Larsen & Toubro Ltd. announced it secured new orders within its power transmission and distribution vertical, totalling between Rs 5,000 and Rs 10,000 crore. The orders are primarily aimed at enhancing and expanding electricity grids at high-voltage levels across the Middle East and Africa.

The company has secured a pivotal contract in consortium with a leading original equipment manufacturer to construct the new National System Control Centre for Kenya, according to an exchange filing on Wednesday. This transmission hub will be integral to managing power flow within the country, integrating various generation sources, and dispatching electricity based on merit order.

The project aims to ensure stable and efficient operations as Kenya increases its reliance on variable renewable energy sources and establishes high-voltage regional interconnections. The scope of work also includes implementing a backup energy management system at a separate location.

In addition to the Kenya project, L&T has received new orders in the Middle East for the turnkey construction of high-voltage transmission lines in Saudi Arabia. The company has also garnered additional orders for Gas Insulated Substations as part of an ongoing power system expansion project in Qatar.

Larsen & Toubro, a $27-billion Indian multinational, is engaged in engineering, procurement, and construction projects, hi-tech manufacturing, and services across multiple geographies.

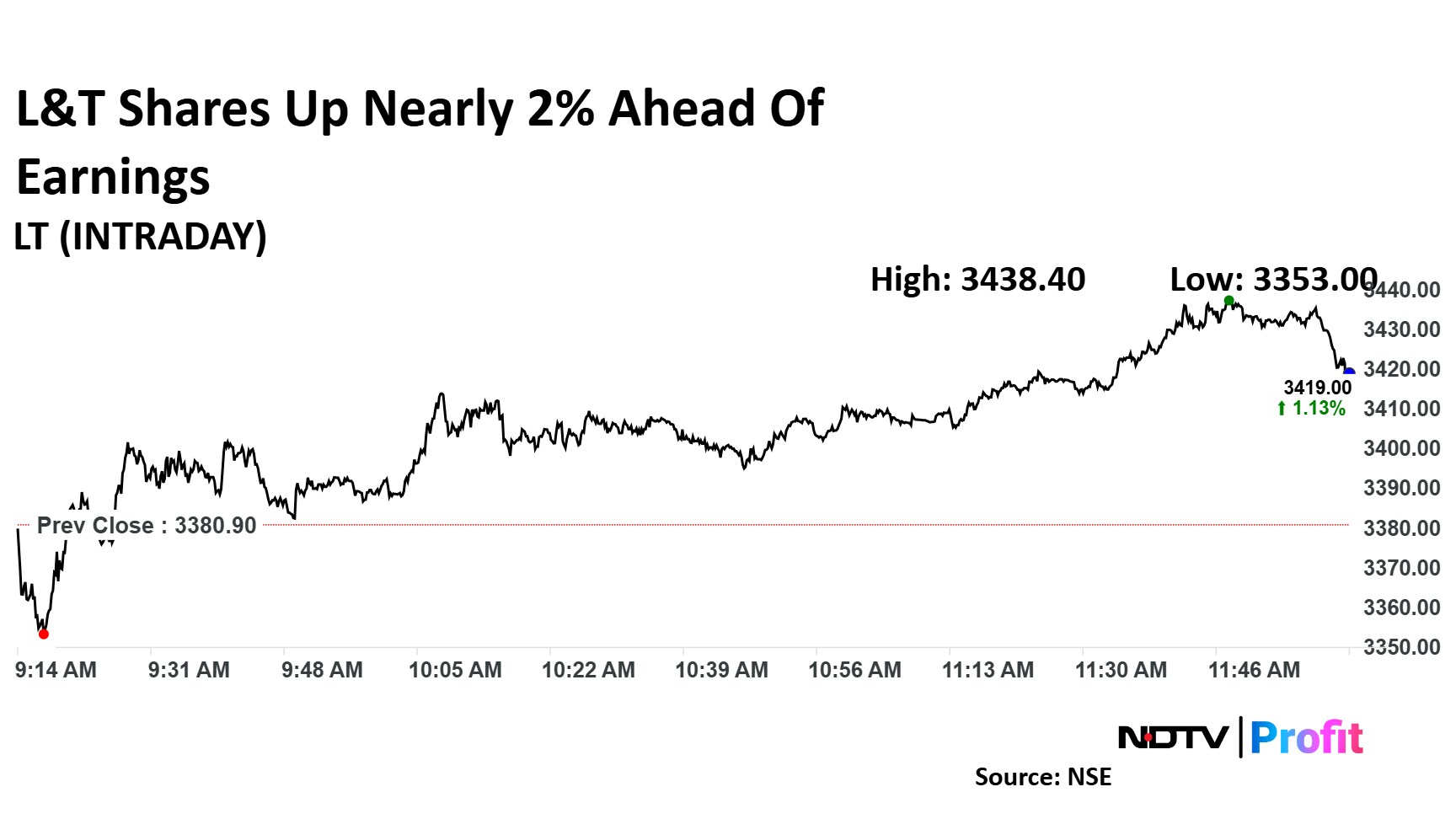

L&T is also set to announce its earnings for the September quarter later on Wednesday. Analysts anticipate a modest decline in the company's net profit for the July to September quarter of the financial year 2025, projecting it to drop marginally to Rs 3,205.31 crore from Rs 3,222.63 crore a year ago.

Larsen & Toubro Share Price Today

L&T stock rose as much as 1.70% during the day to Rs 3,438.40 apiece on the NSE. It was trading 1.54% higher at Rs 3,433.10 apiece, compared to a 0.08% decline in the benchmark Nifty 50 as of 11:59 a.m.

It has risen 17.21% in the last 12 months and declined 2.78% on a year-to-date basis. The relative strength index was at 41.13.

Of the 35 analysts tracking L&T, 28 have a 'buy' rating on the stock, five recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 16.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.