Granules India Ltd. announced on Friday that it has received approval from the US Food and Drug Administration for tablets that treat major depressive disorders.

The company has received approval for its Abbreviated New Drug Application for Bupropion Hydrochloride extended-release tablets USP (SR) 100 mg, 150 mg, and 200 mg filed by Granules Pharmaceuticals, Inc., a wholly owned foreign subsidiary of the company, according to an exchange filing.

Bupropion Hydrochloride Extended-Release Tablets USP (SR) are bioequivalent and therapeutically equivalent to Wellbutrin SR sustained-release tablets, 100 mg, 150 mg, and 200 mg, by GlaxoSmithKline LLC. This is a widely prescribed medication for the treatment of major depressive disorders and the prevention of seasonal affective disorders.

Granules now has a total of 67 ANDA approvals from the US FDA.

"This ANDA approval marks a significant milestone in our journey to expand Granules' presence in the US market. Our continued focus on expanding our product portfolio in regulated markets like the US ensures that we are meeting the growing healthcare needs of patients globally while maintaining the highest standards of safety and efficacy," said Dr. Krishna Prasad Chigurupati, chairman and managing director, Granules India.

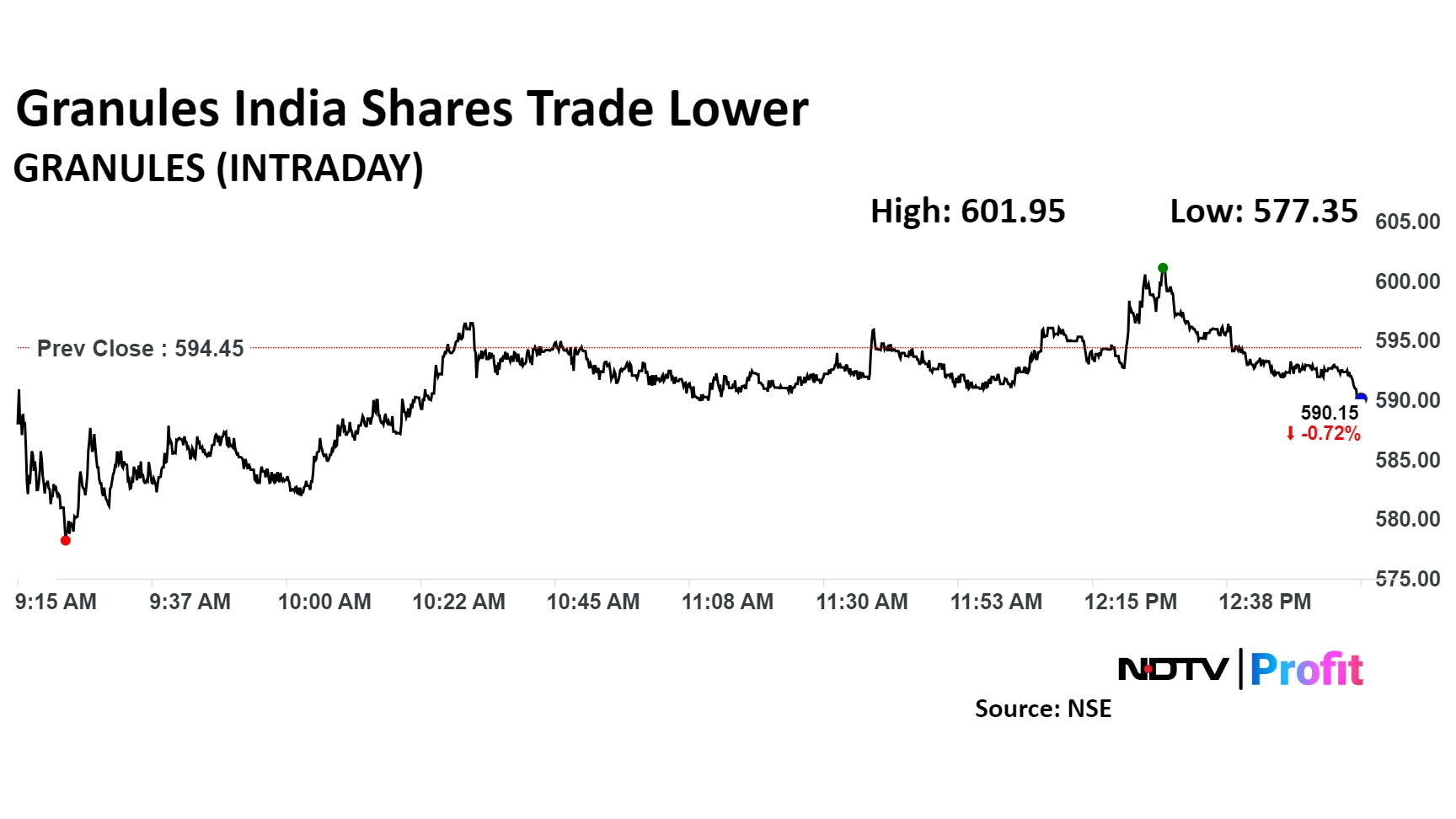

Shares of Granules India were trading 0.25% lower at Rs 592.95 apiece on the NSE, compared to a 0.37% advance in the benchmark Nifty 50 at 1:00 p.m.

The stock has risen by 65.95% in the last 12 months and by 45.69% on a year-to-date basis. The total traded volume so far in the day stood at 1.15 times its 30-day average. The relative strength index was at 40.68.

Seven analysts tracking the company have a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 18.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.