Mamaearth is set to expand its offline presence by partnering with the Canteen Stores Department under the Ministry of Defence. This collaboration will allow the personal beauty brand to distribute its products across CSD outlets in the country, targeting a broader consumer base, including military personnel and their families, an exchange filing said.

The decision to enter the CSD market comes as Mamaearth aims to enhance accessibility to its natural product offerings. The brand identified a significant opportunity within the CSD channel, said Varun Alagh, chief executive officer and co-founder of parent Honasa Consumer Ltd.

"Mamaearth has always focused on reaching our consumers wherever they are, and our presence in the CSD channel under the Ministry of Defence reflects this commitment. We recognised the potential within the CSD network and have successfully established a presence in every state where CSD operates. The response has been incredibly positive, with Mamaearth products quickly becoming a consumer favorite," Alagh said.

The CSD network, which serves military personnel, offers Mamaearth a platform to reach a previously untapped market. With this initiative, the brand hopes to make its products available to consumers who prioritise natural and toxin-free options, the filing said.

In six years, Mamaearth has built a product portfolio of over 200 items and has expanded its reach to more than five million customers in 500 cities across India. The brand is also accessible through major e-commerce platforms and over 40,000 retail points.

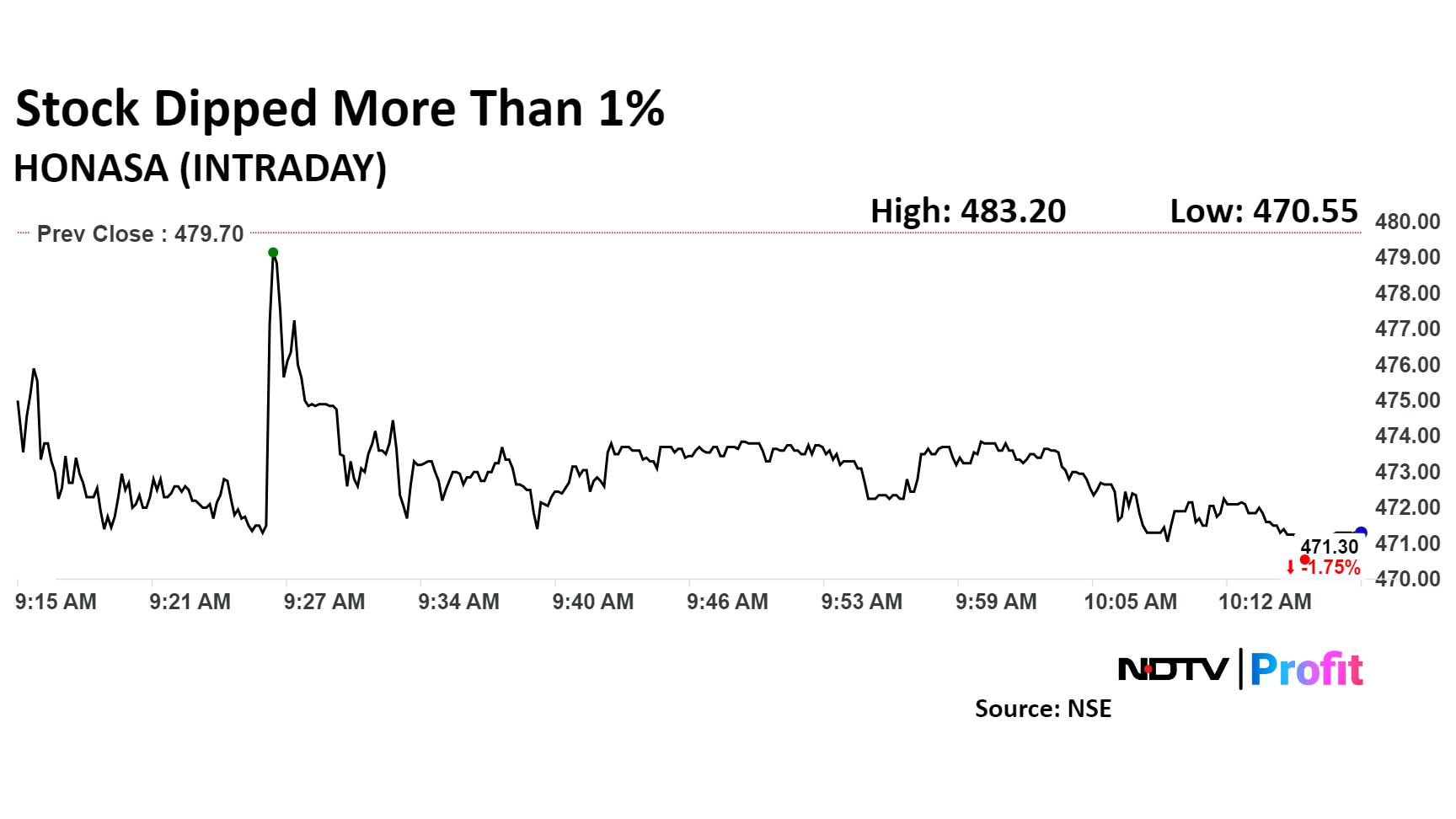

Shares of Honasa Consumer fell as much as 1.91% before paring some losses to trade 1.79% lower at Rs 471.10 apiece, as of 10:26 a.m. This compares to a 0.15% decline in the NSE Nifty 50.

The stock has risen 39.75% in the last 12 months. Total traded volume so far in the day stood at 0.10 times its 30-day average. The relative strength index was at 41.

Out of 12 analysts tracking the company, 10 maintain a 'buy' rating, one recommends a 'hold' and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 12.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.