(Bloomberg) -- For the first time since the throes of the pandemic, Goldman Sachs Group Inc. is worth more than its longtime Wall Street rival Morgan Stanley.

Goldman shares rose 2.6% on Tuesday, boosting its market capitalization to $168.9 billion. That narrowly surpassed Morgan Stanley's market value of $168.6 billion after four years of lagging the competitor, according to data compiled by Bloomberg. It's been a quick rise for David Solomon's firm, as the gap between the two firms stood at more than $20 billion at the beginning of the year.

Goldman's “stock offers among the best risk/reward in our coverage universe given the potential for positive EPS revisions, and for secular re-rating,” BofA Global Research analyst Ebrahim Poonawala wrote in a Tuesday note, calling it his top pick.

Goldman shares have rallied 31% this year to a fresh record high, bolstered by strong trading revenues and banking fees. Morgan Stanley's shares are up only 11% in 2024, lagging its biggest peers and the broader market as its wealth management business has underwhelmed.

“Robust markets bolstered 2Q revenue for the largest US banks, with the run-rate and banking-fee pipelines promising entering 2H — for Goldman Sachs and Morgan Stanley in particular,” Bloomberg Intelligence analyst Alison Williams wrote in a note last week.

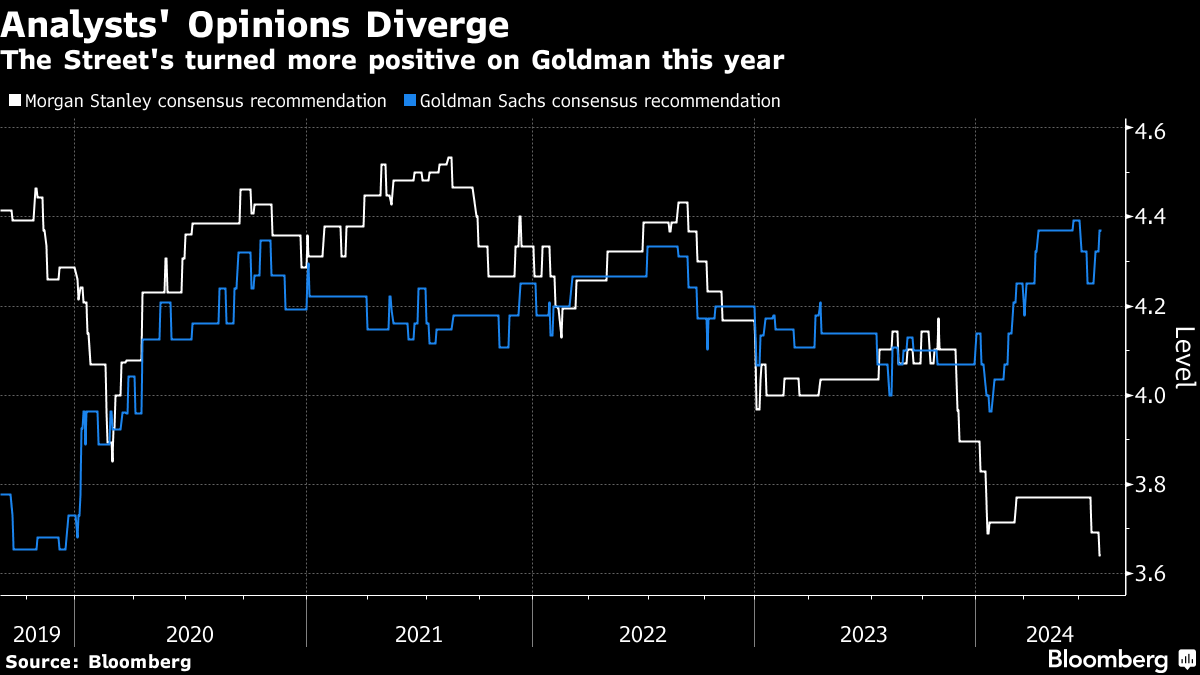

Analysts' recommendations would indicate Goldman's strength could continue, with their views of the stocks diverging in recent months. Goldman analysts turned the most bullish in more than a decade this year, according to data compiled by Bloomberg.

“We still see an attractive opportunity ahead if the firm continues to execute on its strategic plan as we anticipate,” JMP Securities analyst Devin Ryan wrote in a note after Goldman's second-quarter earnings.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.