(Bloomberg) -- London Stock Exchange Group Plc suffered a third outage in a few months as trading in about 2,000 smaller shares was halted, adding to the bourse operator's recent woes.

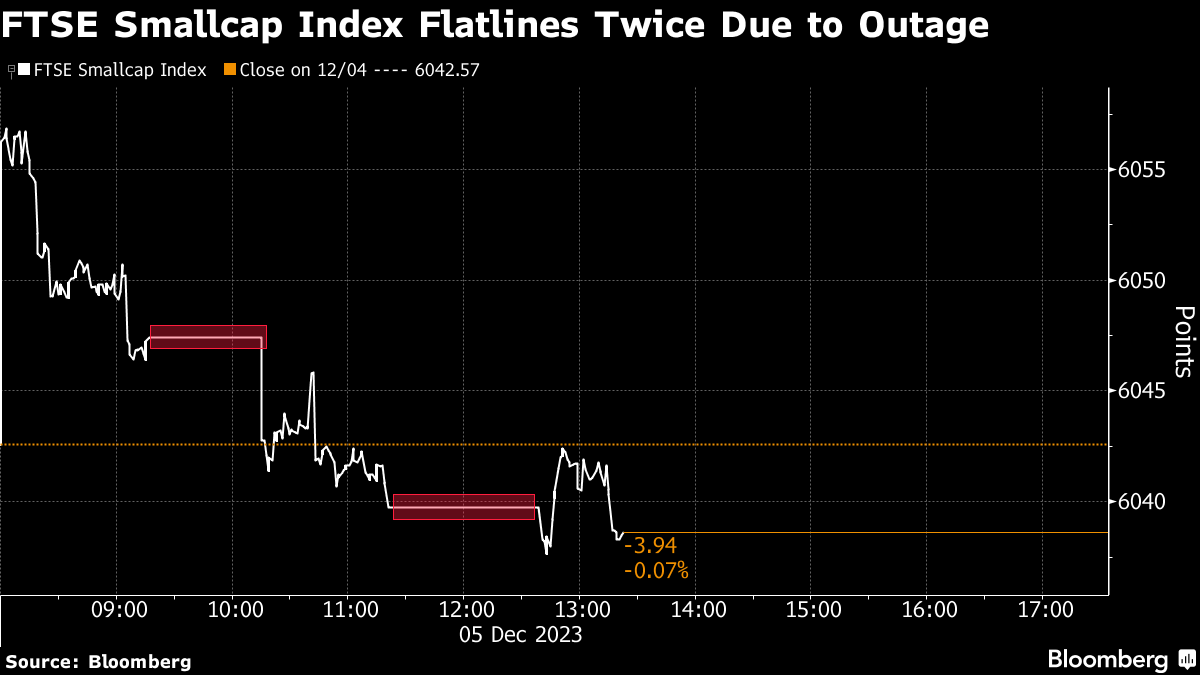

Trading in the affected stocks was interrupted twice during morning trading, according to the exchange's website, with both episodes lasting about an hour. As of 12:43pm local time, regular trading had resumed, LSEG said.

In October, trading in hundreds of smaller shares was halted in the final 80 minutes of a session. And last month, LSEG's FTSE Russell indexes suffered a 40-minute outage, disrupting trades in the UK, Italy and South Africa.

“It doesn't bode well for the LSE as it isn't the first time,” said John Moore, head of trading at Berkeley Capital Wealth Management. “Investors and traders may lose confidence when they cannot transact, as well as attract attention from the regulator as the issues persists. In this day and age we expect 100% uptime as per major stock indexes globally.”

LSEG said it's investigating the latest outage. Back in October, it said the trading halt that affected hundreds of mostly-smaller stocks had been caused by “a matching engine logic issue.”

The recent outages serve as an embarrassment to LSEG as it seeks to transform itself from an exchange provider into a data services giant. Microsoft Corp. in 2022 agreed to buy a 4% stake in the company as part of a deal where LSEG agreed to spend billions of dollars on cloud services with the technology giant over the next 10 years.

In 2021, the company completed its $27 billion purchase of Refinitiv, which was meant to jumpstart the new era for LSEG. To that end, the bourse operator has said it will create five new divisions starting next year: data and analytics, FTSE Russell, risk intelligence, capital markets and post trade.

The parent company of Bloomberg News competes with Refinitiv to provide financial news, data and information.

--With assistance from William Shaw and Kit Rees.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.