Indian Oil Corp. on Monday has withdrawn its proposed rights issue of up to Rs 22,000 crore. The issue was withdrawn as the government, which is the majority owner of the company, won't participate, according to an exchange filing.

The petroleum ministry has said that no funds were allocated for capital support to OMCs in financial year 2025 budget, in comparison to the earlier proposed allocation of Rs 30,000 crore.

In July 2023, the board of directors of the company had approved the proposal to raise Rs 22,000 crore through rights issue of equity shares, due to governments plan to infuse capital into three state-owned fuel retailers to fund their net zero carbon emission projects.

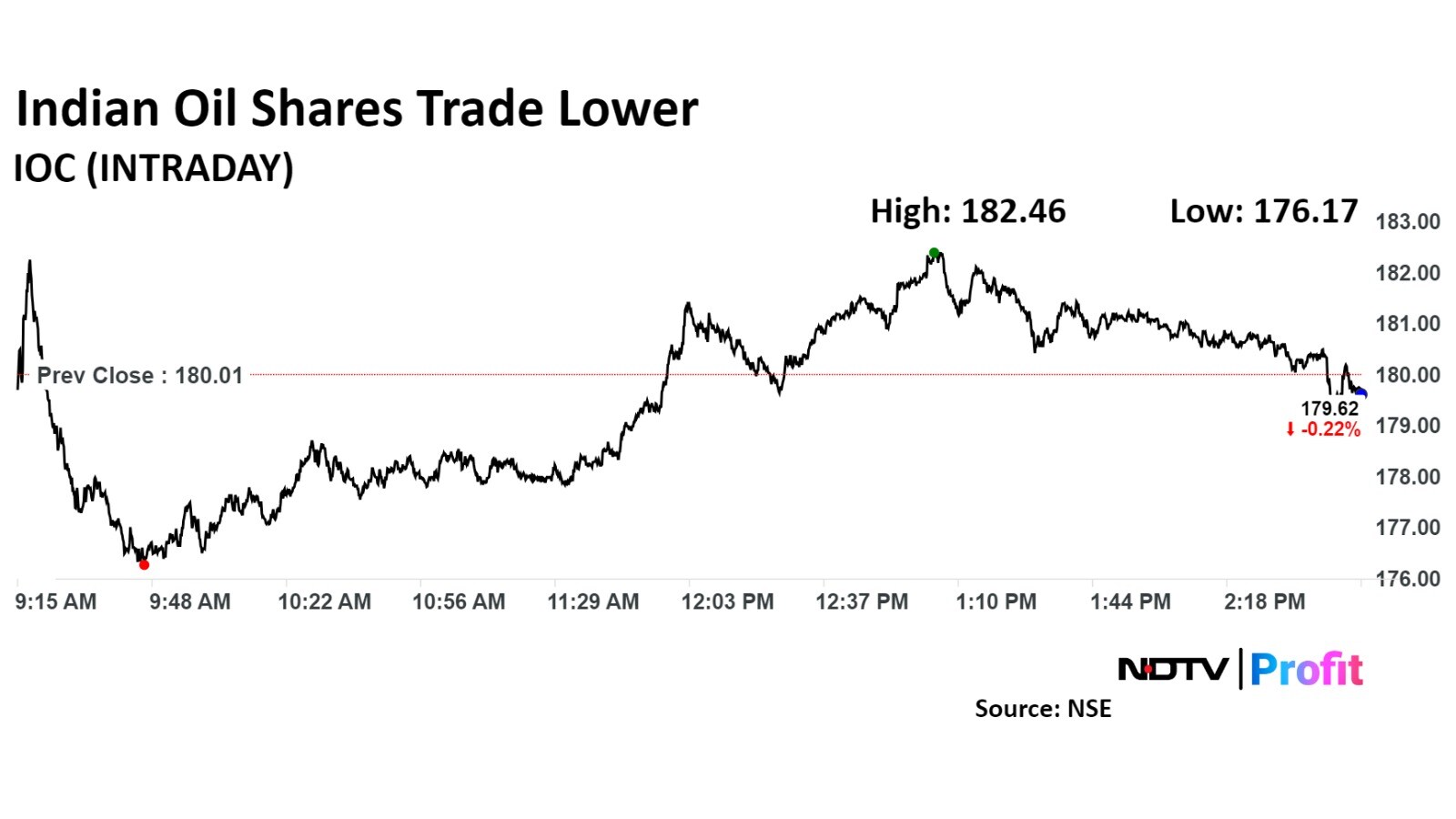

Indian Oil Corp. Share Price

Indian Oil stock fell as much as 2.13% during the day, before erasing loss to trade 0.19% higher at Rs 180.35 apiece, compared to a 1.36% decline in the benchmark Nifty 50 as of 3:15 p.m.

It has risen 100.23% in the last 12 months and 38.95% year-to-date. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 63.19.

Fourteen of the 32 analysts tracking Indian Oil have a 'buy' rating on the stock, five recommend a 'hold' and 13 suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential downside of 2.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.