India's top two telecom operators deactivated connections of more than eight crore low-paying subscribers as they focus on better-paying customers and lowering costs.

Vodafone Idea Ltd. introduced a minimum average revenue per user, and deactivated 3.5 crore users who bought recharge plans of less than Rs 35 a month in the December-ended quarter, according to its filing. Sunil Mittal-led Bharti Airtel Ltd. too had dumped 4.8 crore such users.

Focus on improving average revenue per user comes as older operators battle a tariff war triggered by Reliance Jio Infocomm Ltd.'s rock-bottom pricing. The Mukesh Ambani-led operator, however, continued to expand market share by adding new customers and is poised to dislodge Bharti Airtel from the No. 2 spot.

While Airtel and Vodafone Idea saw a growth in their average revenue per user, Reliance Jio's focus on customer acquisition led to a decline in ARPU.

But revenue accretion didn't boost operational performance of India's two biggest telecom operators. Bharti Airtel's earnings before interest, tax, depreciation and amortisation continued to fall. For Vodafone Idea, it rose on the back of merger synergies. Reliance Jio's Ebitda, after growing for yet another quarter, is more than the combined operating income of its two bigger rivals.

Capital expenditure of all telecom operators declined in the December-ended quarter. Their combined capex fell more than Rs 6,000 crore. Reliance Jio's spending, however, remained higher than its rivals'.

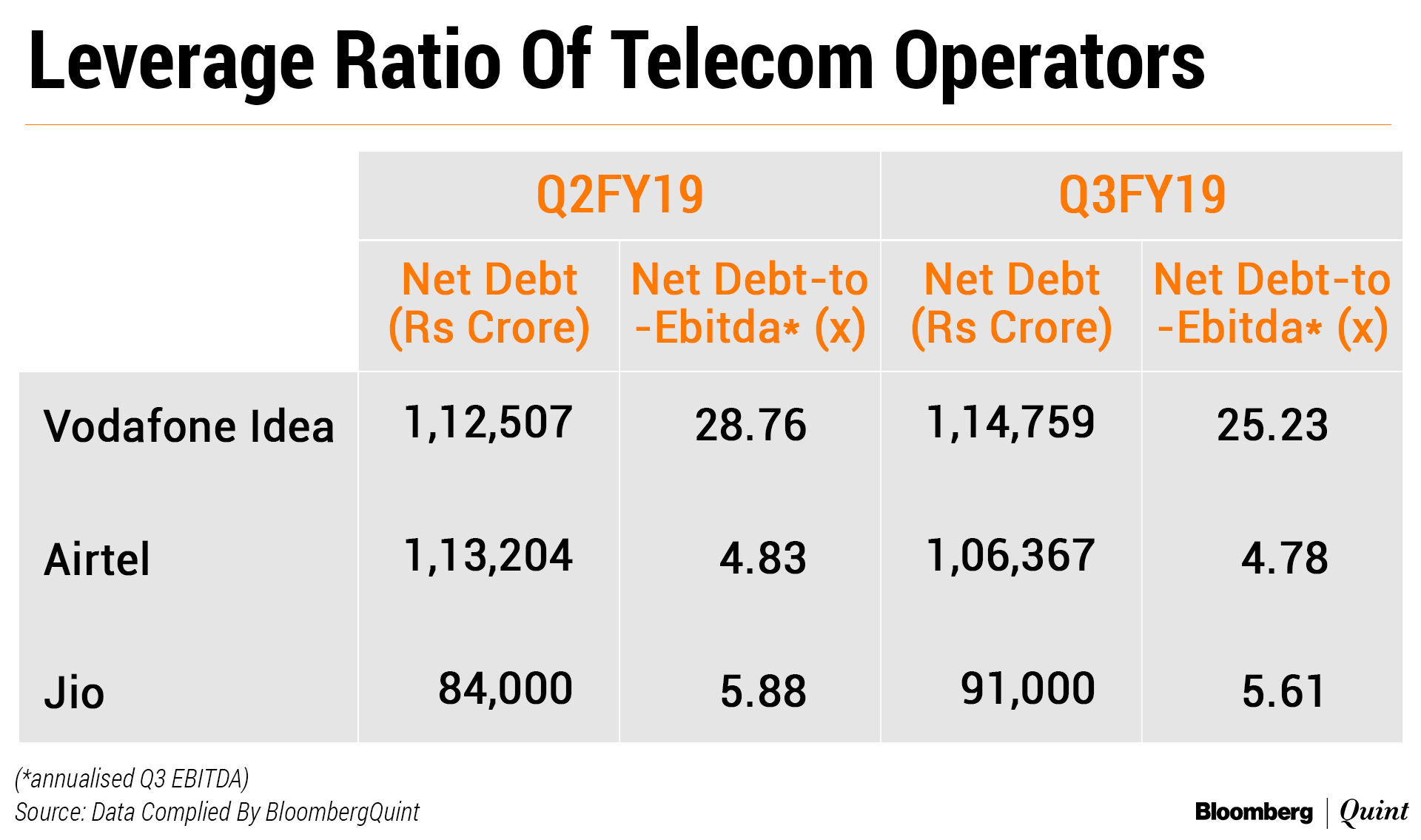

Bharti Airtel was the only player which saw a drop in its net debt. Its consolidated debt fell by Rs 6,800 crore for the first time in the last six quarters on the back of the fund infusion in its African unit, which raised close to $1.25 billion from six different investors by selling around a third of its stake.

The leverage ratio of all the operators eased a bit over the previous quarter.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.