The government has set an ambitious target of achieving net zero carbon emissions by 2070, and has taken various measures to meet this goal. One significant but challenging measure is the Ethanol Blended Petrol Program, which blends ethanol with petrol to reduce carbon emissions. The government aims to achieve a 20% blending target by 2025.

Ethanol-blended petrol allows the engine to combust the fuel completely. This decreases emissions and reduces environmental pollution.

However, there are several reasons why this practice is challenging.

How Is Ethanol Produced?

Ethanol is made by fermenting sugars from crops like sugarcane, grains, or other feedstocks. However, in India, the majority of sugar for ethanol production comes from sugarcane.

This raises the conundrum of a food-fuel conflict, as the same crops used for ethanol are also essential for food production.

The Sugar Dilemma

Sugar is a common household staple. But a large portion of the commodity is diverted for ethanol production. This creates an imbalance in the demand and supply of sugar for domestic consumption.

The government had initially banned the production of ethanol from sugar in December 2023, taking account of concerns about a potential decrease in sugar production.

However, after reassessing the requirements for the Ethanol Blending Program, and the 20% blending target, the government lifted this ban.

Overstepping Limits

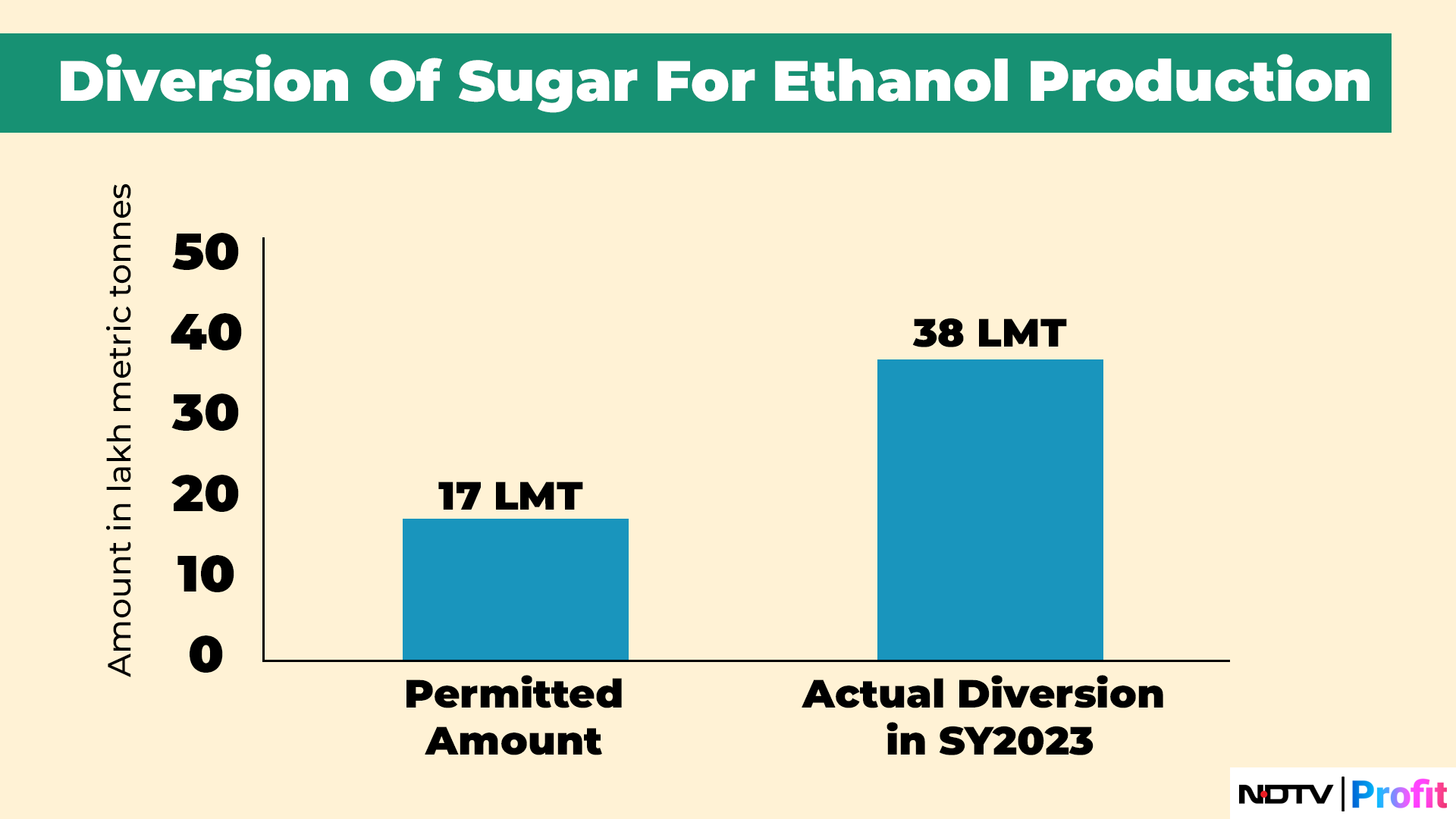

India is permitted to divert up to 17 lakh metric tonnes of sugar for ethanol production.

However, the actual diversion in the sugar year 2023 was 38 lakh metric tonnes, exceeding the government's cap.

The government has banned the export of sugar for an indefinite period to further achieve the blending target and to ensure the domestic supply of sugar, despite the request from the Indian Sugar Mills Association to the government to allow the export of 10 lakh tonnes of sugar.

The 20% Blending Target

India's target is to achieve 20% ethanol blending by 2025-26. But this may come at a cost.

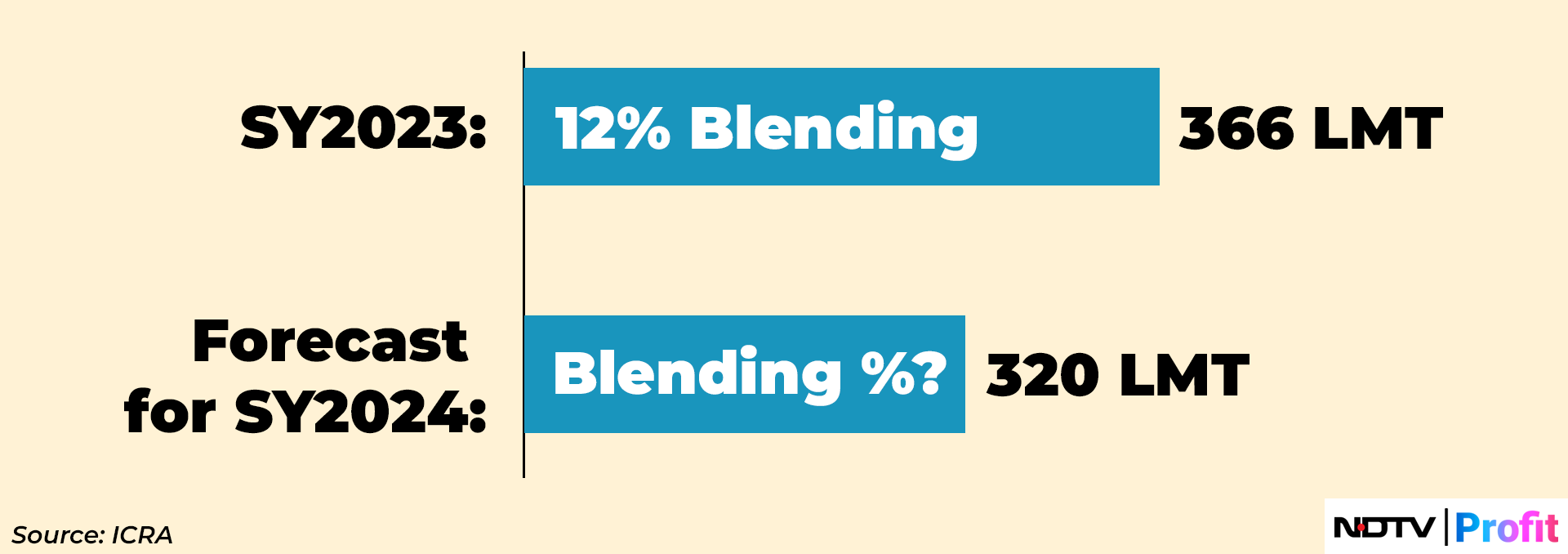

Sugar production is expected to be lower this year, due to lower cane yields and uneven rainfall in key sugar-producing states like Maharashtra and Karnataka, as per an ICRA report. The forecast for this year's production is 320 lakh metric tonnes, 13% lower than the 366 lakh metric tonnes produced in sugar year 2023.

India has managed to achieve 12% ethanol blending with 366 LMT last year. It remains to be seen how the country can achieve 20% ethanol blending with less sugar available this year.

If more sugar is used for ethanol, domestic market prices could rise, which would pinch the pockets of the middle class.

In fact, the sugar consumption volume is increasing in India. The overall domestic consumption volume of sugar in 2023/2024 was 300 LMT in India, as per Statista.

It remains to be seen if the government's restrictions on sugar export, and the 17 lakh tonne cap on sugar diversion will help insulate costs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.