The Indian rupee closed stronger against the U.S. dollar on Wednesday as focus shifts to Fed Chair Powell's testimony in front of the US Congress later today.

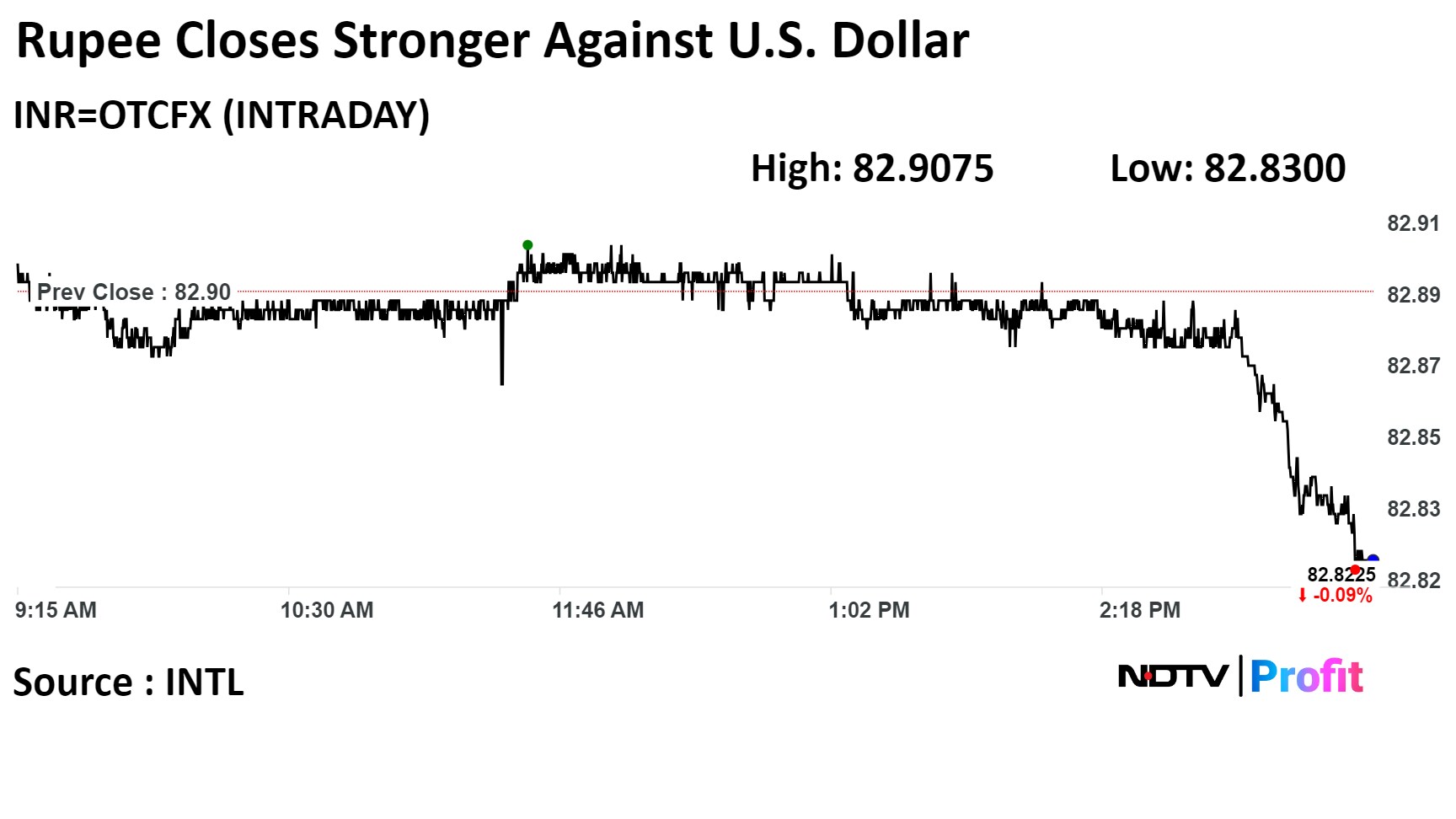

The local currency appreciated seven paise to close at Rs 82.83 against the U.S. Dollar, after opening at Rs 82.90. It closed at 82.90 on Tuesday, according to Bloomberg data

On Tuesday, Bloomberg announced it would be including Indian bonds in its various indices from January 2025. This would bring an annual inflow of about $10-15 billion, according to Anil Kumar Bhansali, executive director and head of treasury at Finrex Treasury Advisors.

"Indian rupee will trade in a narrow range of Rs 82.85-82.95 with flows getting absorbed by probably RBI," Bhansali said.

"Softer than anticipated U.S. macroeconomic data and easing yields weighed on the dollar. But overall, dollar index is stuck between its 100 and 200-DMA before Powell's speech and a series of jobs data from the US this week," Kunal Sodhani, vice president of Shinhan Bank, said.

The Eurozone's strong services and composite PMI readings suggest a slow yet positive economic recovery despite ongoing risks, he said. "For dollar/rupee, Rs 82.80 will act as a support and Rs 83.00 as a resistance," Sodhani said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.