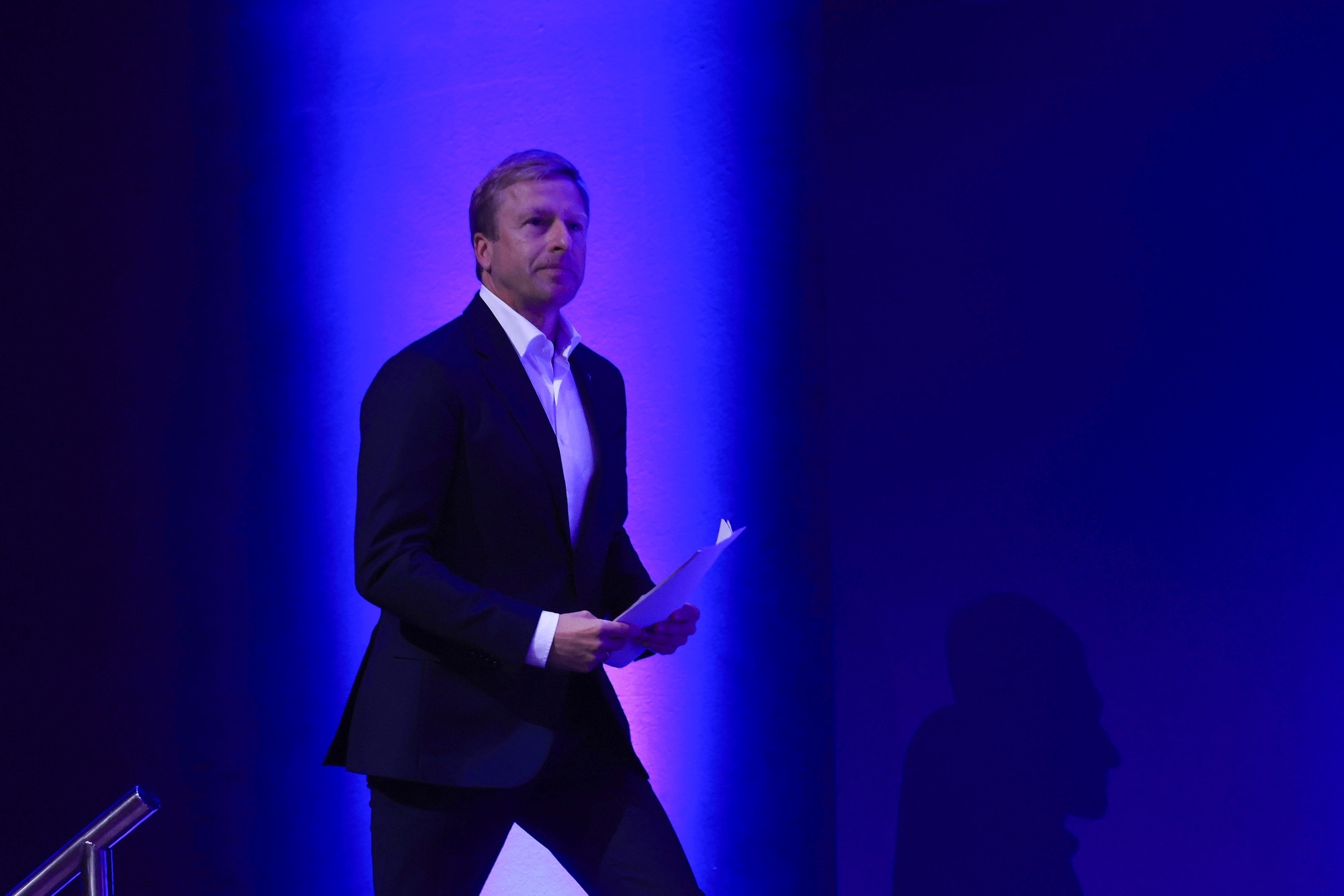

(Bloomberg) -- Standing at the front of the room at an auto industry association's new year reception in Berlin this week, BMW CEO Oliver Zipse had reason to feel vindicated.

Onstage, Transport Minister Volker Wissing was preaching to the crowd of policymakers and industry executives about the importance of “technological openness” in reducing transit emissions.

A singular focus on battery-powered vehicles by policymakers and manufacturers is leaving Germany's most important industry exposed, he said, with a forecast of slumping EV demand in Europe's biggest car market hanging over his message.

Zipse has been making that same point for years, advocating for flexible production lines for combustion, hybrid and even hydrogen-powered cars. His cautious strategy — which chimes with his predecessor's — was attacked as not aggressive enough on challenging electric leader Tesla Inc.

Now, Zipse appeared to have seen into the future. With EV adoption slowing and plug-in hybrids making a return from the sidelines, BMW's careful approach no longer looks like such a bad idea.

“In Germany, demand for electric vehicles does not look good this year,” said Jan Burgard, head of automotive consultant Berylls strategy advisors. “The upper end of the EV market is almost saturated, and there is little on offer in the lower-end €25,000 segment.”

After years of surging growth, selling EVs is becoming tougher. Generous government incentives are disappearing in Europe and fewer vehicles qualify for them in the US. While a range of new models and commitment-light leasing options have attracted the attention of electric enthusiasts, some years into the EV revolution, infrastructure and price still remain roadblocks to widespread adoption.

In Germany, sales are set to drop 14% this year in response to the government yanking subsidies in December, the first decline since 2016, according to the VDA lobbying group. Globally, market watchers have trimmed forecasts amid the enduring reality that the vehicles are much less affordable than equivalent combustion-engine cars — despite a price war kicked off by Tesla.

Thursday's event was an attempt to inject some optimism into an increasingly somber industry. Wissing praised German carmakers and extolled their technology as “celebrated abroad.” When asked what the government could do to bolster the German EV market, the transport minister offered one thought: “Charging infrastructure.”

Yet on this front, Berlin has lagged. In October 2022, Wissing rolled out an ambitious strategy to invest €6.3 billion ($6.85 billion) in a nationwide infrastructure that would increase the number of charging stations in Germany to one million in 2030.

That hasn't gone as quickly as planned. As of last September, there were only about 105,000 functional public charging stations in Germany, according to the infrastructure authority.

At the current rate of construction, VDA noted, Germany will need to triple its pace if it wants to hit its 2030 goal.

The charging conundrum, and who pays for it, remains unresolved many years into the EV transition. While policymakers and car industry representatives at the VDA event agreed that charging was key to reigniting interest in EVs, none wanted to say who should finance such an infrastructure expansion — or how. Rising electricity prices have further tamped down demand, according to a Deutsche Bank analyst note.

The other main challenge for EV uptake is pricing. The coalition must meet its goal of getting 15 million EVs on the road by 2030, or face missing emissions targets. As of November, only about 1 million — or 2% of all cars — on German roads were fully electric. Without further subsidies, some analysts think hitting the 2030 target will be a challenge.

“I think its unrealistic from today's perspective to reach 15 million EVs on German roads by 2030,” said Burgard, the automotive consultant.

Carmarkers are already beginning to hedge their bets. Volkswagen's Audi brand is paring down its EV lineup, and VW is taking a step back from plans to sell stakes in its battery unit. Should the EV slowdown segue into a longer-term slump, it could undermine billions in industry investments, and mean that carmakers won't be able to keep pace with new regulations around lowering emissions.

In the meantime, the increasingly long road to EV adoption is encouraging drivers to stick with their polluting old cars for longer, according to DAT, which collects data on the automotive industry.

For BMW's Zipse, all this could be seen as cause for a victory lap. In an interview with Handelsblatt last year, he went so far as to accuse those sounding the death knell of combustion engines as “negligent,” given how far EVs had to go.

“Do you think regions like Southern Italy will have charging stations in every village within twelve years?”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.