The government is mulling a restructuring plan for stressed power projects which involves taking control of these assets and managing them until they can eventually be sold to new promoters, three bankers in the know told BloombergQuint.

The plan was discussed in a meeting between power ministry officials, state power secretaries, public sector power financiers and top bankers last month, said the bankers. The fineprint of this plan, which aims to resolve stressed assets in the power sector, is still being worked on and a final decision is likely soon, the bankers said.

Banks have already shortlisted nine private power plants to be taken over and subsequently managed by public sector entity NTPC Ltd., according to a Business Standard report last month. BloombergQuint could not independently verify the names of the projects on the list.

No formal decision has yet been taken in the matter, a senior government official said on the condition of anonymity. Separate emailed queries to the power ministry and NTPC did not elicit a response.

How Will Such A Plan Be Structured?

The plan, as per discussions between Union Power Minister Piyush Goyal, banks and power financiers, involves lenders taking over control of individual projects from companies which are unable to repay their debt. These companies may also not be in a financial position to pump in additional investment into projects which are yet to begin generating revenues.

To overcome both these problems, lenders will first convert the debt on the books of these firms into equity and take majority control of the special purpose vehicles that hold these projects. Subsequently, these assets will be pooled and the task of managing them handed over to NTPC.

While the state-owned power conglomerate moves in to manage their operation, the government and lenders would work together to sell these assets to new promoters and recoup the loans extended to them.

According to the bankers quoted above, the government will also help by clearing pending approvals or payments, so that the projects can begin generating revenue.

Putting the structure in place, however, will not be easy. According to one of the lenders quoted above, while the government's assurance is a positive, the plan needs to be followed through carefully.

It remains unclear, for instance, if banks need to fund their working capital requirements to keep these projects going or if the government would step in, the banker point out.

Another issue is the complexity of the structure by which these assets will be taken over and pooled. Debt will have to be converted into equity in each SPV and shareholders resolutions will be needed to clear this conversion. Agreements will also need to be stitched up between banks and the pool that will hold these assets.

The extent to which NTPC will be involved is also not clear. Will it be an asset manager or also a part owner? At present, the central and state governments put together own about 62 percent of the total installed power capacity in India. If this restructuring package is put in place, the government's control over power assets will only widen.

The Best Option?

Such a plan, however, may be the best available option, said Vivek Jain, associate director at India Ratings & Research.

NTPC has the best operational track record for thermal power plants and they have successfully turned around plants in the past. Once NTPC takes the operational control provided the plants also get PPAs (power purchase agreements) and FSAs (fuel supply agreements) in place, the plants may show improved performance, post which these assets might be sold to prospective buyers.Vivek Jain, Associate Director, India Ratings & Research

If banks are unable to find buyers for these assets even after this restructuring package is implemented, they may have to take significant haircuts on their exposures, Jain added.

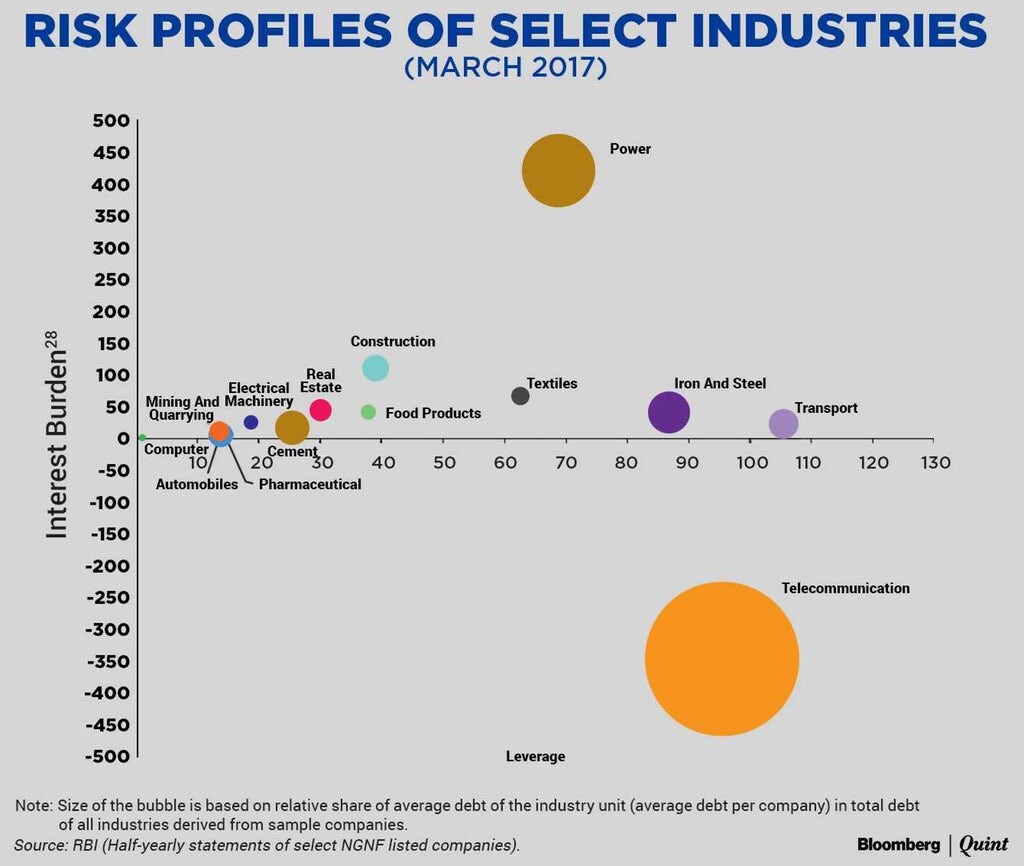

Total stressed assets on bank books have risen to about Rs 10 lakh crore. Apart from iron and steel, transport and telecom companies, power is the largest contributor to stress for banks, the Reserve Bank of India (RBI) had noted in its financial stability report (FSR) released last week. While there has been some improvement in the financial health of the steel sector following government support, banks are still struggling to find a solution to stressed telecom and power accounts.

According to Sabyasachi Majumdar, senior vice president and group head at ICRA, such a restructuring plan will be beneficial but mostly in cases where adequate linkages are in place and the plants are fully built out.

“This would work in projects where the concern is only around availability of working capital. However, in cases where they need more promoter equity and have other issues, such a plan may not be of much help,” said Majumdar while clarifying that the plan is still in the works and that details are still emerging.

This is not the first time that the government has taken a lead in fixing power sector problems. In November 2015, the power ministry had announced Ujwal Discom Assurance Yojana (UDAY) in a bid to resolve the issues facing the power distribution sector. The scheme focussed on converting bank loans to state government bonds, allowing banks to reduce their provisioning against these loans. The scheme also required state governments to follow fiscal discipline and revise power tariffs regularly.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.