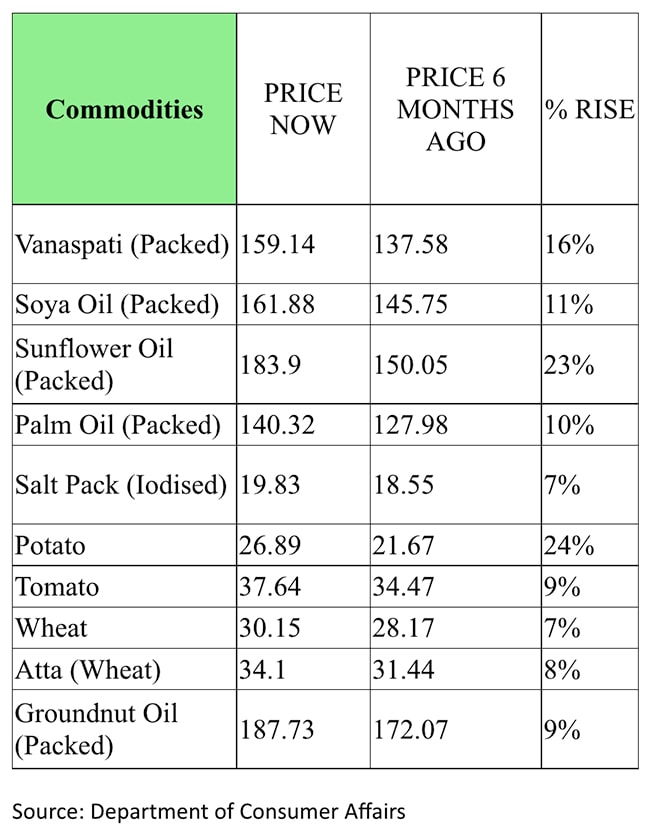

The prices from oil to atta and across essentials have soared because of supply-driven shortages, and the new GST rates on these commodities will add to the already-stretched household budgets.

Supply-driven inflation has been India's bane. The war on the edge of Europe exacerbated and disrupted global supply chains, which were just about beginning to mend from the pandemic-led distortions.

What the Ukraine war did was push up commodities prices across the board, followed by several key countries halting exports of essential food items, like Indonesia's oil-export ban.

India's inflation has surged to above 7 per cent, above the upper end of the Reserve Bank of India's target band of 2-6 per cent each month this year and is expected to remain stubbornly high for the rest of this calendar year.

That spiralling price pressure has hurt Indian consumers already reeling from the pandemic-driven restrictions and weighed on household budgets, dealing with soaring food and essential commodities costs.

Unbranded food items ranging from cereals, pulses to curd, 'lassi' and puffed rice will now be taxed under the tax regime. Prior to this, only branded items used to attract the levy.

At its two-day meeting in Chandigarh, the GST Council agreed to end the tax exemption for several unbranded and pre-packaged food items, including agricultural and dairy products.

A 5 per cent GST rate would now apply to packaged goods such as milk, curd, dried leguminous vegetables, makhana, wheat or meslin flour, jaggery, puffed rice, organic food, manure, and compost.

In addition, it imposed a GST of 18 per cent on bank costs for issuing checks and a tax of 12 per cent on hotel rooms that cost less than 1,000 per day, which is now free from taxation. Today, July 18, those revised GST modifications came into effect.

For a list of items that will get costlier, see: GST Rate Hike Comes Into Effect From Today, These Items Will Get Costlier

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.