At present, the electric vehicle (EV) space is dominated by Elon Musk's electric vehicle and battery maker Tesla.

In January 2020, the company was valued at $117 billion and by the end of the year, who would have thought that figure would skyrocket to over $650 billion. That too in a short span of time.

This meteoric rise has nudged investors to search for companies that may benefit from the EV disruption.

Also, with Indian government firing cylinders for electrifying the automobile sector, investors can't keep their hands away from companies even remotely related to this space, even if it is a loss-making company.

As we know, the auto companies won't be the only ones who will benefit from this megatrend. There's opportunities for various industries. Many stocks have now become a proxy plays for investors looking to dabble in the EV revolution underway globally.

In this article, let's take a look at top EV stocks from each space and what kind of returns they are generating for investors.

#1 Commercial Vehicles

The top EV stocks in the commercial vehicles space include Tata Motors, Olectra Greentech, JBM Auto, Ashok Leyland, SML Isuzu, Eicher Motors, and M&M.

State governments are inviting tenders to buy electric buses for public transport facilities. This gives a strong order push to companies manufacturing electric buses like Ashok Leyland, JBM Auto, Olectra Greentech, Tata Motors, and Eicher Motors.

Tata Motors was one of the first companies to develop a fully electric commercial vehicle on its own. It is preparing to launch its first electric truck. Tata Motors is already the leader in the electric passenger vehicle segment with a share of more than 70%.

Olectra Greentech is one of the lesser known stocks in the EV space. It has major interests in electric buses, composite insulators, amorphous core-distribution transformers, data analytics, and IT consulting. The company has a healthy order book for 1,325 e-buses.

Recently, Maharashtra environment minister Aditya Thackeray announced that Mumbai's entire public transport buses will go electric by 2028.

This comes as a big positive as public bus getting replaced by electric ones will bring opportunities for electric bus makers.

Now let's take a look at how these companies have performed in terms of stock performance over the past one year.

#2 Two, Three, & Four Wheelers

This is the most obvious choice for investors who want to play the EV opportunity. Select automobile companies which are manufacturing EVs in the two, three, and four wheeler segments.

The 4-wheeler segment includes Tata Motors while the 2 and 3-wheeler segments have TVS Motors, Bajaj Auto, Hero MotoCorp, Greaves Cotton, among others.

Although there are several gaps in the 4-wheeler EV space such as limited number of products, high prices, and insufficient batteries, companies have big plans for the future.

The Indian car market is governed by two-wheelers, which account for 75% of the total number of vehicles sold in the country. India's homegrown two-wheeler majors are fast-tracking their EV plans to capture reasonable market shares in the coming years.

India is currently undergoing an EV revolution with high adoptions in 2/3/4-wheeler spaces and increasing interest in private 4-wheeler sector.

Here's how the top stocks from the segment have performed this year.

#3 EV Battery Makers

Lithium-ion (Li-ion) cells are the heart of electric vehicles. These batteries are the most expensive component in EVs, accounting for 40-50% of its cost. These batteries have changed the way products are being designed in the modern world.

Automobile companies are proclaiming lithium ion batteries as the future of automobile energy and rightly so because of its inherent advantages. For example, lithium ion batteries weigh much less than other rechargeable batteries and hold their charge extremely well while the energy output from these batteries remains fairly consistent.

The rapid penetration of electric vehicles in India will drive the need for lithium ion battery manufacturing in the country.

Currently, most electric vehicle makers import cells and batteries from China, the world's top producer of lithium-ion cells.

However, companies are now accelerating plans to produce lithium-ion cells in the country, hoping to take advantage of Rs 18,000 crore worth of government subsidies.

The top players in this segment are Amara Raja Batteries, Exide Industries, and Kabra Extrusion Technik. Although a lion's share is with Amara Raja and Exide.

Here's how the stocks have performed over different time durations.

#4 EV Charging Infrastructure

Like lithium-ion batteries are the heart of electric vehicles, charging points are the next important thing.

EV manufacturing companies are spending lots of capital and energy on charging station infrastructure.

By 2027, the business of EV charging stations can reach an estimated $29.7 billion, at a CAGR of approximately 40% between 2020-2027.

To fast-track the adoption of EVs in India, the government is planning to install up to 70,000 EV chargers across the country in the next few years. The work is already underway.

At least 22,000 EV charging stations will be set up using the facility of 70,000 petrol pumps. For this, oil companies like Indian Oil Corporation and BPCL have already pledged to use their outlets to set up 17,000 EV charging centers.

Companies are tying up with startups to tap into this opportunity. Hero Electric has already announced a collaboration with Bengaluru-based EV charging start-up Charzer to establish one lakh charging stations across India.

The top listed companies involved in this space include, Tata Power, Indian Oil Corporation (IOC), BPCL, Reliance Industries, NTPC, and Power Grid Corporation.

Here's how the above stocks from the charging infrastructure segment have performed this year.

#5 Chemicals

To enhance the specialty product market, chemicals companies have entered the lithium-ion battery business, where they plan to build an integrated business which includes cell manufacturing, battery recycling, and battery production.

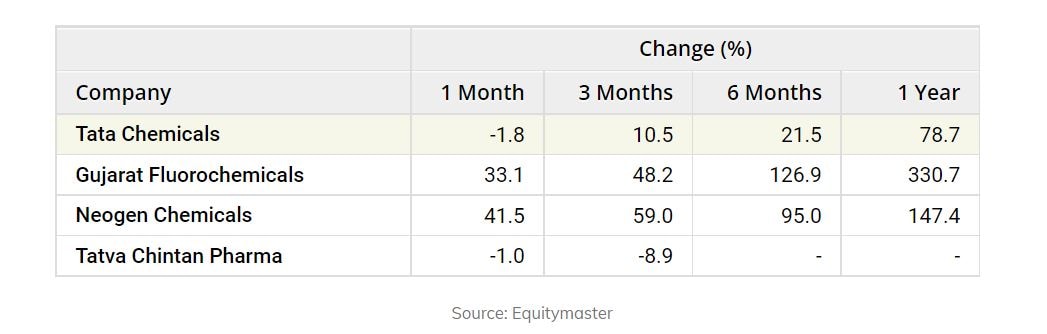

The top stocks involved in this space are Tata Chemicals, Gujarat Fluorochemicals, Neogen Chemicals, and recently listed Tatva Chintan Pharma.

Gujarat Fluorochemicals has forayed into new age business including chemicals & fluoropolymers for EVs, batteries, solar panels, hydrogen fuel cells. The company is in the process of setting up an integrated battery chemicals complex.

Meanwhile, Tatva Chintan Pharma is India's sole distributor of chemicals used in zeolite crystals for the manufacturing of detergents, air purifiers, and dietary supplements.

Here's how the stocks have performed over different durations.

#6 Auto Ancillaries

Indian auto ancillary companies are working with global players in areas like wiring harnesses, rearview mirrors, cockpits, bumpers, and more.

Companies including Sona BLW Precision, Motherson Sumi, Suprajit Engineering, Minda Industries, and Fiem Industries have announced acquisitions of EV tech companies or are ramping up their component business with an eye on the global market as well.

Component makers are understanding that investing in EV component technology and capacity is a matter of survival.

Here's how the top companies have rewarded investors over the past one year.

#7 Commodities

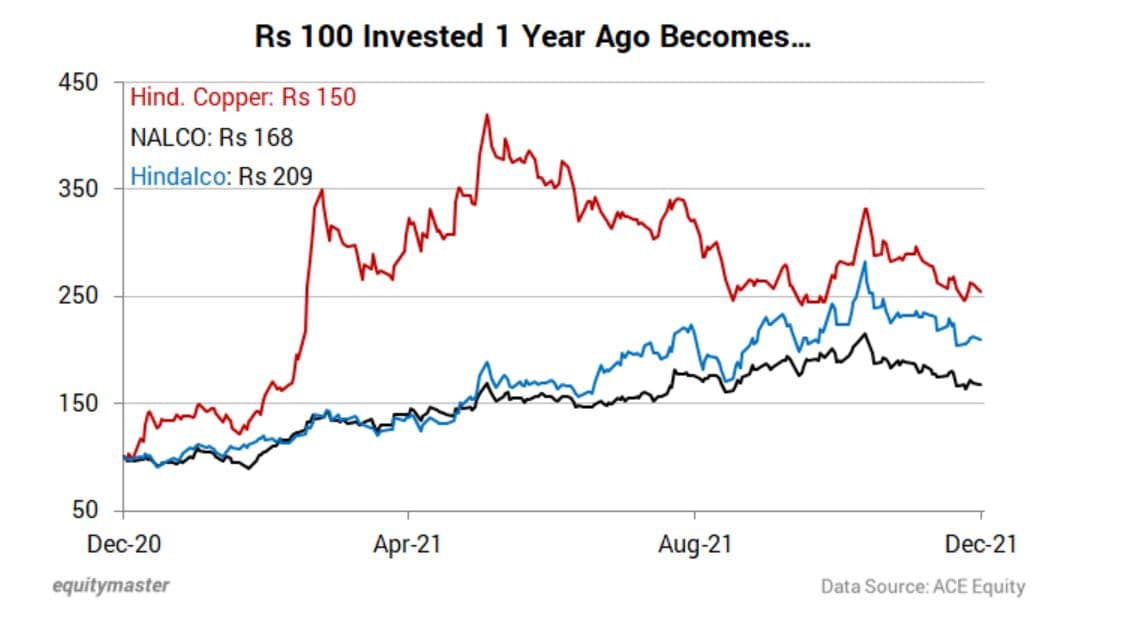

The demand for commodities like lithium, cobalt, copper, and nickel is spiking already as EV demand is increasing.

As these metals are limited and the most commonly used metals in creating electric car batteries, there could be a supply crunch.

Hindustan Copper is betting big bucks on EVs to drive the demand growth. The manufacturing of EVs will consumer copper four times more than traditional internal combustion engines. This bodes well for companies like Hindustan Copper, NALCO, and Hindalco.

These companies can be greatly benefited by the changes in the automobile sector from IC Engine vehicles to EVs, as the prime commodities that will be used in EVs are copper and aluminium.

Here's how much you would have now if you had invested Rs 100 in each stock a year back.

#8 Software (R&D)

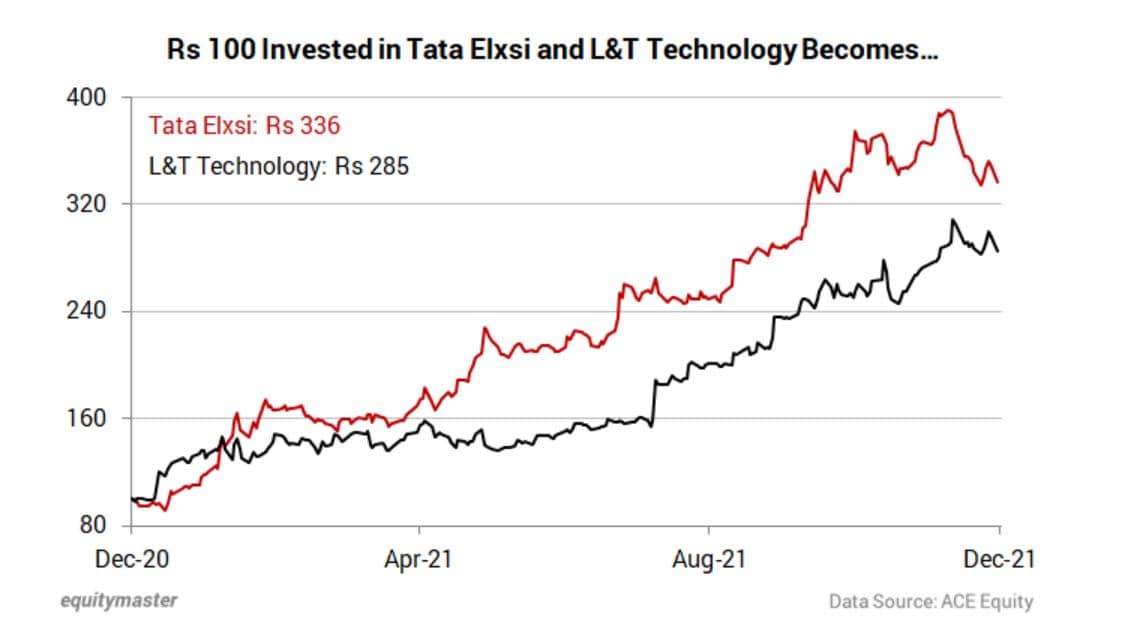

Automobile companies are stepping up investments in technology by investing more on research and development (R&D).

As per reports, spending by auto companies is expected to increase by 6.5% on average, with a focus on software.

Tata Elxsi said in its annual report that automakers and component manufacturers were growing their R&D expenditures on initiatives to develop driver assistance and industry 4.0 capabilities.

The company is engaged with leading OEMs and systems suppliers for the development of next-generation hybrid vehicles.

Meanwhile, L&T Technology's focus on disruptive businesses give it an edge over peers. It has invested in electric, autonomous and connected vehicles, medtech, 5G, artificial intelligence, and digital products.

Here's how Tata Elxsi and L&T Technology have performed over the year gone by.

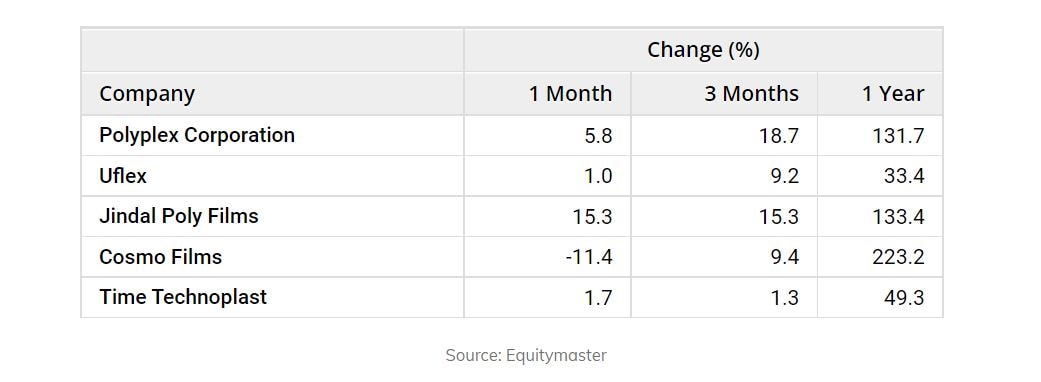

#9 PET Film Manufacturers

Did you know that thin polyester (PET) films with packaging are used in electric vehicle industry?

Polyester film is used in lithium-Ion batteries, and also used to control energy and power density and to increase the safety and life cycle of the battery.

Here are the top companies involved in this space and their performance over different durations.

Why EV stocks will continue to generate massive returns

All the hype surrounding EV stocks is for a good reason. Slowly, EVs are replacing internal combustion engine (ICE) vehicles.

As we saw above, the transition to 100% EVs will bring opportunities not only for EV makers but also for several other players in the EV space.

You just need to invest in the right EV stocks which can make you a fortune.

Luckily, Equitymaster's research has uncovered a little-known way to play this massive 15x opportunity in electric vehicles.

So before you invest a single rupee in any EV stock, we highly recommend you watch this video to study the results of our latest research project.

Happy Investing!

(This article is syndicated from Equitymaster.com)

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.