The Indian rupee closed weaker against the U.S. dollar on Friday as crude oil prices surged.

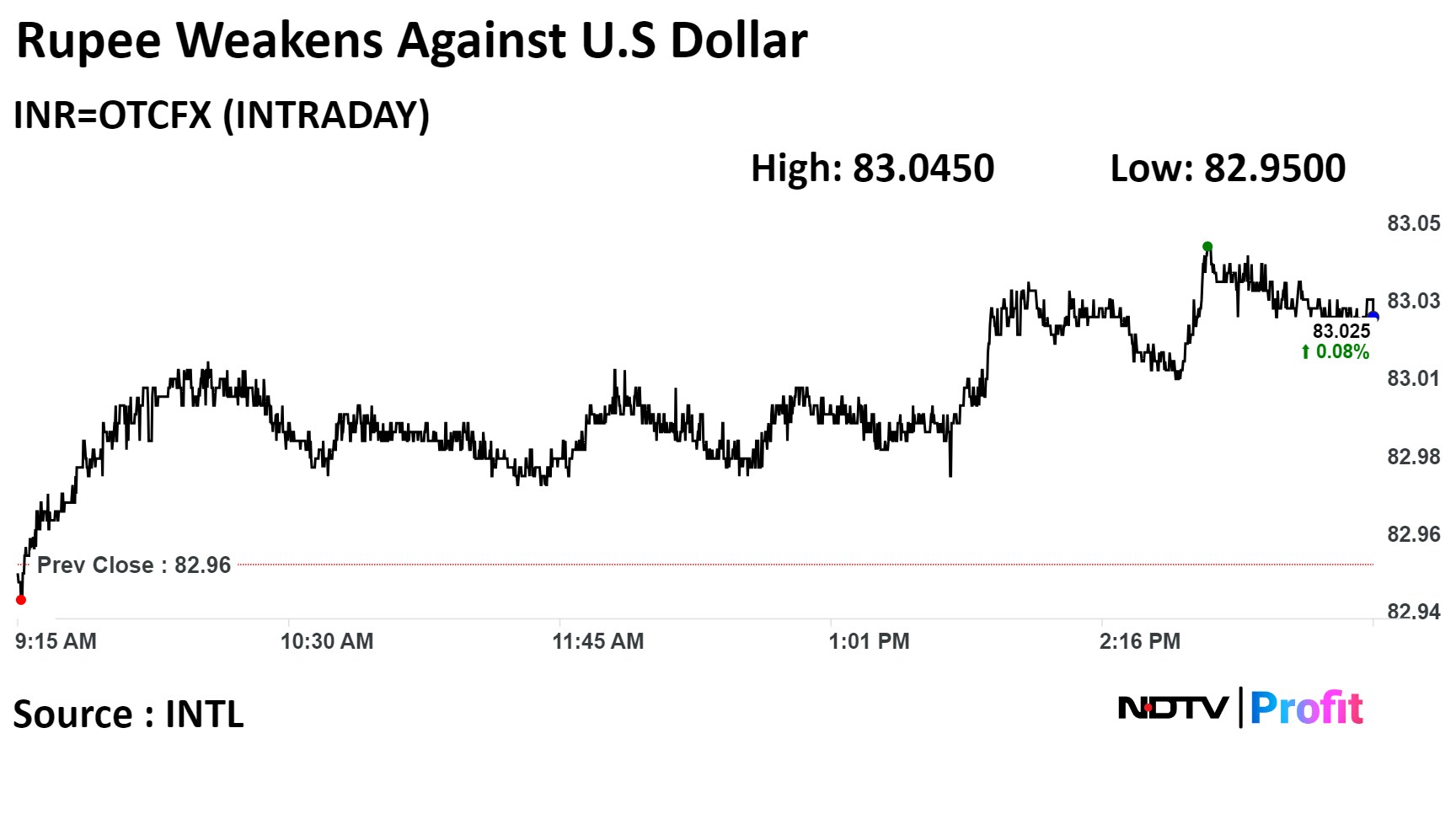

The local currency weakened 7 paise to close at Rs 83.03 against the U.S dollar. It closed at Rs 82.96 on Thursday, according to Bloomberg data.

The Reserve Bank of India also kept policy rates unchanged at 6.5% on Thursday.

The MPC voted to remain focused on the withdrawal of accommodation. MPC voted to keep its stance unchanged with a 5-to-1 majority.

"As of Feb. 7, the Indian rupee remained stable compared to its peers in the emerging market and a few advanced economies," the RBI governor said while presenting the monetary policy statement.

"The Indian rupee exhibited the lowest volatility in FY24. The relative stability of the rupee, despite a stronger US dollar, reflects the strength and stability of the economy," he said.

"Flows into the country continued taking rupee upto Rs 82.88 before RBI bought dollars and it is back to Rs 83.00 levels while closing at Rs 82.9550. Rupee is expected to remain rangebound today also as Inflows get absorbed by RBI," Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors said.

"RBI also in its MPC meeting that Rupee has been very stable reflecting inherent strength of Indian economy as also it's stability. So expect a narrow trading range of Rs 82.90-83.05 today," Bhansali added.

"A decline in U.S. initial jobless claims highlights the resilience of the economy and might convince the Fed to refrain from cutting rates in the short term. Dollar index and yields rallied. For rupee, consolidation may continue between Rs 82.85 and Rs 83.15," Kunal Sodhani, vice president of Shinhan Bank said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.