Shares of Infosys Ltd. closed higher on Wednesday after the IT major announced an expansion of its partnership with tech giant Microsoft to "accelerate customer adoption of generative AI and Microsoft Azure, globally".

The collaboration is aimed at helping the joint customers of both the companies to "realise the value of their technology investments and secure transformative outcomes", a press release said.

The scope of this expanded collaboration will include financial services, the release said. "Infosys' domain expertise with Finacle, alongside Microsoft's advanced capabilities will enable financial institutions to engage, innovate, operate, and transform more efficiently."

The tie-up will also cover healthcare, as Infosys Helix—a healthcare platform built on Microsoft Azure—uses artificial intelligence/machine learning automation to optimise patient outcomes, it said.

The scope of partnership also includes sectors such as supply chain, telecommunications and customer service, according to the release.

“Our expanded collaboration with Infosys will transform industries, enhance business operations, elevate employee experiences, and deliver new value for customers. Together, we will harness the power of generative AI to deliver innovative solutions, drive AI Adoption and enable unprecedented innovation for customers," said Nicole Dezen, chief partner officer at Microsoft.

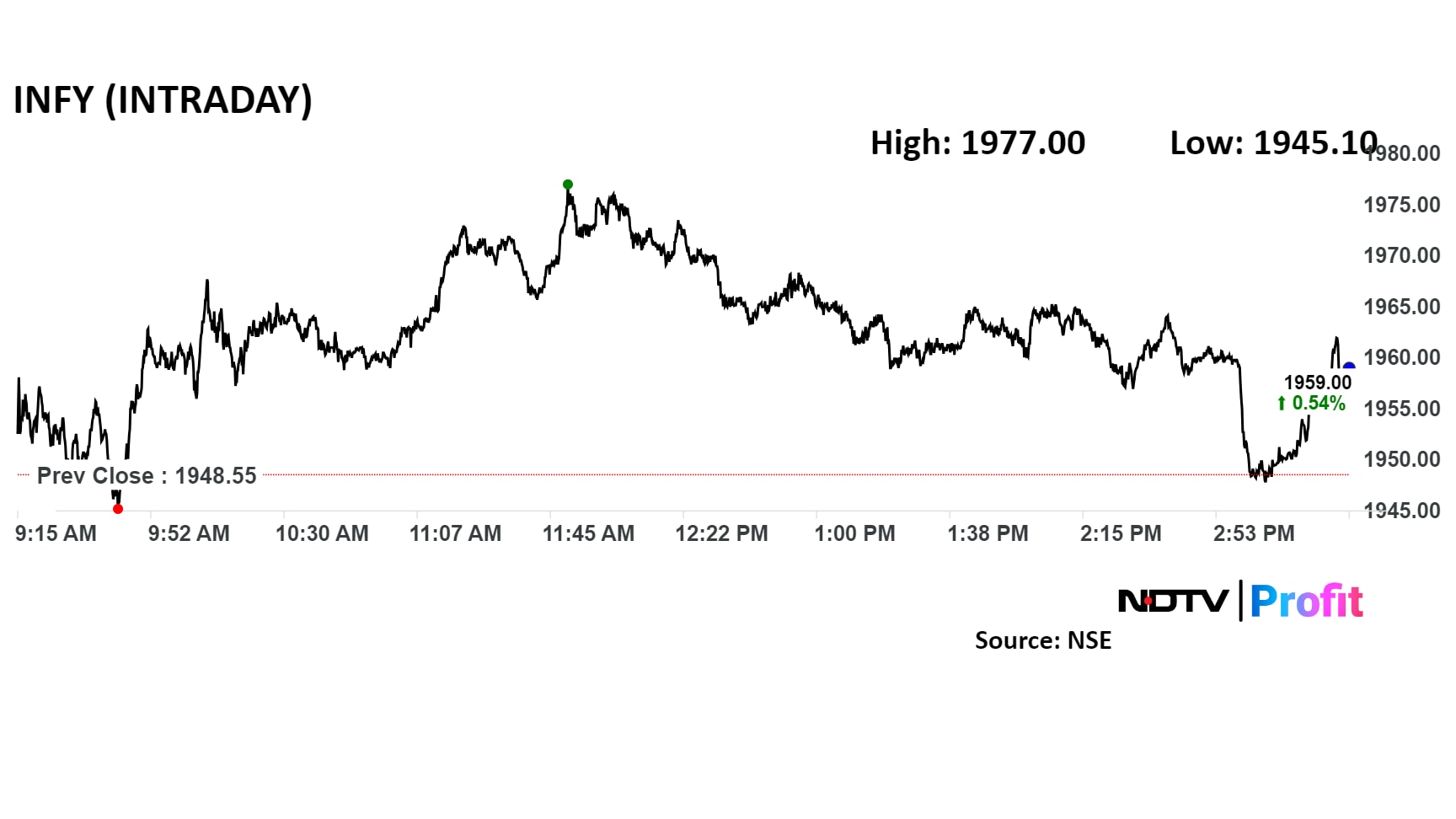

Infosys Share Price

Shares of Infosys Ltd. were trading nearly flat in the final hour of trading before the expansion of partnership with Microsoft was announced. Following the disclosure, the shares rose around 0.6% to Rs 1,961 apiece on the NSE.

The scrip settled 0.22% higher at Rs 1,952.75 apiece, compared to a 0.12% decline in the benchmark Nifty 50.

The stock has climbed by 26.9% year-to-date, and by 32.7% over the past 12 months.

Out of 45 analysts tracking Infosys, 30 have a 'buy' rating, 10 suggest a 'hold', and five recommend a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 1.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.