Shares of InterGlobe Aviation Ltd. rose over 5% to hit a record high after company's net profit more than doubled in the third quarter beating analysts' estimates, aided by the strong demand for travel during the festive season.

The operator of India's largest airline, IndiGo, reported a 19% year-on-year rise in the consolidated net profit to Rs 2,998 crore, according to an exchange filing on Friday. A consensus estimate of analysts tracked by Bloomberg projected a profit of Rs 2,519 crore.

The low-cost carrier incurred a foreign exchange loss of Rs 51 crore in the quarter. Excluding these losses, the net profit aggregated to Rs 3,049 crore in the period. In the corresponding period last year, the airline incurred a foreign exchange loss of over Rs 586 crore.

InterGlobe Aviation Q3 FY24 Earnings Highlights (YoY)

Revenue rose 30% to Rs 19,452 crore (Bloomberg estimate: Rs 18,266 crore).

Ebitda grew 40% to Rs 5,200 crore.

Ebitdar margin at 28% versus 25%.

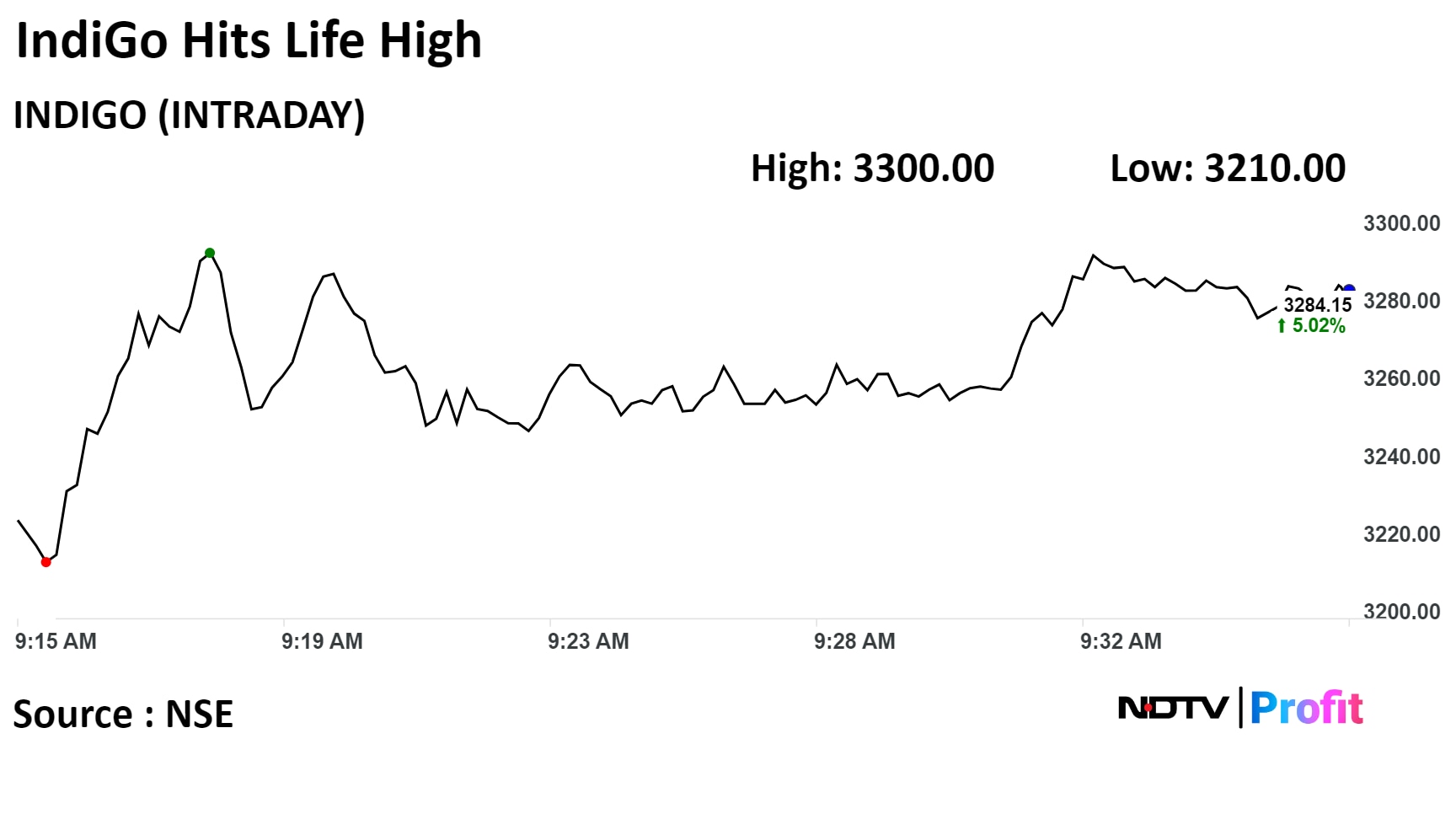

Shares of IndiGo rose as much as 5.53%, the highest singe day jump since May 03, 2023, It is trading 4.16% higher at Rs 3,257.05 as of 9:43 a.m. This compares to a 0.09% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 22 times its 30-day average. The relative strength index was at 72, implying the stock is overbought.

Of the 22 analysts tracking the company, 17 maintain a 'buy', two recommends a 'hold,' and three suggests a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 3.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.