Amid slowing domestic sales, Maruti Suzuki India Ltd. has corrected its inventory levels and now expects to meet its internal 30-day target, according to Chairman RC Bhargava.

"We have corrected our inventory levels and expect inventory levels at 30 days by end of November. We need to ensure all models are at 30-day inventory," Bhargava told NDTV Profit.

This might mean a change in Maruti's production plans. The Maruti India chief said that the company will only produce cars at a level that dealers can sell and monitor retail sales data closely to gauge demand.

He also admitted promotion costs for India's largest carmaker went up in the second quarter which hit operating margin — something analysts have flagged as an earnings dampener.

"We will only look at retail sales, which tell you the condition of the market, instead of wholesale figures. This will lead to better cost savings," he said.

Bhargava said the trend in the last couple of years show some models like the popular hatchback WagonR doing well, even though small cars as a segment struggled. "There has to be some form of agility with dealing with market changes."

Headwind: Affordability

The affordability factor for aspiring car owners still weighs on the industry and will create a major headwind to growth if the shift from two-wheelers to cars for millions of Indians does not happen, RC Bhargava said.

"We were hoping as economy grows, the affordability factor will gradually go away. Affordability factor for cars might take longer to go away. Impact of additional cost post-BS6 is much more on smaller vehicles," he said, referring to sixth version of engines to meet stringent domestic emission norms.

"If economy grows between 6-8% a year, growth of automobile sector should go up by 10%. This trend is not happening in India due to affordability factor," the Maruti Suzuki Chairman said.

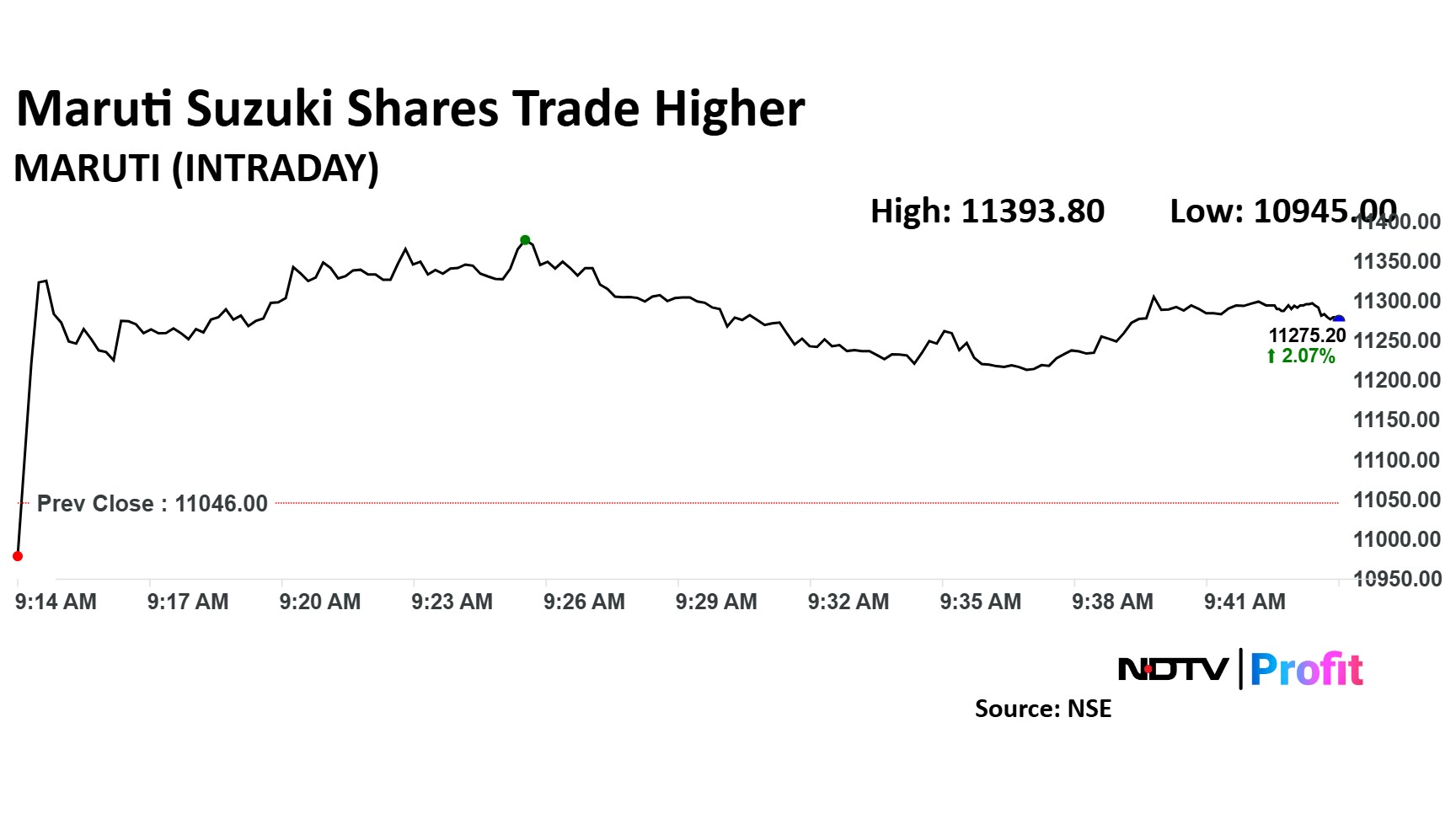

Maruti Suzuki Share Price Movement

Shares of Maruti Suzuki India advanced 3% intraday to Rs 11,393.8 apiece, almost erasing the previous day's decline.

Shares of Maruti Suzuki India advanced 3% intraday to Rs 11,393.8 apiece, almost erasing the previous day's decline. It was trading 2% higher at Rs 11,275 as of 9:45 a.m., compared to 0.3% drop in the NSE Nifty 50 index.

The stock gained 8% in 12 months and 9% on a year-to-date basis. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 34.

Out of 46 analysts tracking the company, 31 maintain a 'buy' rating, 11 recommend a 'hold,' and four suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target of Rs 13,682 implies an upside of 21%

Watch RC Bhargava's Full Conversation Here

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.