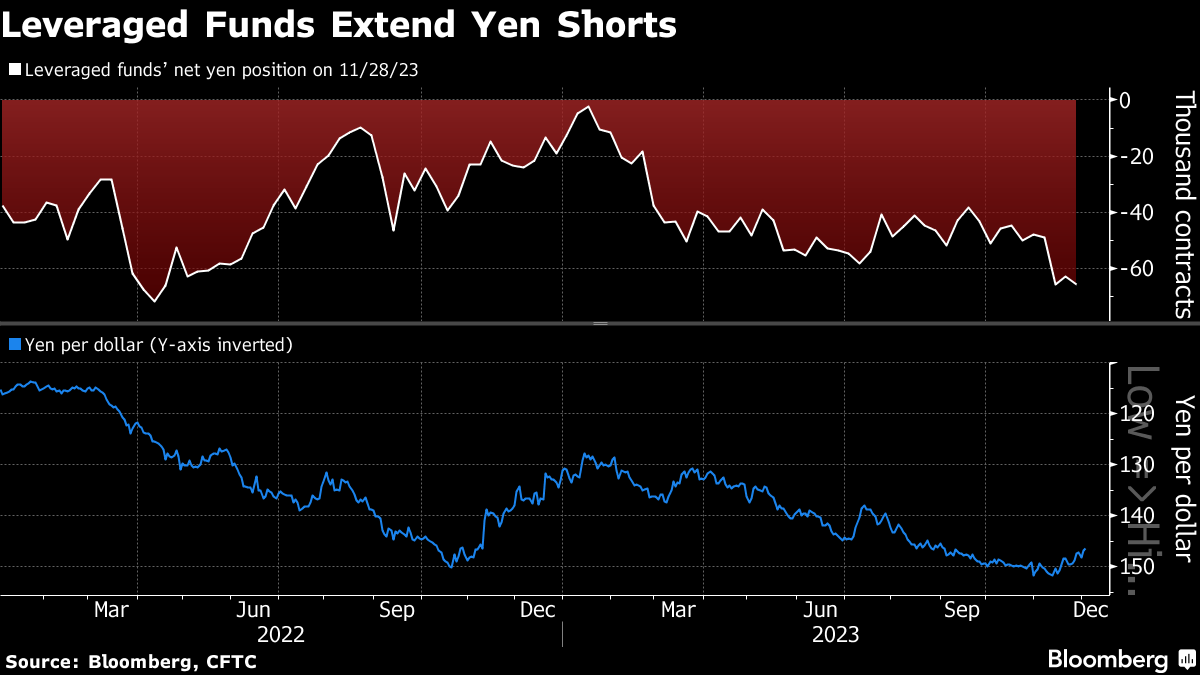

(Bloomberg) -- Hedge funds boosted bearish yen wagers to the highest level since April 2022 last week as speculation increased that the Bank of Japan is unlikely to turn hawkish.

Leveraged funds' net yen shorts increased by 2,833 to 65,611 contracts as of Nov. 28, according to the latest data from the Commodity Futures Trading Commission. Japan's currency appreciated almost 4% from a recent low of 151.91 per dollar set on Nov. 13 to 146.23 on Monday, the strongest since mid-September.

“We continue to see a limit to dollar-yen downside as long as the US appears to be achieving a soft landing and the BOJ remains reluctant to signal an imminent hiking cycle,” wrote Goldman Sachs Group Inc. strategists including Kamakshya Trivedi on Friday. “For that reason, we still think yen strength is approaching limits and should be faded.”

The bets from hedge funds add to signs that investors see yen weakness becoming more entrenched, even though overnight-indexed swaps are pricing in an end to the BOJ's negative-rate policy by June. Japanese life insurers have recently cut currency hedging by the most in more than a decade, signaling receding concern of a rebound in the yen that would wipe out returns from overseas assets.

The BOJ will continue with monetary easing patiently to support the economy at home, Governor Kazuo Ueda said last month.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.