Larsen & Toubro Ltd.'s third quarter revenue is expected to grow on the back of strong order inflows and execution, according to Citi Research.

The brokerage expects a 14% year-on-year increase in revenue for the September-December quarter of FY24, it said in a note.

The infra-to-tech conglomerate is the brokerage's top pick. Citi has raised its target price on the stock to Rs 4,082 from Rs 3,547 earlier.

It projects order inflows of over Rs 50,000 crore in L&T's plant and machinery business, which is more than 10% year-on-year growth on a strong base. The margins are also expected to show signs of bottoming out in the third quarter, subsequently raising hopes for recovery, it said.

However, the brokerage also cautioned about some 'upside risks' to order inflows, which are expected to be taken positively by the market.

L&T continued to exhibit 'strong' execution capabilities in its core plant and machinery business, which is assured by big order wins in India as well as the Middle East. The construction giant also has 'decadal best working capital and cash flow', the brokerage said.

Key Takeaways

Citi Research expects L&T to show strong execution in core P&M business in Q3 FY24.

Expects 14% annual revenue growth.

Sees P&M margin bottoming out in Q3, and margin recovery over the years.

L&T well-positioned to benefit from strong capex cycle in India and Middle East.

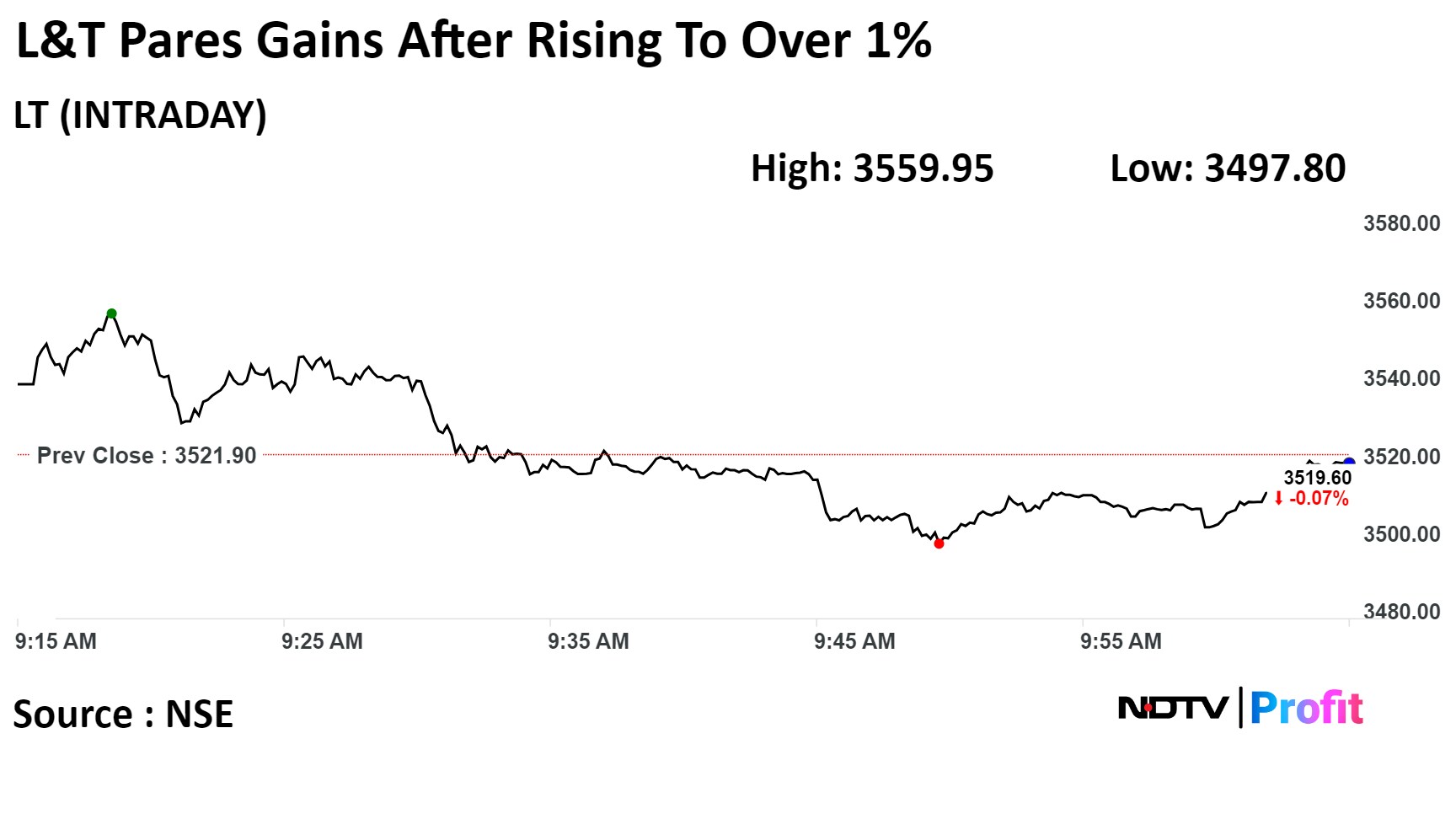

Shares of Larsen & Toubro gained 1.08% before erasing all gains to trade 0.23% lower as of 10:05 a.m. This compares to a 0.13% decline in the NSE Nifty 50.

The stock has risen 65.61% in last 12 months. The relative strength index was at 64.79.

Of the 36 analysts tracking the company, 33 maintain a 'buy' rating, one recommends a 'hold,' and two suggest a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.