Canada Pension Plan Investment Board sold its stake of 1.41% to 2.02% via bulk deal today in Kotak Mahindra Bank and the stock fell 3.10% to Rs 1,714.95 on the NSE.

Should you buy the dip?

As an investor, I am not convinced with the technical chart structure.

The stock has been one of the major underperformer against Bank Nifty since 2020 lows. From the pandemic lows, Bank Nifty has gained over 120% while Kotak Bank is up by ~70% (considering lows to CMP).

Since start of 2021, the stock has been trading in the broader range of Rs 1,650 - Rs 2,100 and trading around the lower band of range now.

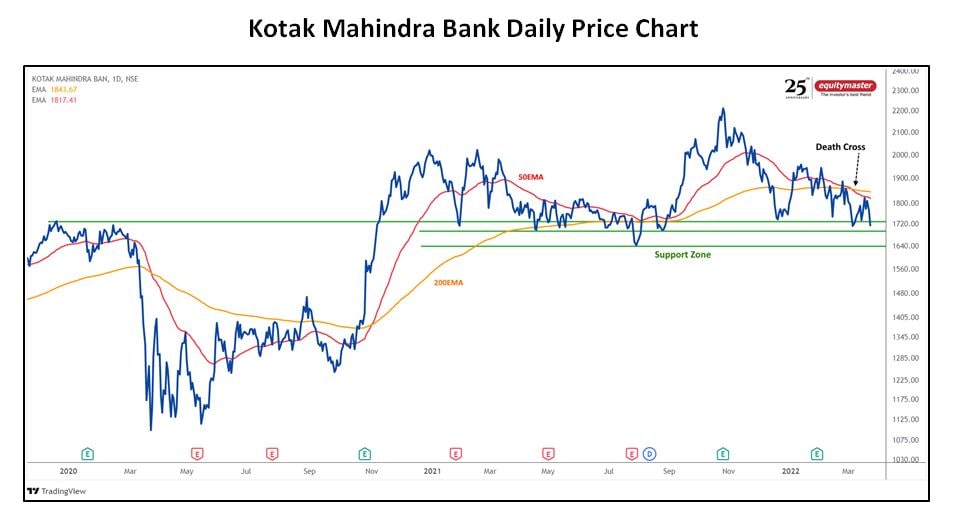

Technically, the death cross is visible on chart at Rs 1,850 signalling an end of bullish trend in the stock. The death cross happens when the short-term moving average (50-days) crosses below the long-term moving average.

In the above chart, the multiple supports are visible in the range of Rs 1,640 - 1,750 but that doesn't convince the buying opportunity.

As per the technical pattern, the bullish confirmation will be above Rs 1,855 while a close below Rs 1,640 will confirm the bearish scenario.

Be a part of Brijesh Bhatia's charting journey as he shares wealth creating ideas from profitable trade setups. Join Brijesh's Telegram Channel – Fast Profits Daily.

You'll get access to the best trading ideas in the stock market.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such.

Note: Equitymaster.com is currently not accessible due to technical reasons. We regret the inconvenience caused. Meanwhile, please access our content on NDTV.com. You can also track us on YouTube and Telegram.

(This article is syndicated from Equitymaster.com)

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.