Kalyan Jewellers Ltd. stock has risen by eight times in the last two years, but valuation still looks appealing if pitted against the high growth of other consumer opportunities, HSBC Global Research said. The stock hit a life high rallying 9% in Thursday morning trade.

The investment firm sees two long-range sources of margin tailwinds for the Kerala-based jeweller. The company has a strong incentive to open its own stores rather than allocating them to franchise partners in profitable micro markets. Doing so could drive a cycle of gradual margin expansion over the long term, which would be a crucial lever for value creation.

Further, with a successful track-record, the terms of trade, such as gold loan interest, may start coming down as well, HSBC said.

The runup in the share price has further legroom, as industry leading revenue growth continue making Kalyan an appealing compounding opportunity.

HSBC retained 'buy' rating on Kalyan Jewellers and raised the target price to Rs 810 per share from Rs 600 apiece, implying a potential upside of 26% over the previous close.

After successfully expanding the Kalyan format through franchising, HSBC now sees an opportunity to grow Candere (studded jewellery) by emulating CaratLane of Titan. "We believe that a successful expansion of Candere could serve as a catalyst for improving stock performance."

Revenue for jewellery retailers are projected to increase by 22-25% in annual terms for the current fiscal, Crisil Ratings said last week. This compares to previous expectations of 17-19%.

This growth will be driven by higher volumes as retail gold prices decline from their record highs, following announcement of the duty cut from 15% to 6% in the Union Budget.

However, operating profitability is anticipated to decrease slightly by 40-60 basis points, bringing it to around 7.1-7.2%, Crisil noted.

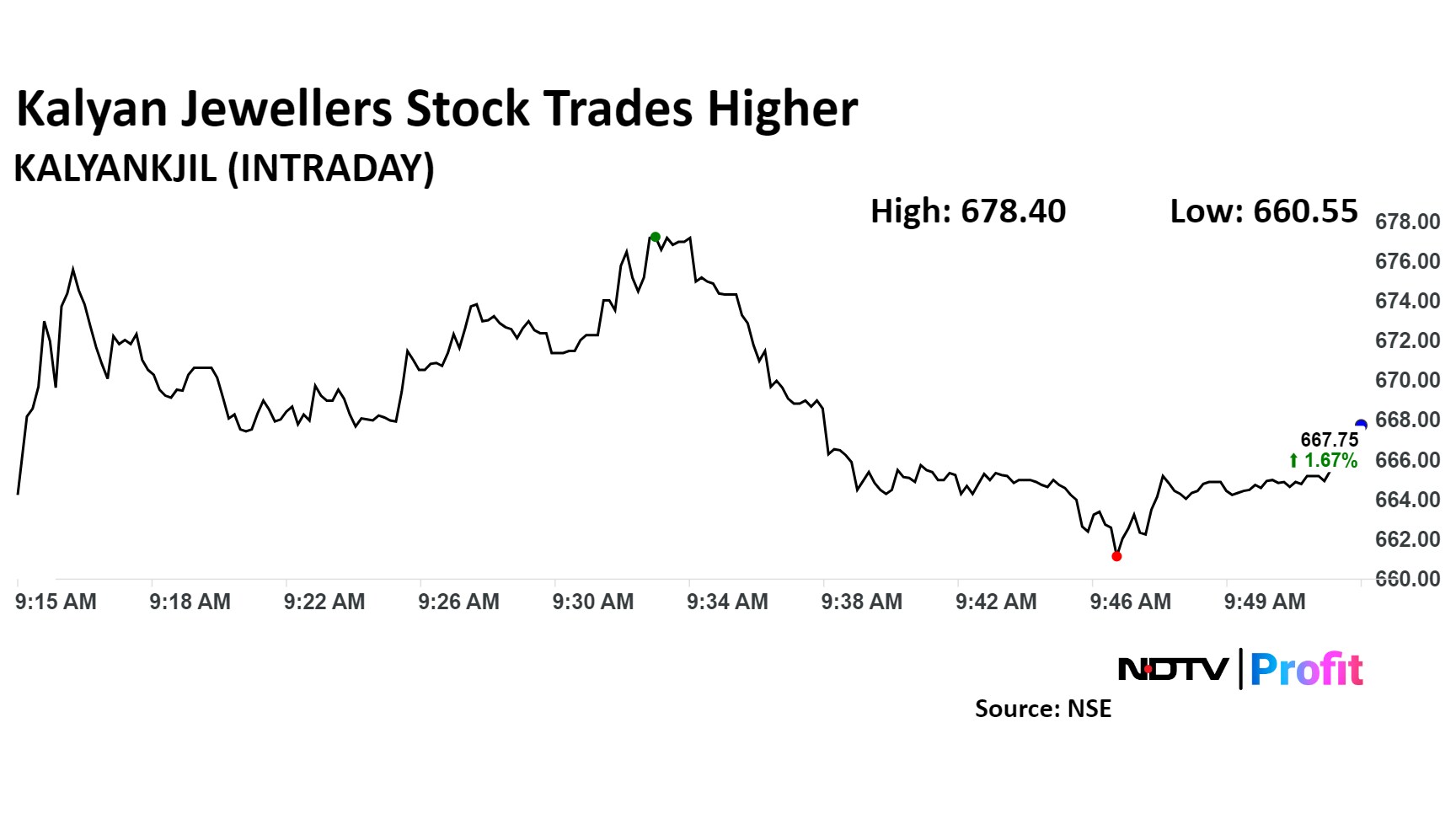

Shares of Kalyan Jewellers advanced 4% intraday to a life high of Rs 683.15 apiece. The scrip pared gains to trade 1.7% higher at Rs 667.75 per share by 9:55 a.m., compared to a 0.4% advance in the NSE Nifty 50.

The stock has risen 195% in the last 12 months and 91% year-to-date. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 75.

All eight analysts tracking Kalyan Jewellers have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 1.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.