined $279 billion in premarket trading.

Earnings got a boost from tens of thousands of job cuts since 2022 and strong sales that beat analysts' estimates during the holiday season. Meta, which reduced headcount by 22% in 2023, unveiled plans for a $50 billion stock buyback, and announced its first quarterly dividend on Thursday, a sign to investors that it has money to spare and a reason for them to stick around.

Amazon posted its best online sales growth since early in the pandemic, helped by quicker shipping times. The company — which initiated its biggest-ever round of corporate job cuts beginning in 2022 that affected about 35,000 people last year — has said more positions will be eliminated in its Prime Video, studios and Twitch livestreaming businesses.

“This new found cost discipline is paying off for investors as these companies were able to prune less productive businesses while still being able to invest some of those savings in the faster growing parts of their business,” said Gil Luria, managing director at D.A. Davidson & Co. “At the same time, these companies have been able to accelerate revenue growth, thus significantly increasing margins.”

Read More: Meta Plans $50 Billion Buyback in Bid to Win Over Investors

The results sent Meta's shares up as much as 17% in premarket trading before New York exchanges opened. Amazon's stock rose as much as 7%.

Meta Chief Executive Officer Mark Zuckerberg acknowledged that the strong business results raise questions about whether Meta should start investing heavily again.

“The biggest thing that's holding me back from doing that is that at this point I feel like I've really come around to thinking that we operate better as a leaner company,” he said Thursday. “There are always these questions about adding a few people here or there to do something, and I guess I just have more of an appreciation about how all of that adds up.”

Zuckerberg stands to get about $700 million a year from the company's first-ever dividend, according to data compiled by Bloomberg.

For years, Meta and Amazon reinvested profits back into the companies, fueling hiring sprees and expanding into new technologies and business lines. The strategy was increasingly apparent in the wake of the Covid-19 pandemic, when both companies spent aggressively. Meta's headcount increased 30% in 2020, and another 23% in 2021, while pivoting the entire company toward a massive investment in augmented and virtual reality technology dubbed the metaverse. Amazon, for its part, doubled the size of its logistics network to meet pandemic demand and increased its workforce almost 30% in 2022 before it cooled on hiring and building new facilities.

Read More: Amazon Gains After Robust Sales, Strong Profit Outlook

The question now becomes whether leaner, more focused versions of Meta and Amazon can continue to strive for the bold and ambitious tech advancements that have made them household names.

In Meta's case, that includes spending aggressively on artificial intelligence advancements, both in generative AI but also on the background technologies to help feed it social media products and power its ad targeting. Zuckerberg is also still committed to VR and AR headsets, and the company's Reality Labs division building these kinds of technologies still lost $16 billion in 2023.

Zuckerberg said he plans to keep headcount growth “relatively minimal” for 2024 and beyond despite the lofty ambitions. “Until we reach a point where we are just really under water on our ability to execute, I kind of want to keep things lean because I think that's the right thing for us to do culturally.”

Amazon CEO Andy Jassy said Amazon reduced the cost to serve a customer's order by 45 cents per unit in 2023, its first decrease on that metric in five years, and he vowed to continue to look for ways to bring those costs even lower.

Chief Financial Officer Brian Olsavsky said the company would be cautious about new investments. “Where we can find efficiencies and do more with less, we're going to do that as well,” he said.

--With assistance from Subrat Patnaik.

(Updates with premarket moves in first and sixth paragraphs.)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.