IndiGo has sustained impressive growth, marking its seventh consecutive quarter of solid results, according to Pieter Elbers, chief executive officer of the airline.

The InterGlobe Aviation Ltd.-operated airline's total income stood at Rs 20,250 crore, up 18% from the same period last year, the CEO told NDTV Profit post the first quarter results. "The airline's net profit stood at Rs 27.3 billion, (Rs 2,730 crore) reflecting a solid margin of around 14%," Elbers said.

He attributed this surge to the airline's strategic planning and operational efficiency, despite facing significant external challenges.

“The quarter's performance continues the trend we've seen in recent months—solid and healthy growth,” Elbers said. The results reflect the ongoing positive market demand outlook, he noted.

However, the industry faces pressures from rising fuel costs and global inflationary trends. These factors have put a strain on profitability as well, he said.

When it comes to declining profitability on year-on-year basis, Elbers explained that comparing this quarter to the same period last year can be misleading due to specific dynamics at that time, such as capacity constraints and fluctuating demand. “Last year's Q1 had unique circumstances that don't align perfectly with current trends. Moreover, seasonal impacts also play a role. Despite these headwinds, our profitability remains robust," he said.

But the airline is confident in its ability to manage these challenges, Elbers said.

Revenue of the budget carrier rose 17.3% year-on-year to Rs 19,571 crore for the quarter. That compared with an estimate of Rs 18,717.6 crore.

The aircraft's capacity increased by 11.1% YoY in the quarter-ended June 30, 2024, while passengers increased 6.2% YoY during the period.

Notably, parent company InterGlobe Aviation's net profit fell 12% year-on-year to Rs 2,729 crore in the April-June quarter.

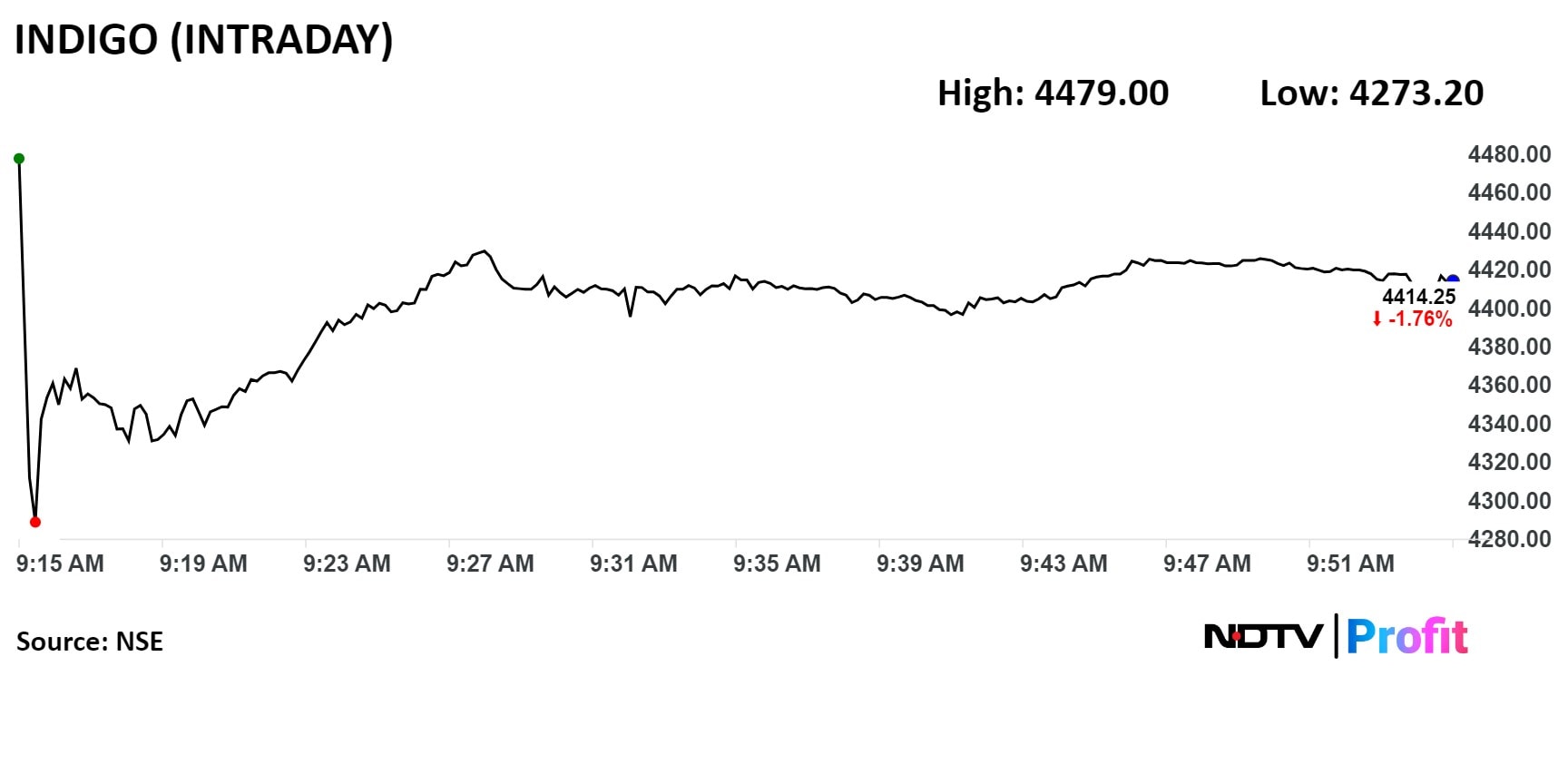

Share Price Takes Hit

Source: NDTV Profit

Shares of InterGlobe Aviation fell nearly 5% before paring loss to trade 1.60% lower at Rs 4,419 per share at 09:52 a.m., compared to a 0.27% advance in the benchmark Nifty 50 around the time.

The stock has risen 70% in the last 12 months and 48% year-to-date. Total traded volume so far in the day stood at 4.1 times its 30-day average. The relative strength index was at 56.

Out of 22 analysts tracking the company, 16 maintain a 'buy' rating, four recommend 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a potential upside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.