KPIT Technologies Ltd.'s board approved raising funds up to Rs 2,880 crore through qualified institutional placement on Wednesday. The company's board of directors has approved the issuance of equity shares and/or other instruments, including eligible securities representing equity shares or convertible securities linked to equity shares, either individually or in combination, through a QIP at a meeting, according to an exchange filing.

The fundraise is subject to approval of the shareholders of the company and receipt of other regulatory approvals at an appropriate' time, the filing said.

The company will be seeking approval of the shareholders for the proposed fundraise by postal ballot.

KPIT Technologies has also announced the appointment of Vijay Keshav Gokhale as an additional and independent director, with effect from Oct. 23, 2024. Gokhale has extensive policy planning and administrative experience. Also, having operated at various levels within the government, he has a deep understating of governance and processes. His expertise in international geopolitical and geoeconomic aspects aligns with the company's strategic interests, it said.

KPIT Technologies Revenue Rises 7.8%

KPIT Technologies reported a 0.2% quarter-on-quarter fall in net profit for the second quarter of this financial year, beating analysts' estimates.

The software firm recorded a consolidated net profit of Rs 204 crore for the quarter ended September, according to its stock exchange notification. This was above the Rs 183-crore estimate by analysts tracked by Bloomberg.

Revenue increased 7.8% quarter-on-quarter for the three months ended September, reaching Rs 1,471 crore. Analysts had projected revenue of Rs 1,453 crore.

Operating income, or earnings before interest, taxes, rose 4.2% quarter-on-quarter to Rs 246 crore. The Ebitda margin contracted to 16.7% from 17.3% in the previous quarter. Analyst estimates for EBIT and EBIT margin tracked by Bloomberg were Rs 243 crore and 16.7%, respectively.

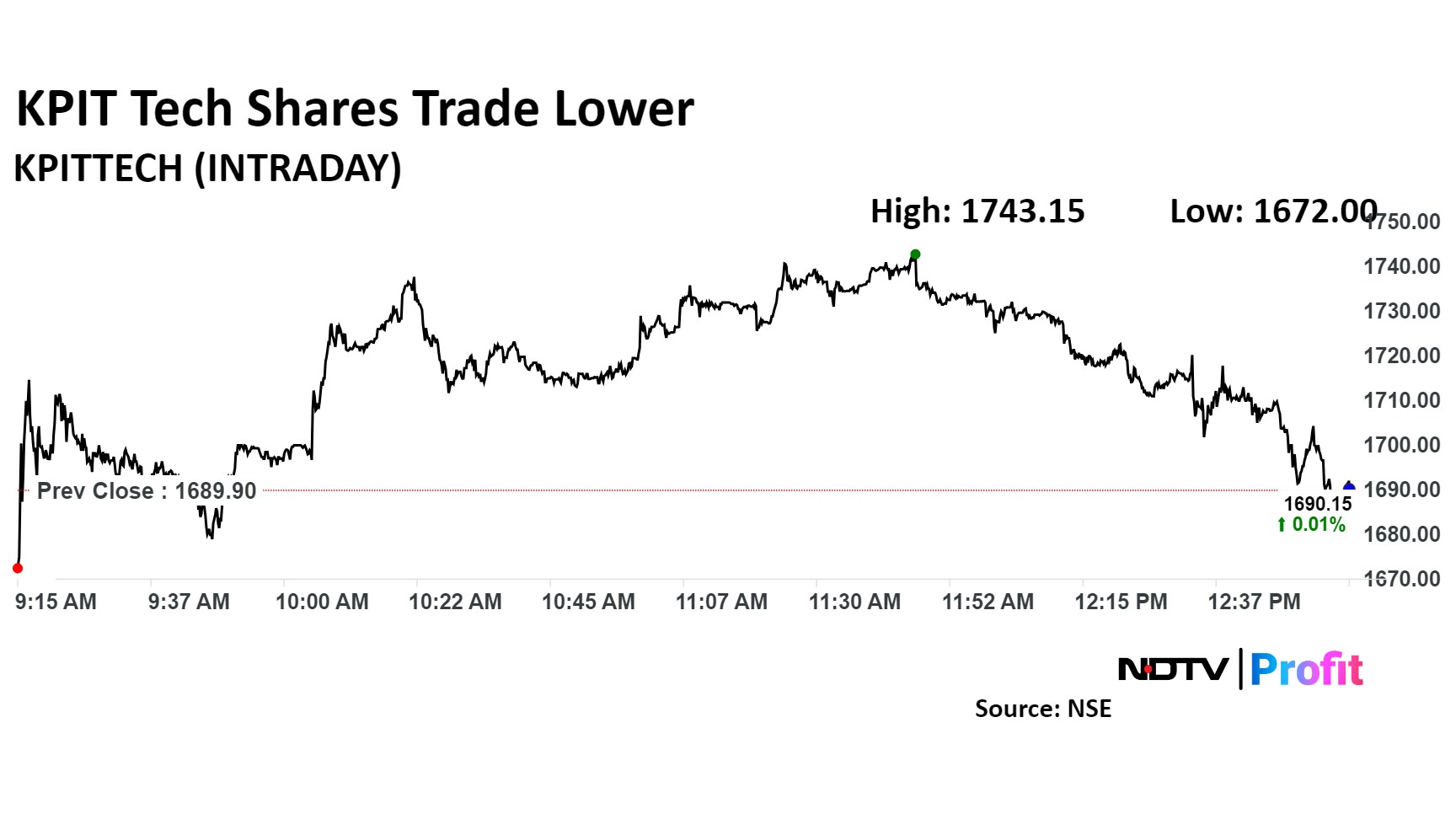

KPIT Technologies Share Price

Shares of KPIT Tech were trading 0.14% lower at Rs 1,687.50 apiece, compared to a 0.36% advance in the benchmark NSE Nifty 50 at 1:00 p.m.

The stock has risen 47% in the last 12 months and 11.90% on a year-to-date basis. Total traded volume so far in the day stood at 0.63 times its 30-day average. The relative strength index was at 45.70 .

Of the 16 analysts tracking the company, 11 have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 14.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.